TDS Fee Chart 2025-25: A Complete Information (Hypothetical, As 2025-25 Is Not A Normal Fiscal 12 months)

TDS Fee Chart 2025-25: A Complete Information (Hypothetical, as 2025-25 is just not a regular fiscal yr)

Associated Articles: TDS Fee Chart 2025-25: A Complete Information (Hypothetical, as 2025-25 is just not a regular fiscal yr)

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to TDS Fee Chart 2025-25: A Complete Information (Hypothetical, as 2025-25 is just not a regular fiscal yr). Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

TDS Fee Chart 2025-25: A Complete Information (Hypothetical, as 2025-25 is just not a regular fiscal yr)

Observe: The fiscal yr 2025-25 doesn’t exist in customary calendar reckoning. This text will as a substitute present a complete overview of TDS (Tax Deducted at Supply) charges and their utility, utilizing hypothetical eventualities and projections based mostly on present developments and potential future adjustments. It’s essential to seek the advice of official authorities sources for probably the most up-to-date and correct data relating to TDS charges for any given fiscal yr. A "TDS Fee Chart 2025-25 PDF" as such wouldn’t exist formally.

Understanding TDS

Tax Deducted at Supply (TDS) is a mechanism employed by the Indian authorities to gather tax on the supply of revenue technology. Which means that the payer (e.g., an organization, employer, or consumer) deducts tax from the cost made to the payee (e.g., an worker, contractor, or vendor) and straight deposits it with the federal government. This ensures well timed tax assortment and reduces the burden on taxpayers to pay a big sum on the finish of the monetary yr.

TDS is relevant to numerous revenue sources, together with:

- Salaries: TDS is deducted from the wage of staff by their employers.

- Hire: TDS is deducted on hire funds exceeding a specified threshold.

- Curiosity: TDS is deducted on curiosity earned on numerous investments like mounted deposits, financial savings accounts, and so forth.

- Skilled charges: TDS is deducted on funds made to professionals like medical doctors, legal professionals, and consultants.

- Contract funds: TDS is deducted on funds made to contractors for companies rendered.

- Funds to suppliers: TDS is deducted on funds made to suppliers of products and companies.

Components Affecting TDS Charges

A number of elements affect the TDS charges relevant to totally different revenue sources:

- Nature of Revenue: The TDS fee varies relying on the kind of revenue. As an illustration, the TDS fee for wage revenue may differ from the speed for curiosity revenue.

- Revenue Tax Slab: The TDS fee is usually linked to the revenue tax slab of the payee. Increased revenue brackets usually entice increased TDS charges.

- Taxpayer Standing: The TDS fee can differ based mostly on whether or not the payee is a person, a Hindu Undivided Household (HUF), an organization, a partnership agency, or a belief. For instance, corporations usually face increased TDS charges than people.

- Authorities Insurance policies: Modifications in authorities insurance policies and tax legal guidelines can straight impression TDS charges. The federal government could revise charges periodically based mostly on financial situations and financial targets.

- Particular Provisions: Sure funds might need particular TDS provisions, with charges differing from the overall charges.

