Navigating The Depreciable Asset Maze: A Complete Information To Firm Act Depreciation Charges

Navigating the Depreciable Asset Maze: A Complete Information to Firm Act Depreciation Charges

Associated Articles: Navigating the Depreciable Asset Maze: A Complete Information to Firm Act Depreciation Charges

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Navigating the Depreciable Asset Maze: A Complete Information to Firm Act Depreciation Charges. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Navigating the Depreciable Asset Maze: A Complete Information to Firm Act Depreciation Charges

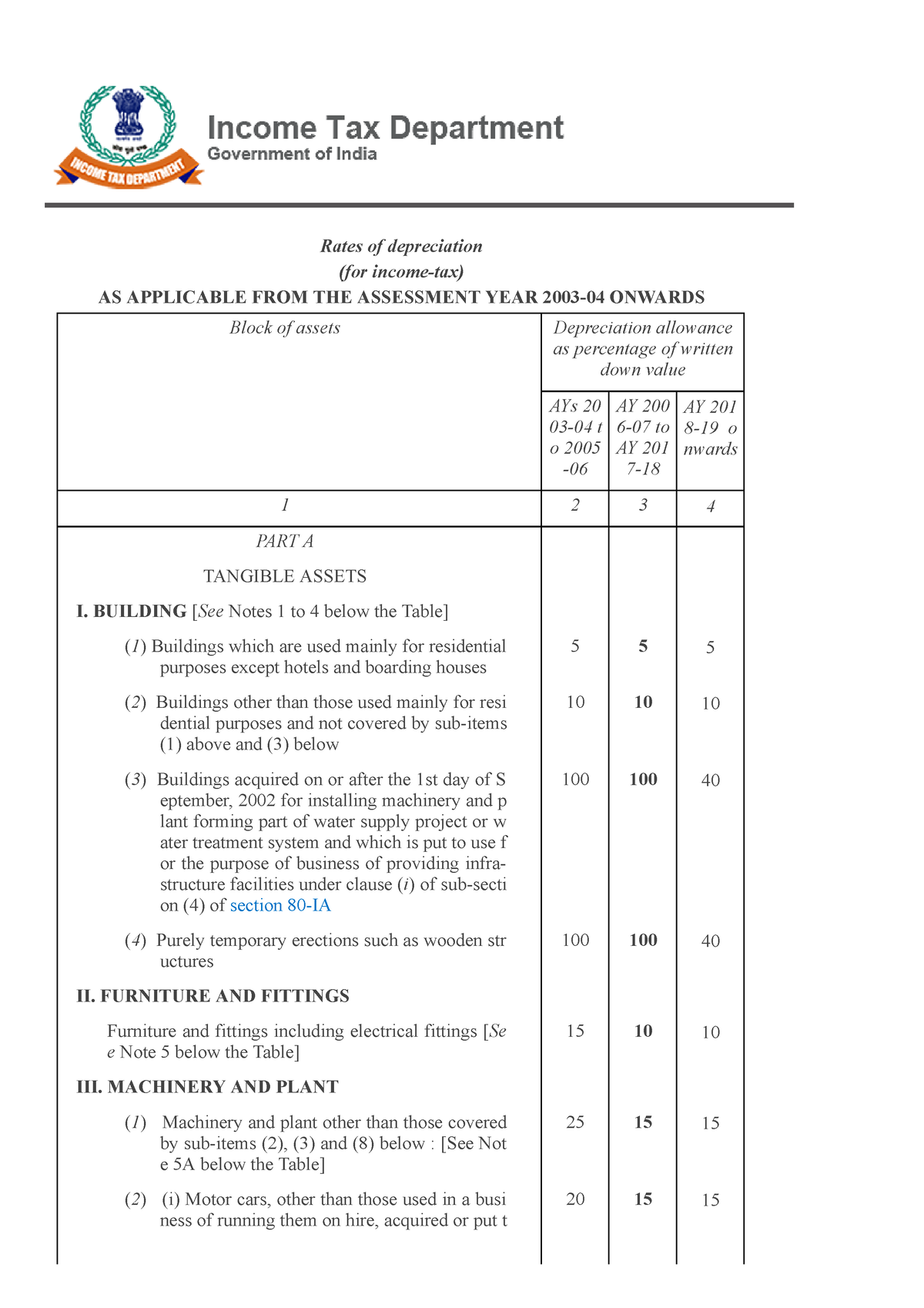

The Firms Act, whereas not explicitly dictating particular depreciation charges, performs an important function in shaping how firms account for the wear and tear and tear of their belongings. Understanding the depreciation course of and the components influencing its calculation is significant for correct monetary reporting, tax compliance, and knowledgeable enterprise choices. This text supplies a complete overview of depreciation underneath the Firms Act, exploring the related laws, out there strategies, and sensible implications for companies. Whereas no single "Firm Act depreciation fee chart" exists, we’ll illuminate the framework inside which these charges are decided.

The Significance of Depreciation underneath Firm Acts

Depreciation displays the systematic allocation of an asset’s price over its helpful life. It isn’t about measuring the precise market worth decline however relatively recognizing the expense of utilizing an asset over time. Correct depreciation is essential for a number of causes:

- Correct Monetary Reporting: Correct depreciation ensures a real and truthful view of an organization’s monetary place and efficiency. Over- or under-depreciation can distort earnings, impacting investor choices and creditworthiness.

