Gold Price Chart This Week: A Deep Dive Into Market Fluctuations And Influencing Elements

Gold Price Chart This Week: A Deep Dive into Market Fluctuations and Influencing Elements

Associated Articles: Gold Price Chart This Week: A Deep Dive into Market Fluctuations and Influencing Elements

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Gold Price Chart This Week: A Deep Dive into Market Fluctuations and Influencing Elements. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Gold Price Chart This Week: A Deep Dive into Market Fluctuations and Influencing Elements

This week’s gold market has witnessed an enchanting interaction of things, leading to worth fluctuations which have captivated traders and analysts alike. Understanding these actions requires a cautious examination of the gold fee chart, alongside an in-depth evaluation of the financial, geopolitical, and market-specific occasions which have formed its trajectory. This text will present a complete overview of this week’s gold worth actions, exploring the underlying causes behind the volatility and providing insights into potential future traits.

This Week’s Gold Value Efficiency: (Observe: Change this part with precise knowledge for the particular week. The next is a template.)

To start, let’s look at a hypothetical gold fee chart for this week. Assume, for illustrative functions, that the worth of gold opened on Monday at $1950 per troy ounce. All through the week, we noticed the next fluctuations:

- Monday: Opened at $1950, closed at $1960 (+$10). This slight enhance might be attributed to [insert specific reason, e.g., a weaker US dollar].

- Tuesday: Opened at $1960, closed at $1945 (-$15). The decline could be linked to [insert specific reason, e.g., positive economic data boosting investor confidence in riskier assets].

- Wednesday: Opened at $1945, closed at $1955 (+$10). This rebound might be attributed to [insert specific reason, e.g., escalating geopolitical tensions increasing safe-haven demand].

- Thursday: Opened at $1955, closed at $1970 (+$15). The rise could be resulting from [insert specific reason, e.g., concerns about inflation and central bank policy].

- Friday: Opened at $1970, closed at $1965 (-$5). The slight dip might be attributed to [insert specific reason, e.g., profit-taking by investors after a week of gains].

This hypothetical chart illustrates the everyday volatility skilled within the gold market, even inside a single week. The precise chart for the week in query would exchange this instance, exhibiting particular opening and shutting costs, in addition to intraday highs and lows. A visible illustration of the chart would additional improve understanding.

Elements Influencing Gold Costs This Week:

A number of key components contribute to the fluctuations noticed within the gold fee chart this week. These will be broadly categorized as:

1. Macroeconomic Elements:

-

Inflation and Curiosity Charges: Gold is commonly seen as a hedge in opposition to inflation. If inflation expectations rise, traders are inclined to flock to gold as a retailer of worth, pushing costs larger. Conversely, rising rates of interest, which generally accompany efforts to fight inflation, could make holding non-interest-bearing belongings like gold much less enticing, probably main to cost declines. This week’s actions might replicate the market’s interpretation of current inflation knowledge and central financial institution pronouncements on financial coverage. (Detailed evaluation of particular knowledge releases and their affect on gold costs needs to be included right here).

-

US Greenback Energy: The US greenback and gold costs usually have an inverse relationship. A stronger greenback makes gold dearer for holders of different currencies, decreasing demand and probably miserable costs. Conversely, a weaker greenback can enhance gold’s enchantment, driving costs upward. This week’s actions within the greenback index needs to be analyzed and correlated with gold worth modifications.

-

Financial Progress: Sturdy financial development can typically result in decrease demand for gold, as traders shift their focus to riskier belongings with larger potential returns. Conversely, issues about financial slowdown or recession can enhance safe-haven demand for gold, driving costs larger. This week’s financial indicators and their affect on investor sentiment have to be explored.

2. Geopolitical Elements:

Geopolitical instability is a significant driver of gold costs. Occasions comparable to wars, political upheavals, and worldwide tensions usually enhance demand for gold as a secure haven asset, pushing costs larger. This week, any important geopolitical occasions, comparable to escalating tensions between nations, political uncertainty in key areas, or main worldwide conflicts, needs to be analyzed for his or her contribution to gold worth volatility. The particular affect of those occasions on investor sentiment and their reflection within the gold fee chart needs to be detailed.

3. Market-Particular Elements:

-

Provide and Demand: The general provide and demand dynamics within the gold market play a big position in worth willpower. Elements comparable to gold mining manufacturing, jewellery demand, and central financial institution purchases affect the availability aspect, whereas investor sentiment and industrial demand have an effect on the demand aspect. Any important modifications in these components this week needs to be mentioned.

-

Funding Flows: Flows of funding capital into and out of gold-backed exchange-traded funds (ETFs) and different gold investments can have a big affect on costs. A surge in ETF inflows suggests elevated investor confidence in gold, probably driving costs larger, whereas outflows can have the alternative impact. Evaluation of ETF flows this week is essential.

