Driving The Rollercoaster: A 5-Yr Evaluation Of Gasoline Costs (2019-2023)

Driving the Rollercoaster: A 5-Yr Evaluation of Gasoline Costs (2019-2023)

Associated Articles: Driving the Rollercoaster: A 5-Yr Evaluation of Gasoline Costs (2019-2023)

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Driving the Rollercoaster: A 5-Yr Evaluation of Gasoline Costs (2019-2023). Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Driving the Rollercoaster: A 5-Yr Evaluation of Gasoline Costs (2019-2023)

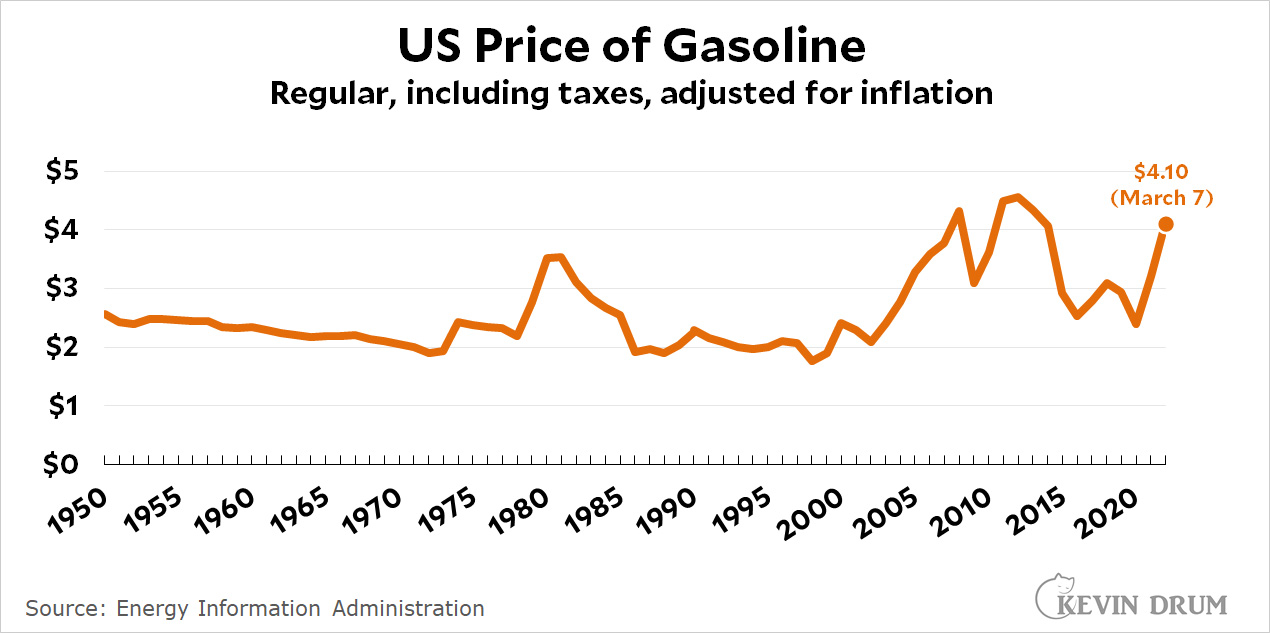

The value of gasoline, a seemingly mundane side of every day life, exerts a robust affect on international economies and particular person family budgets. Fluctuations in gasoline costs, usually dramatic and unpredictable, ripple by varied sectors, impacting every little thing from transportation prices and inflation to client spending and political stability. This text delves right into a five-year evaluation of gasoline costs, spanning from 2019 to 2023, analyzing the important thing elements driving these fluctuations and their broader implications. Whereas particular numbers will range based mostly on location and knowledge supply, the general traits and influencing elements stay constant.

2019: A Yr of Relative Stability and Gradual Decline

The 12 months 2019 started with gasoline costs hovering round a comparatively steady vary, reflecting a worldwide oil market characterised by reasonable provide and demand. Whereas there have been minor fluctuations all year long, the general development was a gradual decline. A number of elements contributed to this downward stress:

- OPEC Manufacturing: The Group of the Petroleum Exporting Nations (OPEC) maintained comparatively excessive manufacturing ranges, guaranteeing a ample provide of crude oil to satisfy international demand. This prevented vital worth spikes brought on by provide shortages.

- World Financial Slowdown: Considerations a couple of potential international financial slowdown, significantly in key markets like China and Europe, dampened demand for oil and consequently, gasoline. Companies and customers decreased their consumption, resulting in decrease costs.

- Geopolitical Stability (Initially): Whereas geopolitical tensions at all times simmer beneath the floor, 2019 initially noticed a interval of relative stability in main oil-producing areas, avoiding vital disruptions to produce chains.

Nonetheless, this comparatively calm interval would not final. In the direction of the top of 2019, the seeds of future volatility have been already being sown. The continued commerce struggle between the US and China created uncertainty within the international market, impacting investor confidence and influencing oil costs.