- Tax Compliance: Depreciation is a tax-deductible expense, decreasing taxable earnings. Correct calculation is crucial to keep away from penalties and guarantee compliance with tax laws.

- Asset Administration: Monitoring depreciation helps companies monitor the lifespan and efficiency of their belongings, informing alternative choices and capital expenditure planning.

- Determination-Making: Dependable depreciation knowledge assists in making knowledgeable choices associated to asset disposal, funding appraisal, and general enterprise technique.

The Firms Act’s Function: Rules, Not Prescriptions

Firm Acts worldwide, together with these in lots of jurisdictions, do not sometimes prescribe particular depreciation charges for every asset class. As an alternative, they deal with ideas of sound accounting observe, emphasizing the necessity for:

- Consistency: Firms should apply the identical depreciation methodology constantly from yr to yr for comparable belongings except there is a justifiable change.

- Materiality: The chosen depreciation methodology needs to be applicable for the dimensions and nature of the asset and its affect on the monetary statements. Minor discrepancies is likely to be acceptable, however vital inaccuracies usually are not.

- Prudence: Depreciation ought to replicate a cautious strategy, recognizing the potential for asset worth decline.

- Disclosure: Firms should clearly disclose their depreciation insurance policies, strategies used, and the ensuing costs of their monetary statements.

Selecting the Proper Depreciation Technique

A number of strategies can be found for calculating depreciation, every with its personal benefits and drawbacks:

-

Straight-Line Technique: That is the best methodology, allocating the asset’s price evenly over its helpful life. It is calculated as:

(Value - Salvage Worth) / Helpful LifeThe place:

- Value is the unique buy worth of the asset.

- Salvage Worth is the estimated worth of the asset on the finish of its helpful life.

- Helpful Life is the estimated interval the asset might be in use.

-

Decreasing Steadiness Technique (Declining Steadiness Technique): This methodology applies a set share to the asset’s web e-book worth (price much less accrued depreciation) every year. It ends in greater depreciation costs within the early years and decrease costs in later years. The speed is usually double the straight-line fee.

-

Items of Manufacturing Technique: This methodology calculates depreciation based mostly on the precise use of the asset. It is ultimate for belongings whose worth declines immediately with utilization, akin to equipment. The formulation is:

((Value - Salvage Worth) / Complete Items of Manufacturing) * Items Produced within the 12 months -

Sum-of-the-Years’ Digits Technique: This accelerated depreciation methodology ends in greater depreciation costs within the early years and decrease costs in later years. The formulation is complicated however entails summing the digits of the asset’s helpful life and utilizing that sum as a denominator.

Figuring out Helpful Life and Salvage Worth: Key Issues

The accuracy of depreciation calculations hinges on precisely estimating the asset’s helpful life and salvage worth. These estimations require cautious consideration of a number of components:

- Technological Obsolescence: Speedy technological developments can shorten the helpful lifetime of belongings.

- Bodily Put on and Tear: The bodily situation of the asset and its upkeep historical past affect its helpful life.

- Authorized and Regulatory Modifications: Modifications in legal guidelines or laws may affect an asset’s helpful life or render it out of date.

- Meant Use: The depth and nature of the asset’s use have an effect on its helpful life.

- Market Circumstances: The market worth of comparable belongings can present insights into salvage worth.

Sensible Implications and Challenges

Figuring out applicable depreciation charges is a posh course of. Companies typically depend on trade benchmarks, professional opinions, and inside assessments to estimate helpful lives and salvage values. Inconsistencies can come up resulting from:

- Subjectivity in Estimations: Estimating helpful life and salvage worth entails inherent subjectivity.

- Modifications in Enterprise Circumstances: Surprising adjustments in market situations or enterprise operations can render preliminary estimations inaccurate.

- Lack of Standardized Charges: The absence of prescribed charges necessitates cautious consideration and documentation of the chosen methodology and its rationale.

The Significance of Documentation and Disclosure

Meticulous record-keeping is essential. Firms should keep detailed information of asset acquisitions, depreciation calculations, and any changes made. This documentation is crucial for audits and tax compliance. The chosen depreciation methodology, helpful life estimates, and salvage worth assumptions needs to be clearly disclosed within the monetary statements to make sure transparency and accountability.

Conclusion: A Framework for Accountable Depreciation

Whereas the Firms Act does not present a ready-made depreciation fee chart, it establishes a framework for accountable and correct depreciation accounting. The important thing lies in deciding on an applicable methodology, rigorously estimating helpful life and salvage worth, and sustaining complete information. By adhering to the ideas of consistency, materiality, prudence, and disclosure, firms can guarantee their depreciation practices align with accounting requirements, facilitate correct monetary reporting, and assist knowledgeable enterprise choices. Common overview and adjustment of depreciation insurance policies are additionally important to replicate altering circumstances and keep the integrity of monetary info. Consulting with accounting professionals is very really useful to navigate the complexities of depreciation accounting and guarantee compliance with all relevant laws.

Closure

Thus, we hope this text has supplied priceless insights into Navigating the Depreciable Asset Maze: A Complete Information to Firm Act Depreciation Charges. We thanks for taking the time to learn this text. See you in our subsequent article!