Navigating The Fluctuations: A Complete Information To Dwell Gold Worth Charts

Navigating the Fluctuations: A Complete Information to Dwell Gold Worth Charts

Associated Articles: Navigating the Fluctuations: A Complete Information to Dwell Gold Worth Charts

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Navigating the Fluctuations: A Complete Information to Dwell Gold Worth Charts. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Navigating the Fluctuations: A Complete Information to Dwell Gold Worth Charts

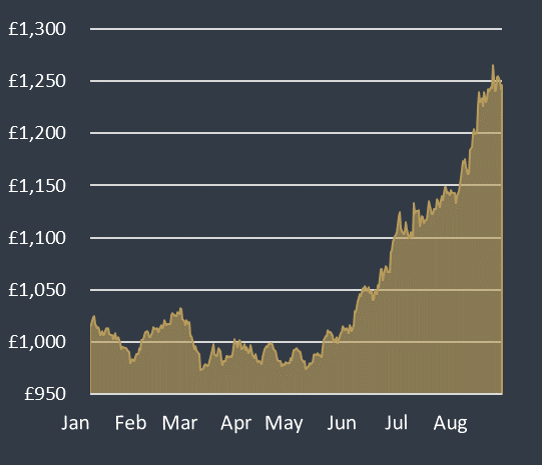

Gold, a timeless image of wealth and stability, has captivated buyers for millennia. Its inherent worth, coupled with its position as a secure haven asset throughout financial uncertainty, makes it a compelling funding selection. Understanding the dynamics of gold’s value, nevertheless, requires greater than only a cursory look at a headline. That is the place reside gold value charts grow to be indispensable instruments for navigating the complexities of this treasured metallic market. This text will delve into the intricacies of reside gold value charts, explaining their elements, decoding their actions, and highlighting their significance for each seasoned buyers and newcomers alike.

Understanding the Parts of a Dwell Gold Worth Chart

A typical reside gold value chart presents a visible illustration of the gold value’s fluctuations over a selected interval. These charts are usually interactive, permitting customers to zoom out and in, modify the timeframe, and overlay numerous technical indicators. Key elements embody:

-

Worth Axis (Y-axis): This vertical axis shows the value of gold, normally in US {dollars} per troy ounce (USD/oz). The size is usually logarithmic, that means equal share adjustments are represented by equal distances on the chart, whatever the absolute value degree.

-

Time Axis (X-axis): This horizontal axis shows the time interval coated by the chart. This could vary from a couple of minutes to a number of years, relying on the person’s desire. Frequent timeframes embody intraday (minutes, hours), each day, weekly, month-to-month, and yearly charts.

-

Worth Information Factors: These characterize the gold value at particular cut-off dates. They’re normally linked by strains to create a steady visible illustration of value actions. Candlestick charts, a well-liked selection for gold value visualization, present extra details about the opening, closing, excessive, and low costs for every interval.

-

Technical Indicators (Non-obligatory): Many reside gold value charts provide the choice to overlay technical indicators. These are mathematical calculations utilized to historic value information to determine potential traits, assist and resistance ranges, and momentum shifts. Frequent examples embody shifting averages (e.g., 20-day, 50-day, 200-day), Relative Power Index (RSI), and Bollinger Bands. These indicators can help in forecasting future value actions, but it surely’s essential to recollect they aren’t foolproof.

-

Quantity (Non-obligatory): Some charts additionally show buying and selling quantity, which represents the amount of gold traded throughout a selected interval. Excessive quantity throughout a value motion can counsel stronger conviction behind the development.

Deciphering Worth Actions on a Dwell Gold Worth Chart

Deciphering a reside gold value chart requires understanding a number of key ideas:

-

Developments: Gold costs can exhibit upward traits (bull markets), downward traits (bear markets), or sideways traits (consolidation durations). Figuring out the prevailing development is essential for making knowledgeable funding selections. Upward traits counsel rising demand and potential value appreciation, whereas downward traits counsel weakening demand and potential value depreciation.

-

Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by. Help ranges characterize value flooring the place shopping for strain is anticipated to outweigh promoting strain, stopping additional value declines. Resistance ranges characterize value ceilings the place promoting strain is anticipated to outweigh shopping for strain, stopping additional value will increase. Breaks above resistance or under assist can sign important shifts in momentum.