2020: The COVID-19 Crash and Subsequent Restoration

The 12 months 2020 will without end be etched in historical past because the 12 months the COVID-19 pandemic dramatically reshaped the worldwide panorama, together with the vitality market. The unprecedented lockdowns and restrictions applied worldwide led to a dramatic collapse in international oil demand. Folks stayed house, companies closed, and journey got here to a close to standstill. This resulted in an unprecedented plunge in gasoline costs:

- Demand Destruction: The sharp discount in demand far outweighed the provision, resulting in a dramatic oversupply of oil. Storage amenities rapidly crammed up, making a disaster for oil producers.

- Value Warfare: A worth struggle erupted between Saudi Arabia and Russia, additional exacerbating the state of affairs. Each nations flooded the market with oil, driving costs all the way down to traditionally low ranges. Unfavorable oil costs have been even briefly noticed in some futures markets.

- Authorities Intervention: Governments around the globe intervened to mitigate the financial fallout of the pandemic, however their actions had a combined affect on gasoline costs. Stimulus packages boosted client spending in some areas, however the total affect of lockdowns and decreased financial exercise dominated.

The latter half of 2020 noticed a gradual restoration in gasoline costs as economies started to reopen and demand slowly rebounded. Nonetheless, the restoration remained fragile and uneven, reflecting the continued uncertainty surrounding the pandemic.

2021: Rebound and Provide Chain Points

As vaccination applications rolled out and economies started to recuperate, 2021 witnessed a major rebound in gasoline costs. A number of elements contributed to this surge:

- Elevated Demand: With lockdowns easing, journey and financial exercise picked up, resulting in a surge in oil demand. This resurgence in demand outpaced the provision, placing upward stress on costs.

- Provide Chain Disruptions: The pandemic disrupted international provide chains, impacting the manufacturing and transportation of oil and refined merchandise. This constrained provide additional contributed to rising costs.

- OPEC+ Manufacturing Cuts: OPEC and its allies (OPEC+) regularly decreased oil manufacturing to handle the market and forestall a worth collapse, additional supporting increased costs.

The 12 months noticed a gradual climb in gasoline costs, culminating in vital will increase in the direction of the top of the 12 months. This rise mirrored a mixture of sturdy demand and lingering provide chain bottlenecks.

2022: The Russian Invasion and Power Disaster

The 12 months 2022 marked a turning level, with the Russian invasion of Ukraine triggering a worldwide vitality disaster and sending gasoline costs hovering to unprecedented ranges in lots of areas. This dramatic enhance stemmed from:

- Sanctions on Russia: Western nations imposed sweeping sanctions on Russia, a significant oil and fuel producer, severely disrupting international vitality provides. This created a major provide shortfall, driving costs increased.

- Power Safety Considerations: The invasion heightened vitality safety considerations amongst nations, resulting in elevated demand for different vitality sources and a scramble to safe vitality provides.

- Inflationary Pressures: The surge in vitality costs fueled broader inflationary pressures, impacting the price of items and providers throughout the board.

The affect of the struggle in Ukraine on gasoline costs was profound and long-lasting, with costs remaining elevated all year long regardless of some minor fluctuations.

2023: Navigating Uncertainty

2023 started with gasoline costs remaining comparatively excessive, reflecting the continued geopolitical uncertainty and lingering provide chain points. Nonetheless, the 12 months has additionally seen some worth moderation, pushed by a number of elements:

- Recessionary Fears: Considerations a couple of potential international recession have dampened demand for oil, placing downward stress on costs.

- Elevated Oil Manufacturing: OPEC+ has regularly elevated oil manufacturing, serving to to alleviate provide constraints.

- Shifting Geopolitical Dynamics: Whereas the struggle in Ukraine continues, there have been some shifts within the international geopolitical panorama, impacting oil market dynamics.

The outlook for 2023 and past stays unsure. A number of elements, together with the continued struggle in Ukraine, the tempo of worldwide financial restoration, OPEC+ manufacturing choices, and the expansion of renewable vitality, will proceed to form gasoline costs within the coming years.

Conclusion:

The five-year interval from 2019 to 2023 has been a rollercoaster journey for gasoline costs, reflecting the complicated interaction of worldwide financial circumstances, geopolitical occasions, technological developments, and authorities insurance policies. Understanding the elements driving these fluctuations is essential for people, companies, and policymakers alike. Whereas predicting future worth actions with certainty is not possible, analyzing previous traits and contemplating the varied influencing elements can present priceless insights into the potential trajectory of gasoline costs within the years to return. This understanding is crucial for navigating the risky vitality panorama and making knowledgeable choices about vitality consumption and funding.

Closure

Thus, we hope this text has offered priceless insights into Driving the Rollercoaster: A 5-Yr Evaluation of Gasoline Costs (2019-2023). We thanks for taking the time to learn this text. See you in our subsequent article!