-

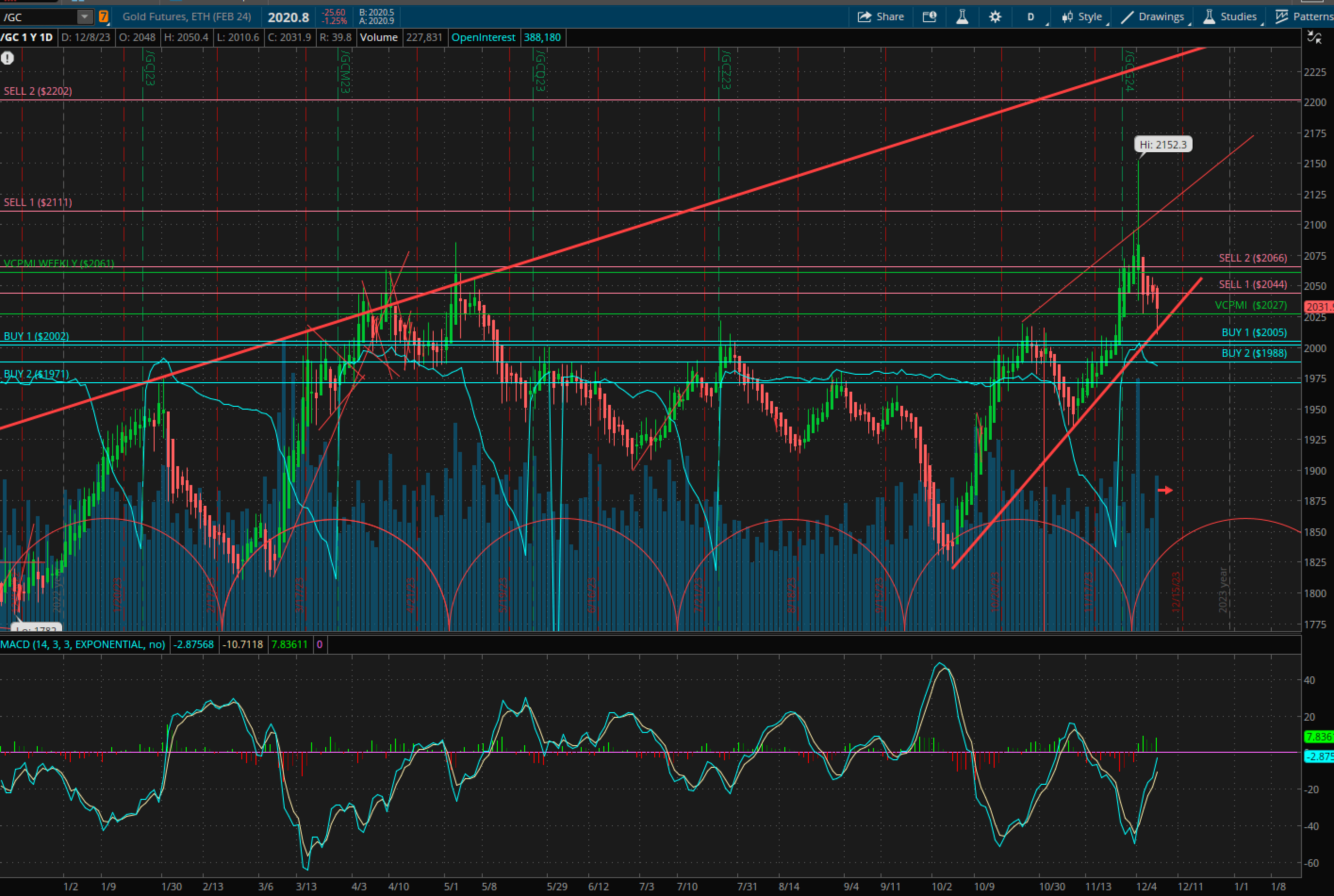

Technical Evaluation: Chart patterns and technical indicators can present insights into potential future worth actions. Technical analysts usually use instruments comparable to shifting averages, help and resistance ranges, and different indicators to foretell worth traits. This part ought to incorporate related technical evaluation for the week in query, highlighting key help and resistance ranges, trendlines, and any important chart patterns noticed.

Future Outlook:

Predicting future gold costs is inherently difficult, because the market is influenced by a posh interaction of things. Nonetheless, primarily based on the evaluation of this week’s gold fee chart and the underlying components mentioned above, we are able to supply some potential situations for the approaching weeks:

-

Situation 1: Continued Volatility: If geopolitical uncertainty persists and macroeconomic knowledge stay blended, gold costs are more likely to stay unstable, fluctuating inside an outlined vary.

-

Situation 2: Upward Pattern: If inflation stays elevated, the US greenback weakens, and geopolitical dangers enhance, gold costs may expertise an upward pattern.

-

Situation 3: Downward Pattern: If inflation cools, rates of interest rise considerably, and financial development accelerates, gold costs may expertise a downward pattern.

You will need to be aware that these are simply potential situations, and the precise worth actions will rely upon the unfolding of varied financial, geopolitical, and market occasions.

Conclusion:

This week’s gold fee chart displays a dynamic market influenced by a posh interaction of macroeconomic, geopolitical, and market-specific components. Understanding these components is essential for traders looking for to navigate the gold market successfully. Whereas predicting future worth actions with certainty is unimaginable, cautious evaluation of the chart, coupled with a deep understanding of the underlying drivers, can assist traders make knowledgeable selections and handle their threat successfully. Steady monitoring of financial knowledge, geopolitical developments, and market sentiment is significant for staying forward of the curve on this ever-evolving market. Keep in mind to seek the advice of with a monetary advisor earlier than making any funding selections. (Keep in mind to switch the hypothetical knowledge and evaluation with precise knowledge and insights for the particular week.)

/bnn/media/media_files/3402357da85ec0765612d61b3192a0fa17b1fd50fafdb5c14abfd5c5a74a3cb9.jpg)

Closure

Thus, we hope this text has offered invaluable insights into Gold Price Chart This Week: A Deep Dive into Market Fluctuations and Influencing Elements. We hope you discover this text informative and helpful. See you in our subsequent article!