Mastering Cash Management: A Deep Dive Into Management Chart Evaluation For Monetary Stability

Mastering Cash Management: A Deep Dive into Management Chart Evaluation for Monetary Stability

Associated Articles: Mastering Cash Management: A Deep Dive into Management Chart Evaluation for Monetary Stability

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Mastering Cash Management: A Deep Dive into Management Chart Evaluation for Monetary Stability. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Mastering Cash Management: A Deep Dive into Management Chart Evaluation for Monetary Stability

Monetary stability is the bedrock of any profitable particular person or group. Sustaining management over cash, nonetheless, is extra than simply balancing a checkbook; it requires a scientific strategy to understanding and managing monetary fluctuations. That is the place management chart evaluation comes into play. Whereas historically utilized in manufacturing and high quality management, the rules of management charts provide a robust methodology for monitoring and enhancing monetary efficiency, figuring out anomalies, and in the end enhancing monetary stability. This text explores the appliance of management charts in cash management, detailing their numerous sorts, interpretation, and sensible implications.

Understanding Management Charts: A Basis for Monetary Stability

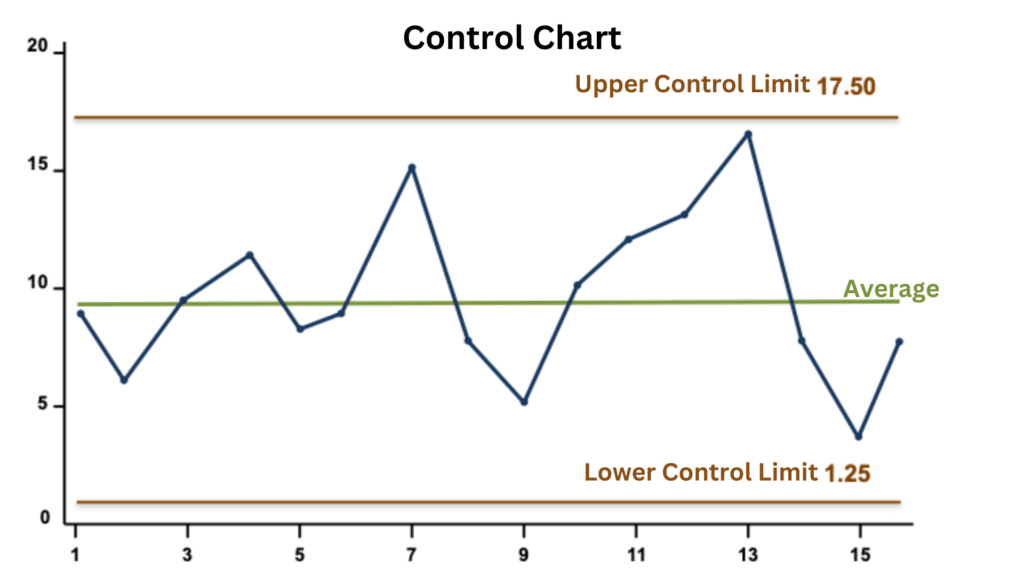

Management charts are graphical instruments used to watch a course of over time. They show knowledge factors plotted in chronological order, together with statistically calculated management limits. These limits outline the anticipated vary of variation for the method. Knowledge factors falling inside these limits counsel the method is steady and predictable. Factors exterior the boundaries point out potential particular causes of variation, signaling a necessity for investigation and corrective motion.

The core good thing about utilizing management charts in monetary administration lies of their means to separate widespread trigger variation from particular trigger variation. Widespread trigger variation is inherent within the system and is predicted. Particular trigger variation, however, represents uncommon occasions or adjustments that considerably impression the method. Figuring out these particular causes is essential for efficient intervention and prevention of future issues.

Varieties of Management Charts Relevant to Monetary Knowledge

A number of kinds of management charts may be tailored for analyzing monetary knowledge, every suited to various kinds of variables:

-

People and Transferring Vary (I-MR) Charts: These charts are perfect for monitoring particular person knowledge factors, akin to day by day money stream or weekly gross sales figures. The I-chart plots the person knowledge factors, whereas the MR-chart plots the transferring vary (absolutely the distinction between consecutive knowledge factors), offering insights into the variability of the method. That is notably helpful when coping with rare knowledge factors or when the info lacks subgroups.

