Gold Vs Platinum Worth Chart

gold vs platinum worth chart

Associated Articles: gold vs platinum worth chart

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to gold vs platinum worth chart. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Gold vs. Platinum: A Comparative Worth Chart Evaluation

Gold and platinum, each valuable metals prized for his or her rarity, sturdiness, and industrial functions, have lengthy captivated buyers and collectors. Whereas typically thought-about interchangeable in sure contexts, their worth actions inform distinct tales, reflecting totally different market dynamics and underlying financial forces. Understanding the connection between gold and platinum costs, as depicted in a comparative worth chart, is essential for knowledgeable funding choices. This text will delve into an in depth evaluation of historic worth knowledge, exploring the components influencing the value fluctuations of every metallic and highlighting the important thing variations and similarities between their worth charts.

A Visible Journey Via Time: The Gold vs. Platinum Worth Chart

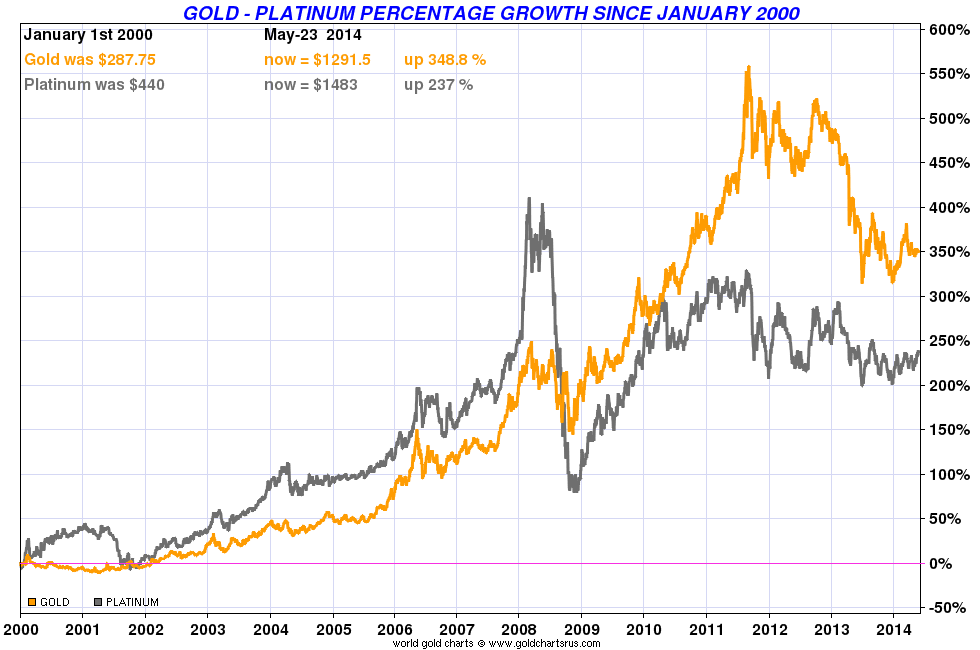

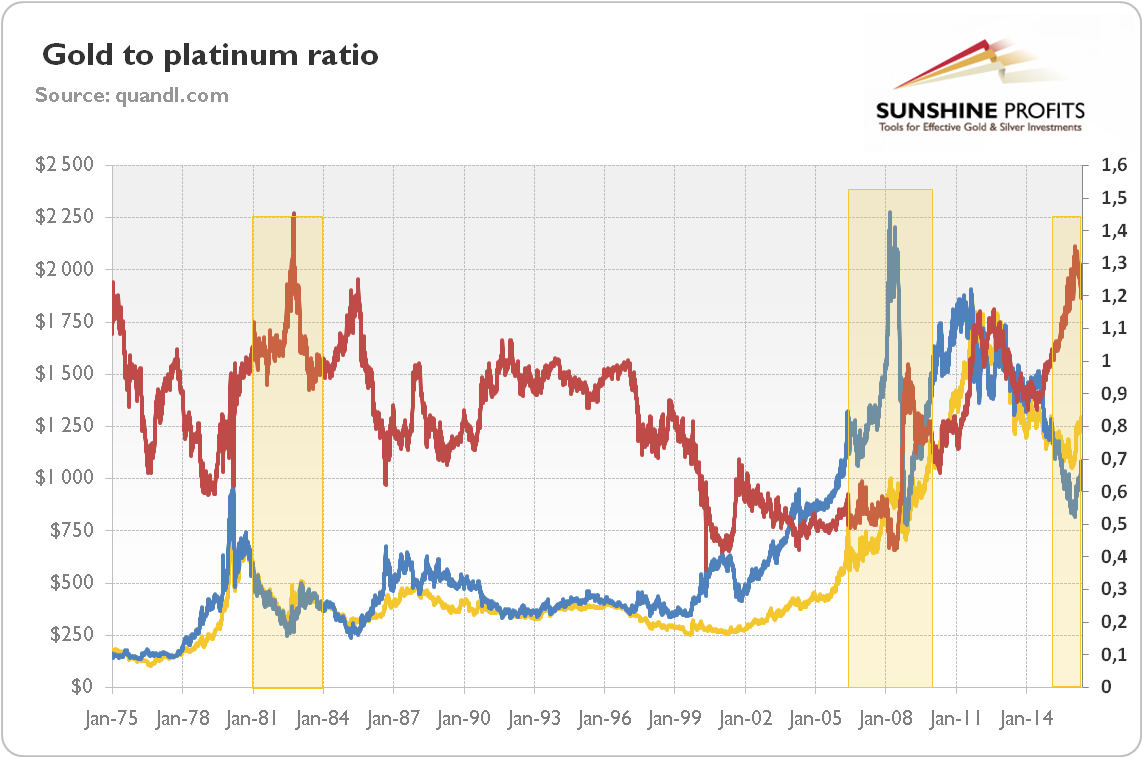

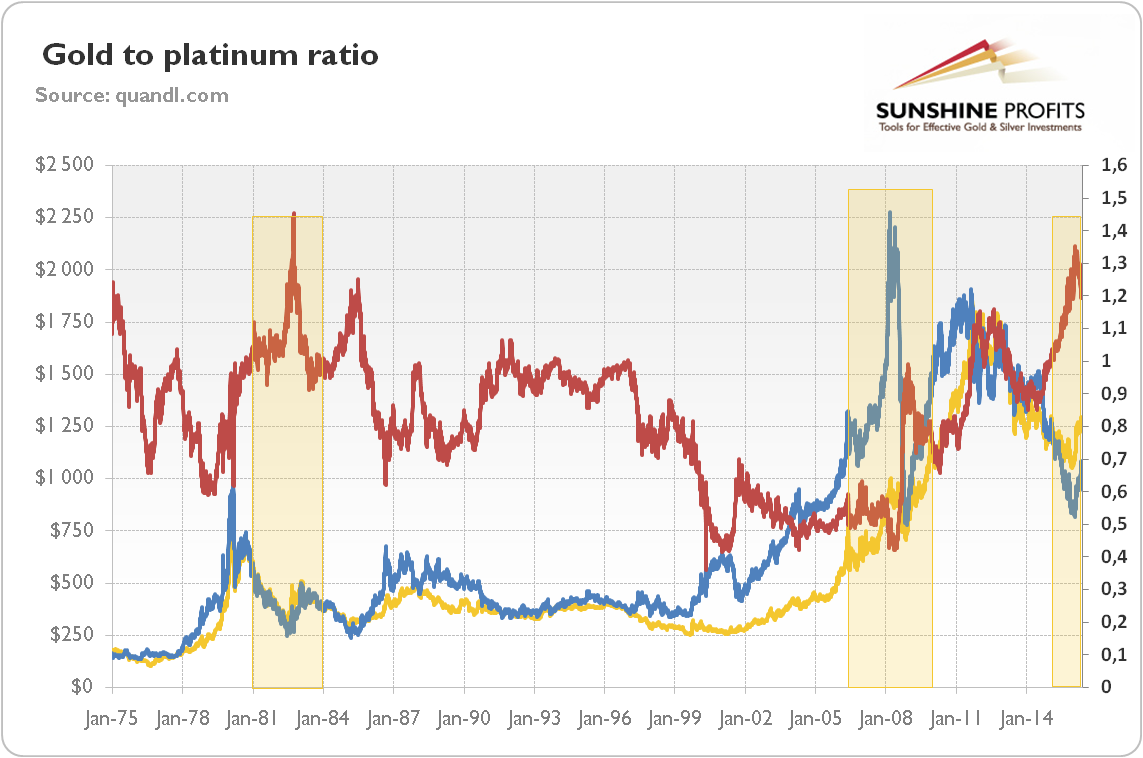

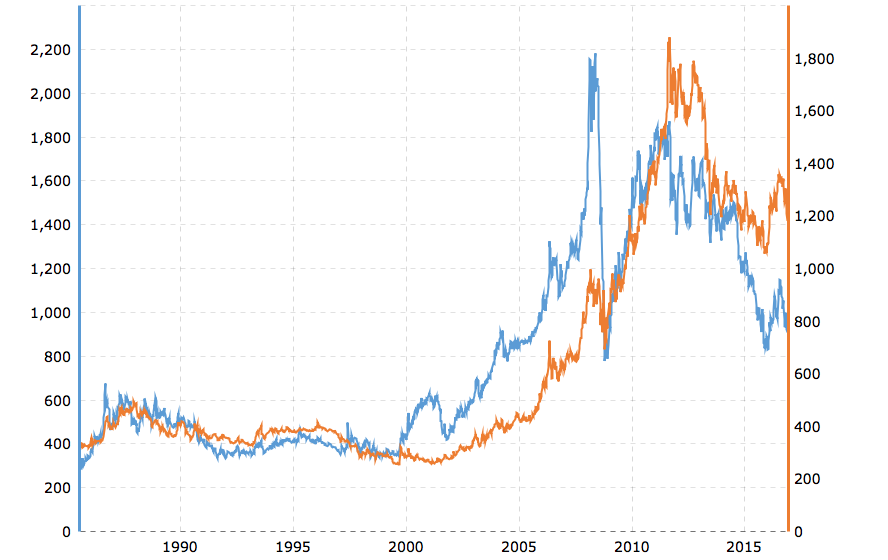

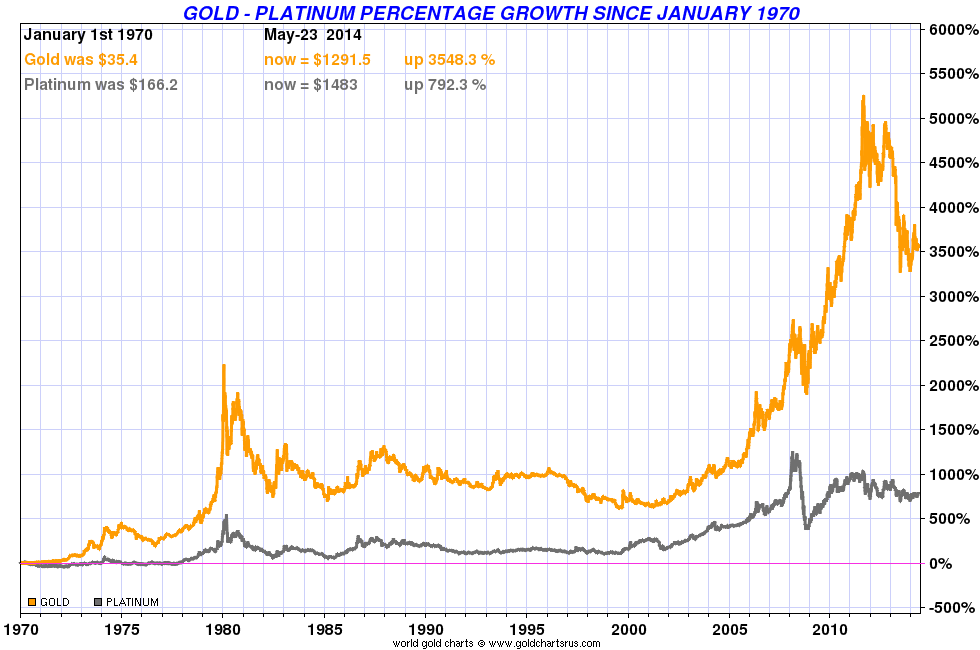

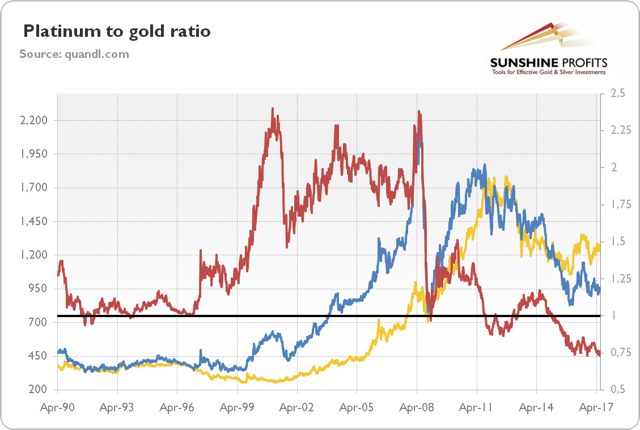

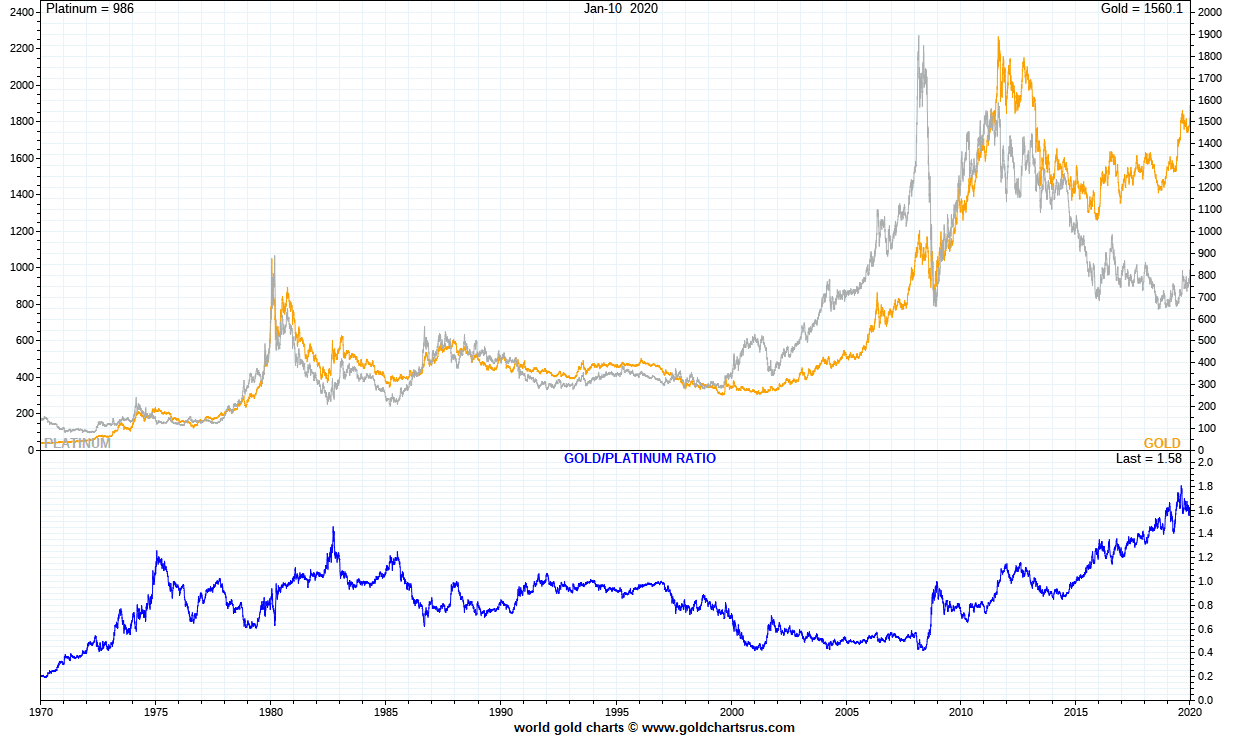

A comparative worth chart of gold and platinum over the previous few many years reveals an enchanting interaction of worth actions. Whereas each metals usually pattern upwards