-

Worth Patterns: Charts usually reveal recurring value patterns that may present clues about future value actions. Examples embody head and shoulders patterns (suggesting a possible value reversal), double tops and bottoms (suggesting potential development reversals), and triangles (suggesting durations of consolidation).

-

Candlestick Patterns: Candlestick charts provide a richer visible illustration of value actions, with every candlestick representing the opening, closing, excessive, and low costs for a selected interval. Sure candlestick patterns, equivalent to engulfing patterns or hammer patterns, can sign potential development reversals or continuations.

Components Influencing Dwell Gold Costs

Understanding the components influencing gold costs is important for efficient chart interpretation. Key components embody:

-

US Greenback Power: Gold is priced in US {dollars}. A stronger greenback typically results in decrease gold costs, because it turns into costlier for holders of different currencies to purchase gold. Conversely, a weaker greenback usually boosts gold costs.

-

Curiosity Charges: Larger rates of interest are likely to negatively affect gold costs, as they make holding non-interest-bearing belongings like gold much less enticing in comparison with interest-bearing investments.

-

Inflation: Gold is commonly seen as a hedge towards inflation. In periods of excessive inflation, buyers usually flock to gold as a retailer of worth, driving up its value.

-

Geopolitical Occasions: Geopolitical instability and uncertainty usually result in elevated demand for gold as a secure haven asset, driving up its value. Wars, political crises, and terrorist assaults are examples of occasions that may considerably affect gold costs.

-

Provide and Demand: Like several commodity, the value of gold is influenced by the interaction of provide and demand. Elevated mining manufacturing can put downward strain on costs, whereas robust investor demand can drive costs increased.

-

Market Sentiment: Investor sentiment performs an important position in gold value actions. Constructive sentiment can result in elevated shopping for strain and better costs, whereas damaging sentiment can result in elevated promoting strain and decrease costs.

Using Dwell Gold Worth Charts for Funding Methods

Dwell gold value charts are invaluable instruments for numerous funding methods:

-

Technical Evaluation: Technical analysts use charts to determine traits, patterns, and indicators to foretell future value actions. They rely closely on historic value information and technical indicators to make knowledgeable buying and selling selections.

-

Basic Evaluation: Basic analysts think about macroeconomic components, equivalent to rates of interest, inflation, and geopolitical occasions, to evaluate the intrinsic worth of gold and decide whether or not the present value is undervalued or overvalued. They use charts to observe the market’s response to those basic components.

-

Swing Buying and selling: Swing merchants use charts to determine short-to-medium-term value swings, aiming to revenue from value fluctuations over durations starting from a number of days to a number of weeks.

-

Day Buying and selling: Day merchants use charts to determine very short-term value actions, aiming to revenue from intraday value fluctuations. They rely closely on real-time chart updates and technical indicators.

-

Lengthy-Time period Investing: Lengthy-term buyers use charts to trace the general development of gold costs over prolonged durations, aiming to profit from long-term value appreciation.

Cautions and Issues

Whereas reside gold value charts are highly effective instruments, it is essential to make use of them responsibly:

-

Previous efficiency is just not indicative of future outcomes: Charts mirror historic value actions, however they can’t assure future value actions.

-

Technical indicators are usually not foolproof: Technical indicators can present worthwhile insights, however they aren’t all the time correct, and relying solely on them may be dangerous.

-

Diversification is essential: Investing in gold must be a part of a diversified portfolio. Do not put all of your eggs in a single basket.

-

Danger administration is important: Outline your danger tolerance and implement applicable danger administration methods to guard your capital.

-

Keep knowledgeable: Preserve abreast of macroeconomic occasions and market information that may affect gold costs.

In conclusion, reside gold value charts are important instruments for anybody all in favour of investing in or buying and selling gold. By understanding the elements of those charts, decoding value actions, and contemplating the components influencing gold costs, buyers could make extra knowledgeable selections and navigate the complexities of this dynamic market. Nonetheless, keep in mind that chart evaluation is only one piece of the puzzle. Combining chart evaluation with basic evaluation and sound danger administration practices is essential for reaching long-term success within the gold market. At all times conduct thorough analysis and think about looking for recommendation from a professional monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered worthwhile insights into Navigating the Fluctuations: A Complete Information to Dwell Gold Worth Charts. We thanks for taking the time to learn this text. See you in our subsequent article!