Nifty 50 Reside Chart In the present day: A Deep Dive Into Market Dynamics

Nifty 50 Reside Chart In the present day: A Deep Dive into Market Dynamics

Associated Articles: Nifty 50 Reside Chart In the present day: A Deep Dive into Market Dynamics

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Nifty 50 Reside Chart In the present day: A Deep Dive into Market Dynamics. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Nifty 50 Reside Chart In the present day: A Deep Dive into Market Dynamics

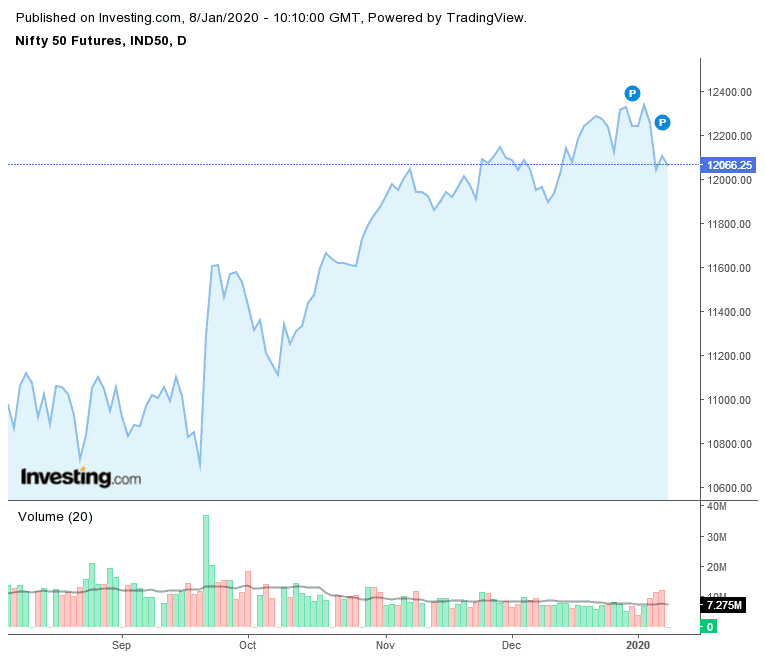

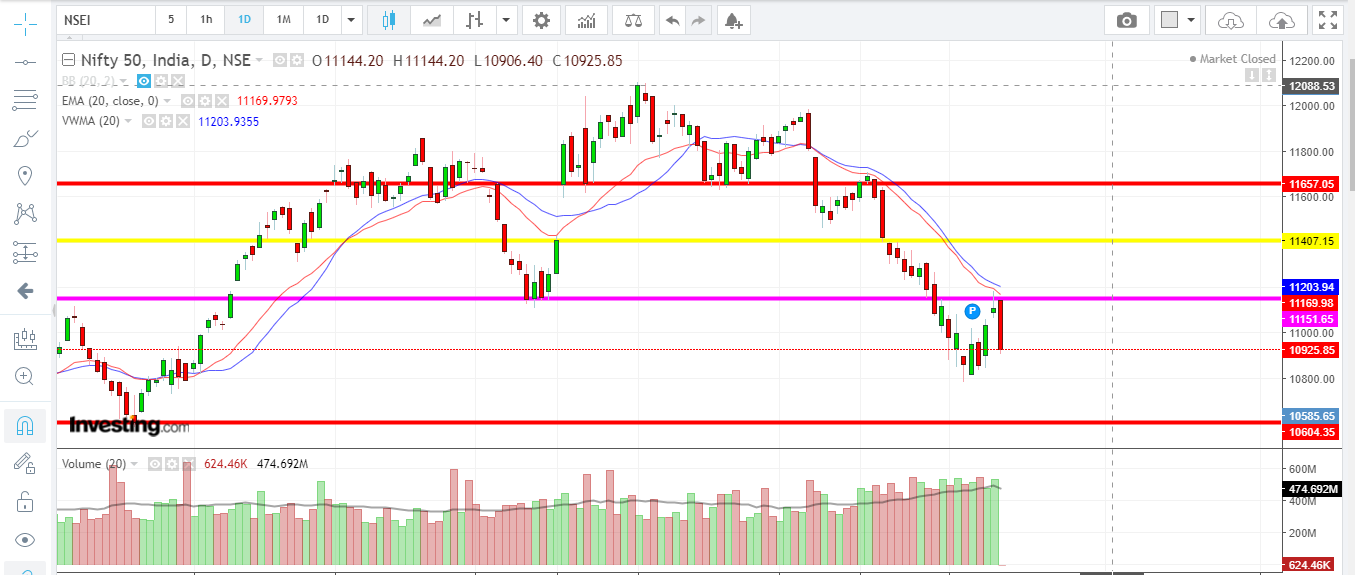

The Nifty 50, India’s benchmark index, is a dynamic reflection of the nation’s financial well being and investor sentiment. Understanding its stay chart requires extra than simply observing the fluctuating numbers; it necessitates a grasp of the underlying elements driving its motion. This text will delve into the intricacies of the Nifty 50 stay chart immediately, analyzing its present place, the forces shaping its trajectory, and the implications for buyers. We may also discover some key technical indicators and basic elements to assist readers higher interpret the market’s narrative.