-

X-bar and R Charts: When knowledge may be grouped into subgroups (e.g., month-to-month bills categorized by division), X-bar and R charts are extremely efficient. The X-bar chart tracks the common of every subgroup, whereas the R-chart screens the vary inside every subgroup. This strategy helps establish each shifts within the common and adjustments in variability.

-

C-charts and U-charts: These charts are particularly designed for rely knowledge, such because the variety of buyer complaints, bounced checks, or late funds. C-charts are used when the pattern measurement is fixed, whereas U-charts are used when the pattern measurement varies. These charts are essential for monitoring the frequency of undesirable occasions.

-

p-charts and np-charts: These charts are used for analyzing proportions or percentages. For instance, a p-chart can monitor the share of profitable transactions, whereas an np-chart can monitor the variety of unsuccessful transactions. These are helpful for monitoring the standard or success fee of economic processes.

Making use of Management Charts to Particular Monetary Eventualities

The appliance of management charts in monetary administration is various and far-reaching. Let’s take into account some sensible examples:

-

Money Stream Administration: An I-MR chart can be utilized to watch day by day money stream, revealing patterns and figuring out potential points like surprising bills or delays in funds. Out-of-control factors would possibly sign the necessity for quick motion, akin to securing further funding or adjusting spending.

-

Gross sales Forecasting and Evaluation: X-bar and R charts can be utilized to investigate gross sales knowledge grouped by month or quarter. This enables for the identification of tendencies, seasonality, and potential anomalies. Out-of-control factors would possibly point out a necessity to analyze advertising and marketing methods or exterior components affecting gross sales.

-

Debt Administration: Management charts can monitor excellent debt ranges over time, serving to to establish tendencies and potential dangers. This enables for proactive debt administration methods, stopping extreme debt accumulation.

-

Funding Efficiency: Management charts can be utilized to watch the efficiency of funding portfolios, figuring out intervals of great underperformance or overperformance. This helps in evaluating funding methods and making knowledgeable selections.

-

Threat Administration: Management charts can monitor the frequency and severity of economic dangers, akin to fraud or defaults. This enables for the event of efficient danger mitigation methods.

Deciphering Management Charts: Recognizing Indicators of Instability

Deciphering management charts requires understanding the that means of factors exterior the management limits and patterns inside the chart.

-

Factors exterior the management limits: These factors strongly counsel the presence of particular trigger variation. Investigation is important to establish the underlying trigger. This might contain reviewing monetary data, conducting interviews, or analyzing exterior components.

-

Developments: A constant upward or downward pattern, even when all factors stay inside the management limits, suggests a gradual shift within the course of. This warrants consideration and potential adjustment of methods.

-

Stratification: Clustering of factors above or beneath the central line signifies potential stratification, implying the presence of subgroups with completely different traits. Additional evaluation is required to establish these subgroups and perceive their impression.

-

Cycles: Recurring patterns of excessive and low values counsel cyclical conduct, which could be associated to seasonal components or different recurring occasions. Understanding these cycles is essential for correct forecasting and planning.

Limitations and Concerns

Whereas management charts provide invaluable insights, it is essential to acknowledge their limitations:

-

Knowledge high quality: The accuracy of management chart evaluation relies upon closely on the standard of the underlying knowledge. Inaccurate or incomplete knowledge will result in deceptive outcomes.

-

Assumptions: Management charts depend on sure statistical assumptions, akin to normality and independence of knowledge factors. Violation of those assumptions can have an effect on the accuracy of the evaluation.

-

Contextual understanding: Management charts shouldn’t be interpreted in isolation. Contextual data and knowledgeable judgment are essential for correct interpretation and decision-making.

Conclusion: Embracing Knowledge-Pushed Monetary Management

Management chart evaluation gives a sturdy and systematic strategy to managing monetary stability. By visually representing monetary knowledge and figuring out patterns and anomalies, management charts empower people and organizations to make knowledgeable selections, optimize monetary processes, and mitigate dangers. Whereas mastering management chart evaluation requires understanding statistical rules and cautious interpretation, the advantages when it comes to enhanced monetary management and improved decision-making far outweigh the hassle concerned. Embracing data-driven approaches like management chart evaluation is essential for navigating the complexities of recent finance and reaching long-term monetary success. By proactively monitoring monetary processes and responding successfully to alerts of instability, people and organizations can construct a powerful basis for lasting monetary stability.

Closure

Thus, we hope this text has offered invaluable insights into Mastering Cash Management: A Deep Dive into Management Chart Evaluation for Monetary Stability. We respect your consideration to our article. See you in our subsequent article!