over the long run, reflecting their inherent worth and shortage, their short-term and medium-term worth fluctuations typically diverge considerably. Intervals of sturdy correlation exist, however these are punctuated by intervals the place the metals transfer in reverse instructions.

(Insert a high-quality, interactive chart right here exhibiting the value of gold and platinum over no less than the previous 20 years. Ideally, this chart would enable customers to zoom in on particular time intervals and examine the value actions of each metals. The chart ought to be clearly labeled with axes representing time and worth (in USD per troy ounce). Think about using a logarithmic scale for the value axis to raised visualize giant worth swings.)

Components Influencing Gold Costs:

Gold’s worth is primarily influenced by its position as a safe-haven asset. Throughout instances of financial uncertainty, geopolitical instability, or inflation, buyers flock to gold as a hedge towards danger. This "flight to security" drives up demand and consequently, the value. Different components influencing gold costs embody:

- Inflation: Gold is usually thought-about an inflation hedge, as its worth tends to rise alongside inflation. When the buying energy of fiat currencies declines, buyers search refuge in gold, which retains its intrinsic worth.

- Curiosity Charges: Inversely associated to gold costs, increased rates of interest make holding non-interest-bearing belongings like gold much less engaging. Conversely, decrease rates of interest can enhance gold’s enchantment.

