TDS Fee Chart For FY 21-22: A Complete Information And Downloadable PDF

TDS Fee Chart for FY 21-22: A Complete Information and Downloadable PDF

Associated Articles: TDS Fee Chart for FY 21-22: A Complete Information and Downloadable PDF

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to TDS Fee Chart for FY 21-22: A Complete Information and Downloadable PDF. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

TDS Fee Chart for FY 21-22: A Complete Information and Downloadable PDF

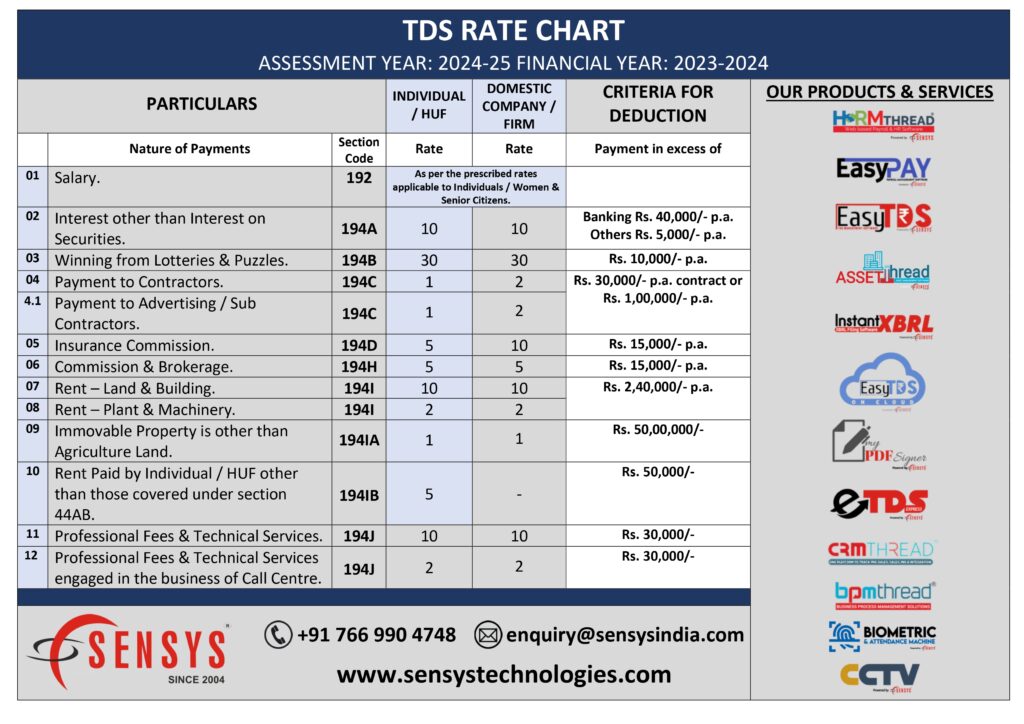

The Tax Deducted at Supply (TDS) is a vital facet of India’s tax system, designed to gather tax straight on the supply of earnings. This ensures well timed tax assortment and reduces the burden on the taxpayer on the finish of the monetary 12 months. For the Monetary Yr 2021-22 (FY 21-22), the TDS charges diverse relying on the character of earnings and the payee’s standing. Understanding these charges is significant for each the deductor (the particular person or entity deducting TDS) and the deductee (the recipient of the earnings). This text gives a complete overview of the TDS charges relevant throughout FY 21-22, together with a downloadable PDF containing a summarized chart.

Understanding TDS and its Applicability

Earlier than diving into the precise charges, let’s briefly recap the idea of TDS. TDS is relevant on numerous sorts of earnings, together with:

- Salaries: TDS is deducted from the wage of staff by their employers.

- Curiosity: TDS is deducted on curiosity earned from financial institution deposits, fastened deposits, and different interest-bearing devices.

- Lease: TDS is deducted on hire funds made to landlords exceeding a sure threshold.

- Skilled charges: TDS is deducted on funds made to professionals like medical doctors, legal professionals, and consultants.

- Fee: TDS is relevant on fee funds.

- Contract funds: TDS is deducted on funds made to contractors.

- Funds to non-residents: TDS charges are larger for funds made to non-residents.

The charges of TDS range relying on the character of the earnings and the tax standing of the recipient. For example, the TDS fee for salaried people is totally different from that for a non-resident particular person. Moreover, the TDS charges could be influenced by the provisions of the Revenue Tax Act, 1961, and any amendments or notifications issued by the Revenue Tax Division.