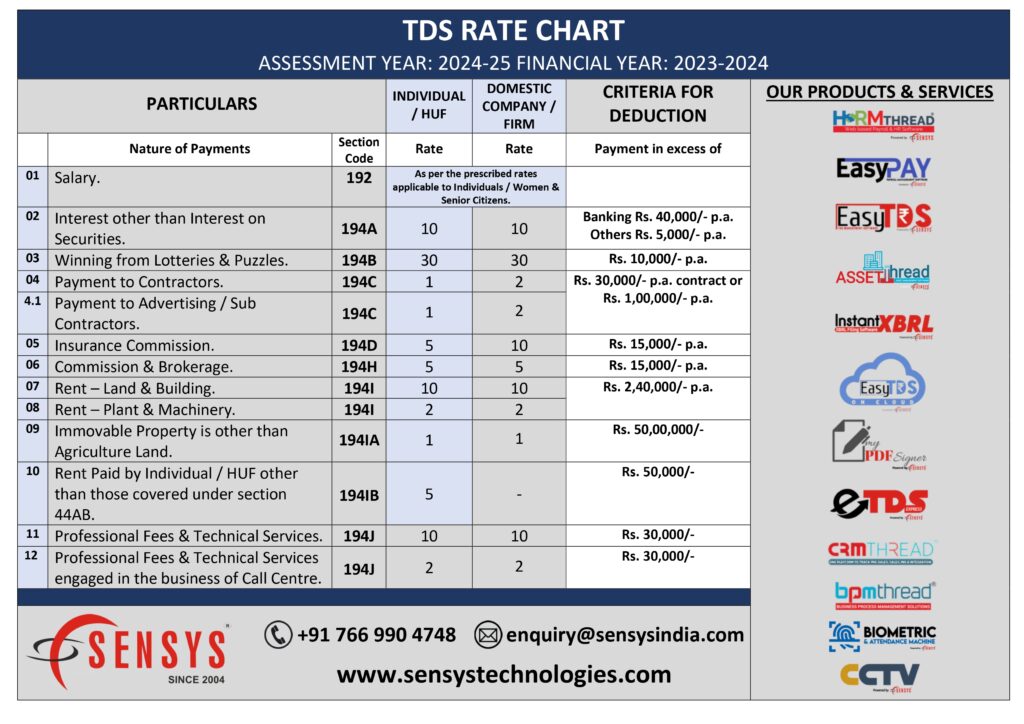

Hypothetical TDS Fee Chart (Illustrative solely – NOT for precise tax computation)

Since a "2025-25" fiscal yr is non-existent, the next is a hypothetical chart illustrating potential TDS charges based mostly on present developments and projected adjustments. These charges are for illustrative functions solely and shouldn’t be used for precise tax calculations. At all times discuss with official authorities notifications.

| Revenue Supply | Hypothetical TDS Fee (2025-26) | Notes |

|---|---|---|

| Wage (Particular person) | 10% – 30% (slab-based) | Is dependent upon the person’s complete revenue and relevant tax slab. |

| Hire | 10% (above specified restrict) | Threshold restrict could also be revised; Seek the advice of newest official tips. |

| Curiosity (FD) | 7.5% – 15% (relying on financial institution) | Varies relying on the financial institution and rate of interest. |

| Skilled Charges | 10% – 20% | Might differ relying on the character of the occupation and cost quantity. |

| Contract Funds | 10% – 20% | Varies based mostly on the contract worth and nature of companies supplied. |

| Funds to Suppliers | 1% – 5% (GST relevant) | Typically is determined by GST registration and sort of products/companies provided. |

Vital Concerns:

- PAN and TAN: Each the payee’s PAN (Everlasting Account Quantity) and the payer’s TAN (Tax Deduction and Assortment Account Quantity) are important for TDS compliance.

- TDS Returns: The payer is obligated to file TDS returns with the Revenue Tax Division, reporting the TDS deducted and deposited.

- Kind 16/16A: The payer supplies Kind 16 (for salaried staff) or Kind 16A (for different funds) to the payee as proof of TDS deduction.

- Tax Legal responsibility: TDS deducted is taken into account an advance tax cost. Nevertheless, the payee should have extra tax legal responsibility relying on their complete revenue.

- Penalties: Non-compliance with TDS rules may end up in penalties and curiosity expenses.

Looking for Skilled Recommendation:

Given the complexities of TDS rules, it is extremely beneficial to seek the advice of with a tax skilled or chartered accountant for correct steerage and help in complying with all relevant legal guidelines. The hypothetical charges and data supplied listed below are for instructional functions solely and shouldn’t be thought-about an alternative choice to skilled tax recommendation. At all times discuss with the official web site of the Revenue Tax Division of India for probably the most present and dependable data on TDS charges and rules.

Disclaimer: This text supplies common data and shouldn’t be thought-about skilled tax recommendation. The hypothetical TDS charges and eventualities are for illustrative functions solely and don’t replicate official authorities coverage. At all times seek the advice of official authorities sources and search skilled recommendation for particular tax-related queries.

![[PDF] TDS Rate Chart FY 2023-24 PDF - Panot Book](https://panotbook.com/wp-content/uploads/2023/04/tds-rate-chart-fy-2023-24.webp)

Closure

Thus, we hope this text has supplied precious insights into TDS Fee Chart 2025-25: A Complete Information (Hypothetical, as 2025-25 is just not a regular fiscal yr). We recognize your consideration to our article. See you in our subsequent article!