- US Greenback Energy: The worth of gold is usually inversely correlated with the US greenback’s worth. A stronger greenback makes gold dearer for holders of different currencies, lowering demand and probably reducing the value.

- Central Financial institution Exercise: Central banks’ shopping for and promoting of gold can considerably affect market costs. Massive purchases by central banks, significantly in rising markets, can drive up demand and costs.

- Jewellery and Funding Demand: Demand for gold within the jewellery and funding sectors performs an important position. Adjustments in client spending habits and funding sentiment can affect worth actions.

- Provide and Manufacturing: Whereas gold is a comparatively scarce useful resource, new discoveries and enhancements in mining know-how can have an effect on the provision aspect, probably influencing costs.

Components Influencing Platinum Costs:

In contrast to gold, platinum’s worth is extra carefully tied to industrial demand. Whereas it additionally serves as a safe-haven asset to a lesser extent than gold, its major drivers are associated to its industrial functions:

- Automotive Trade: The most important client of platinum is the automotive trade, the place it is utilized in catalytic converters to cut back dangerous emissions. Fluctuations in automotive manufacturing and gross sales immediately affect platinum demand and worth.

- Jewellery and Funding Demand: Whereas much less vital than its position within the automotive sector, platinum additionally finds its means into jewellery and funding markets. Demand in these sectors can affect worth actions, albeit to a lesser diploma than in gold.

- Electronics Trade: Platinum can be utilized in varied digital parts, contributing to its industrial demand. Development or contraction within the electronics sector can have an effect on platinum costs.

- Provide and Manufacturing: Just like gold, platinum’s provide is influenced by mining manufacturing and new discoveries. Nevertheless, platinum’s provide is extra concentrated geographically, making it probably extra weak to geopolitical occasions.

- Palladium Costs: Platinum and palladium are sometimes used interchangeably in sure functions. Worth actions in palladium can affect platinum’s worth, as they’re substitutes in some industrial processes.

- Financial Development: World financial progress is a big driver of platinum demand, as industrial exercise will increase. Recessions or slowdowns can negatively affect platinum costs.

Evaluating the Worth Charts: Key Variations and Similarities

An in depth examination of the gold vs. platinum worth chart reveals each similarities and vital variations:

- Lengthy-Time period Upward Pattern: Each gold and platinum usually exhibit a long-term upward pattern, reflecting their inherent worth and shortage. Nevertheless, the magnitude and consistency of this upward pattern differ between the 2 metals.

- Volatility: Platinum tends to be extra unstable than gold, exhibiting extra pronounced worth swings in response to adjustments in industrial demand. Gold’s worth actions are usually smoother, reflecting its stronger position as a safe-haven asset.

- Correlation and Divergence: Whereas intervals of optimistic correlation exist, the place each metals transfer in the identical route, there are additionally instances when their costs diverge considerably. These divergences typically replicate the differing components influencing every metallic’s worth. As an example, a surge in automotive manufacturing would possibly enhance platinum costs whereas gold stays comparatively steady. Conversely, a world financial disaster would possibly drive up gold costs whereas negatively impacting platinum as a consequence of diminished industrial demand.

- Influence of Financial Occasions: Each metals are affected by macroeconomic occasions, however the nature and extent of the affect differ. Gold tends to learn from financial uncertainty and inflation, whereas platinum’s worth is extra delicate to international financial progress and industrial exercise.

Funding Implications:

Understanding the variations within the worth charts of gold and platinum is essential for buyers. Gold gives a extra steady, defensive funding, appropriate for these in search of a protected haven throughout instances of financial turmoil. Platinum, however, presents a extra speculative funding alternative, with increased potential returns but additionally better danger. Diversification inside a portfolio, together with each gold and platinum, can provide a balanced strategy, mitigating danger whereas probably capturing beneficial properties from totally different market circumstances.

Conclusion:

The gold vs. platinum worth chart supplies a wealthy tapestry of market dynamics, reflecting the distinctive components influencing every metallic’s worth. Whereas each metals provide beneficial funding alternatives, their distinct traits and worth behaviors necessitate a cautious understanding of the underlying drivers earlier than making funding choices. By analyzing historic worth knowledge, contemplating present market circumstances, and assessing particular person danger tolerance, buyers can develop a well-informed technique for incorporating gold and platinum into their portfolios. Steady monitoring of the comparative worth chart and consciousness of the components influencing every metallic’s worth are important for navigating the complexities of this dynamic market.

Closure

Thus, we hope this text has supplied beneficial insights into gold vs platinum worth chart. We hope you discover this text informative and helpful. See you in our subsequent article!