Mastering The Artwork Of Chart Sample Buying and selling: A Complete Information

Mastering the Artwork of Chart Sample Buying and selling: A Complete Information

Associated Articles: Mastering the Artwork of Chart Sample Buying and selling: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Mastering the Artwork of Chart Sample Buying and selling: A Complete Information. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Mastering the Artwork of Chart Sample Buying and selling: A Complete Information

Chart patterns, recurring formations on worth charts, provide merchants invaluable insights into market sentiment and potential future worth actions. Whereas no sample ensures success, understanding and accurately figuring out them can considerably enhance buying and selling methods. This text explores a variety of chart patterns, overlaying their traits, identification, and buying and selling methods, aiming to offer a complete information for merchants of all ranges.

Understanding Chart Patterns: The Basis of Technical Evaluation

Chart patterns are visible representations of the battle between consumers and sellers. These formations emerge because of shifts in market sentiment, usually reflecting durations of consolidation earlier than a big worth transfer. By figuring out these patterns, merchants can anticipate potential breakouts, reversals, or continuations of present tendencies. The success of chart sample buying and selling depends closely on correct identification, threat administration, and affirmation via different technical indicators.

Main Chart Sample Classes:

Chart patterns are broadly categorized into two principal teams: continuation and reversal patterns.

I. Continuation Patterns: These patterns recommend a short lived pause in an present development, adopted by a resumption of that development in the identical path.

-

Triangles: Triangles are characterised by converging trendlines, indicating a interval of indecision between consumers and sellers. There are three principal sorts:

- Symmetrical Triangles: Costs oscillate between two converging trendlines with no discernible upward or downward bias. A breakout above the higher trendline confirms an uptrend continuation, whereas a break beneath the decrease trendline indicators a downtrend resumption.

- Ascending Triangles: The higher trendline is horizontal, whereas the decrease trendline slopes upward. This sample suggests a bullish continuation, with a breakout above the higher trendline anticipated.

- Descending Triangles: The decrease trendline is horizontal, whereas the higher trendline slopes downward. This sample suggests a bearish continuation, with a breakdown beneath the decrease trendline anticipated.

-

Rectangles: Rectangles are characterised by horizontal help and resistance ranges, indicating a interval of sideways consolidation. Breakouts above the resistance degree verify an uptrend continuation, whereas breakdowns beneath the help degree sign a downtrend resumption. The size of the rectangle usually gives a sign of the potential magnitude of the next transfer.

-

Flags and Pennants: These patterns resemble miniature triangles, showing throughout sturdy tendencies. Flags are characterised by parallel trendlines, whereas pennants are converging triangles. Each point out a short lived pause within the development, with a breakout within the path of the prevailing development anticipated.

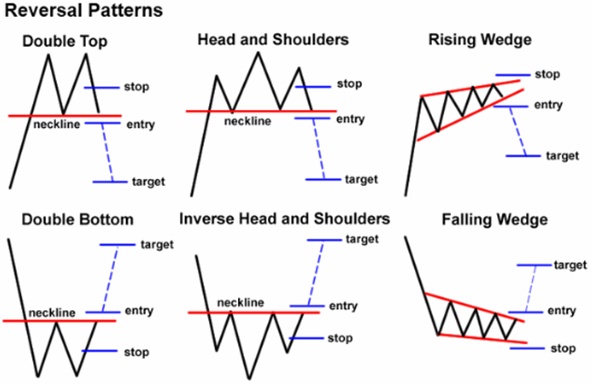

II. Reversal Patterns: These patterns recommend a possible change within the path of the prevailing development.

-

Head and Shoulders: This can be a basic reversal sample consisting of three peaks, with the center peak (the "head") being considerably larger than the opposite two ("shoulders"). A neckline connects the troughs between the peaks. A breakdown beneath the neckline confirms the reversal, indicating a possible downtrend. The inverse sample, the "inverse head and shoulders," indicators a possible uptrend reversal.

-

Double Tops and Double Bottoms: Double tops are characterised by two comparable worth highs, adopted by a decline. Double bottoms encompass two comparable worth lows, adopted by an increase. A breakdown beneath the neckline in a double prime or a breakout above the neckline in a double backside confirms the reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three peaks or troughs. These patterns usually point out stronger reversal indicators because of the elevated affirmation.

-

Rounding Tops and Bottoms: These patterns are characterised by a gradual curve, forming a rounded form. Rounding tops recommend a bearish reversal, whereas rounding bottoms point out a bullish reversal. These patterns usually take longer to kind than different reversal patterns.

-

Wedge Patterns: Wedge patterns are characterised by converging trendlines, just like triangles. Nevertheless, in contrast to triangles, wedges are thought of reversal patterns after they seem within the context of a longtime development. A rising wedge (upward sloping trendlines) suggests a bearish reversal, whereas a falling wedge (downward sloping trendlines) indicators a bullish reversal.

Buying and selling Methods for Chart Patterns:

Profitable chart sample buying and selling requires a well-defined technique incorporating threat administration and affirmation methods.

-

Affirmation: Relying solely on chart patterns is dangerous. Confirmations from different technical indicators, corresponding to quantity, shifting averages, and oscillators (RSI, MACD), are essential. Elevated quantity throughout a breakout usually signifies stronger conviction.

-

Assist and Resistance: Figuring out key help and resistance ranges is important. Breakouts ought to ideally happen above resistance or beneath help, reinforcing the sample’s sign.

-

Entry and Exit Methods: Entry factors ought to be rigorously chosen, usually close to the breakout degree. Cease-loss orders ought to be positioned beneath the help degree for lengthy positions and above the resistance degree for brief positions to restrict potential losses. Take-profit targets will be set primarily based on the sample’s projected worth motion, utilizing Fibonacci retracements or different methods.

-

Danger Administration: By no means threat greater than a small proportion of your buying and selling capital on any single commerce. Correct threat administration is essential for long-term success in any buying and selling technique.

-

Sample Recognition Follow: Mastering chart sample identification requires intensive observe. Analyzing historic charts and backtesting buying and selling methods are important for enhancing sample recognition abilities.

Challenges and Limitations:

Whereas chart patterns provide invaluable insights, they aren’t foolproof. A number of components can restrict their effectiveness:

-

Subjectivity: Figuring out chart patterns will be subjective, with totally different merchants doubtlessly decoding the identical formation in another way.

-

False Breakouts: Typically, costs might break via a sample’s help or resistance degree solely to revert again, resulting in false indicators.

-

Market Noise: Market noise can obscure chart patterns, making them tough to determine precisely.

-

Lack of Context: Chart patterns ought to be analyzed throughout the broader market context, contemplating components corresponding to total market sentiment, financial indicators, and information occasions.

Conclusion:

Chart patterns are a strong device in a dealer’s arsenal, providing invaluable insights into potential market actions. Nevertheless, profitable chart sample buying and selling requires a complete understanding of varied patterns, meticulous identification, affirmation via different indicators, sturdy threat administration, and constant observe. By combining chart sample evaluation with different technical and basic evaluation methods, merchants can considerably improve their buying and selling methods and enhance their probabilities of success. Do not forget that steady studying and adaptation are key to mastering the artwork of chart sample buying and selling. By no means rely solely on chart patterns; at all times incorporate a holistic method to buying and selling choices.

Closure

Thus, we hope this text has supplied invaluable insights into Mastering the Artwork of Chart Sample Buying and selling: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!