Present Market Snapshot (Observe: This part must be up to date with real-time knowledge. The next is a template):

As of [Time of writing, e.g., 10:30 AM IST, October 26, 2023], the Nifty 50 index is buying and selling at [Current Nifty 50 Value] factors, displaying a [Percentage Change, e.g., 0.5%] [Increase/Decrease] in comparison with yesterday’s closing value of [Yesterday’s Closing Price]. The quantity traded is at present at [Volume Traded], indicating [High/Moderate/Low] market exercise. The index opened at [Opening Price] and reached an intraday excessive of [Intraday High] and a low of [Intraday Low]. The general market sentiment seems to be [Bullish/Bearish/Neutral], primarily based on [Reasons, e.g., recent economic data, global market trends, specific sector performance].

Key Components Influencing the Nifty 50 In the present day:

A number of intertwined elements contribute to the Nifty 50’s stay chart actions. Understanding these helps in making knowledgeable funding selections.

-

International Market Developments: The Nifty 50 shouldn’t be an remoted entity. International occasions, corresponding to actions in US markets (Dow Jones, S&P 500, Nasdaq), fluctuations in crude oil costs, and geopolitical tensions, considerably impression investor sentiment and consequently, the Nifty’s efficiency. A unfavourable development in international markets usually results in risk-aversion, inflicting promoting strain on Indian equities.

-

Home Financial Knowledge: Key financial indicators launched in India, corresponding to inflation knowledge (CPI, WPI), GDP development figures, industrial manufacturing indices, and international alternate reserves, instantly affect investor confidence. Constructive financial knowledge usually boosts the Nifty, whereas unfavourable knowledge can set off sell-offs.

-

Rupee-Greenback Trade Fee: The worth of the Indian Rupee in opposition to the US greenback has a substantial impression on the Nifty. A weakening Rupee could make Indian exports extra aggressive but in addition enhance the price of imports, affecting company profitability and investor sentiment.

-

Sector-Particular Efficiency: The Nifty 50 is a composite index, representing numerous sectors of the Indian economic system. Sturdy efficiency in particular sectors like IT, banking, prescribed drugs, or vehicles can positively affect the general index. Conversely, underperformance in key sectors can pull the index down.

-

Curiosity Fee Selections: Financial coverage selections by the Reserve Financial institution of India (RBI), significantly modifications in repo charges, instantly impression borrowing prices for companies and buyers. Rate of interest hikes usually dampen investor enthusiasm, resulting in a bearish development, whereas charge cuts can stimulate financial exercise and enhance market sentiment.

-

Overseas Institutional Investor (FII) and Home Institutional Investor (DII) Exercise: The move of funds from FIIs and DIIs performs a vital position in Nifty’s motion. Vital FII inflows usually push the index upwards, whereas outflows can result in declines. DII exercise additionally contributes considerably to the market’s course.

-

Authorities Insurance policies and Rules: Authorities insurance policies associated to taxation, infrastructure growth, and rules impacting particular sectors can considerably affect the Nifty’s trajectory. Constructive coverage bulletins usually enhance investor confidence.

-

Company Earnings: Quarterly and annual earnings stories of corporations listed within the Nifty 50 considerably impression their particular person inventory costs and, consequently, the general index. Constructive earnings surprises usually result in shopping for strain, whereas disappointing outcomes can set off sell-offs.

Technical Evaluation of the Nifty 50 Reside Chart:

Technical evaluation includes utilizing charts and indicators to foretell future value actions. A number of instruments could be utilized to interpret the Nifty 50’s stay chart:

-

Transferring Averages: Transferring averages (e.g., 50-day, 100-day, 200-day) clean out value fluctuations and assist determine traits. Crossovers between completely different transferring averages can sign potential purchase or promote alerts.

-

Relative Power Index (RSI): The RSI measures the magnitude of latest value modifications to guage overbought or oversold circumstances. RSI values above 70 usually point out an overbought market, whereas values beneath 30 counsel an oversold market.

-

MACD (Transferring Common Convergence Divergence): MACD is a trend-following momentum indicator that helps determine modifications within the power, course, momentum, and length of a development.

-

Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by. Help ranges signify potential shopping for alternatives, whereas resistance ranges point out potential promoting strain.

-

Candlestick Patterns: Candlestick patterns present visible representations of value actions and might provide insights into potential future value motion. Examples embrace bullish engulfing patterns, bearish engulfing patterns, hammers, and capturing stars.

Basic Evaluation:

Basic evaluation focuses on evaluating the intrinsic worth of the businesses comprising the Nifty 50. This includes analyzing elements like:

-

Earnings per share (EPS): EPS displays an organization’s profitability. Greater EPS usually signifies stronger monetary well being.

-

Worth-to-earnings ratio (P/E): The P/E ratio compares an organization’s inventory value to its earnings per share. A excessive P/E ratio might counsel the inventory is overvalued, whereas a low P/E ratio might point out undervaluation.

-

Debt-to-equity ratio: This ratio signifies an organization’s monetary leverage. A excessive debt-to-equity ratio can sign greater monetary danger.

-

Return on fairness (ROE): ROE measures an organization’s profitability relative to shareholder fairness. The next ROE usually suggests higher administration effectivity.

Disclaimer: This text is for informational functions solely and doesn’t represent monetary recommendation. Investing within the share market includes danger, and it is essential to conduct thorough analysis and seek the advice of with a monetary advisor earlier than making any funding selections. The knowledge supplied right here is predicated on present market circumstances and should change quickly. At all times discuss with real-time knowledge and think about your particular person danger tolerance earlier than investing. The interpretation of technical and basic evaluation is subjective and should fluctuate amongst analysts.

Closure

Thus, we hope this text has supplied useful insights into Nifty 50 Reside Chart In the present day: A Deep Dive into Market Dynamics. We admire your consideration to our article. See you in our subsequent article!