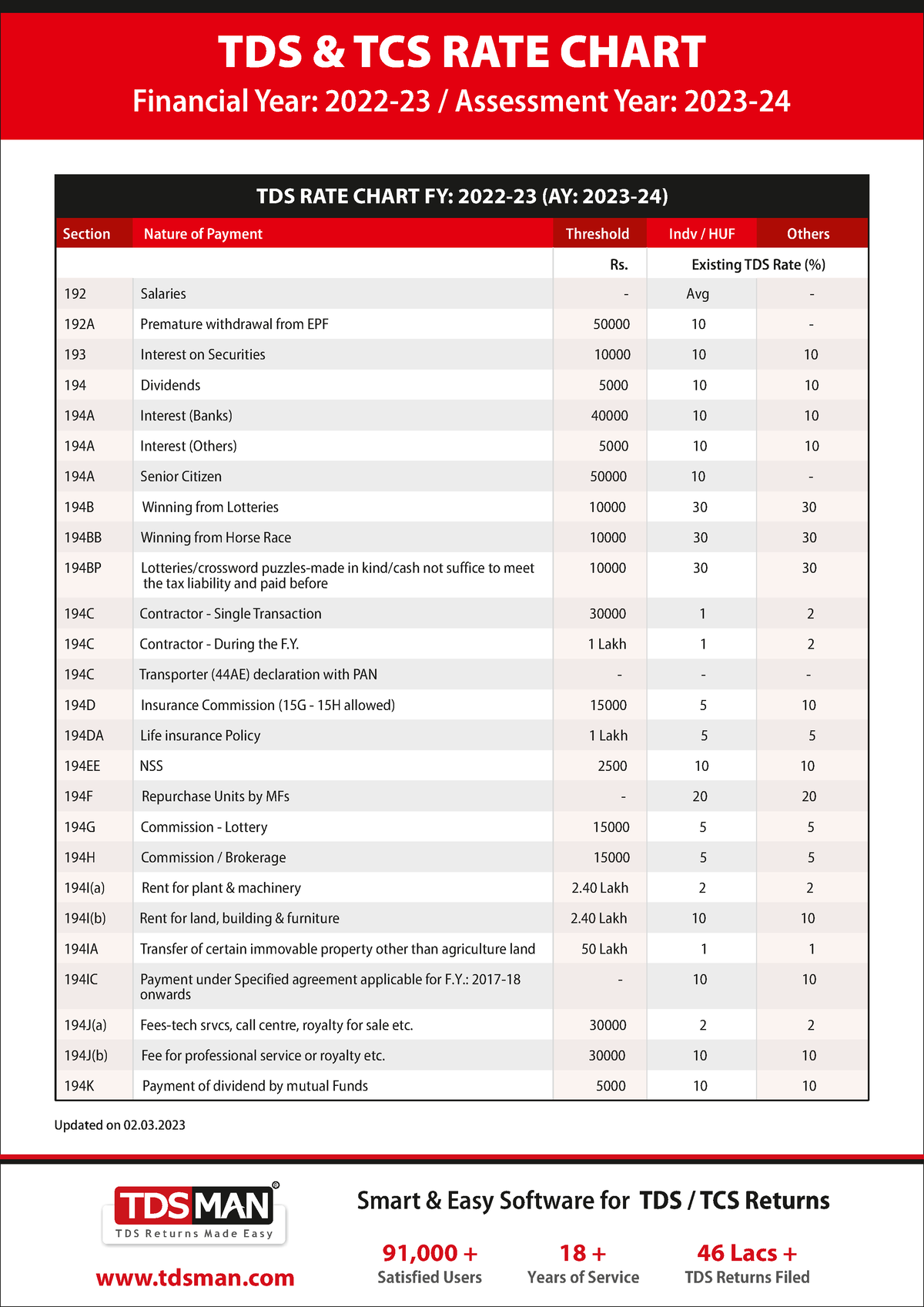

TDS Charges for FY 21-22: A Detailed Breakdown

The TDS charges for FY 21-22 had been largely per the earlier monetary 12 months, with minor changes in sure classes primarily based on authorities coverage and tax reforms. It is essential to notice that these charges had been topic to alter primarily based on the person’s tax slab and different related components. The next is a normal overview; all the time consult with the official Revenue Tax Division notifications for probably the most correct and up to date data.

1. Wage:

The TDS on wage was calculated primarily based on the person’s tax slab and different deductions claimed below the Revenue Tax Act. The employer was chargeable for deducting TDS on the acceptable fee and depositing it with the federal government. The tax slab charges remained comparatively per earlier years.

2. Curiosity:

-

Curiosity on Financial institution Deposits/Mounted Deposits: The TDS fee on curiosity earnings from financial institution deposits and glued deposits diverse relying on the curiosity quantity. For people beneath a sure threshold, no TDS was deducted. Above the brink, the TDS fee was sometimes 10% or 20%, relying on whether or not the PAN was furnished or not. Senior residents typically benefited from a decrease TDS fee.

-

Curiosity on Securities: TDS charges on curiosity earnings from securities additionally diverse, relying on the character of the safety and the PAN standing of the recipient.

3. Lease:

TDS on hire funds was relevant if the annual hire exceeded a sure threshold. The speed was sometimes 10% or 20%, relying on whether or not the owner supplied their PAN.

4. Skilled Charges/Fee/Contract Funds:

TDS charges on funds to professionals, contractors, and for fee had been typically 10% or 20%, relying on whether or not the PAN was furnished. Completely different charges would possibly apply for funds to non-residents.

5. Funds to Non-Residents:

Increased TDS charges had been relevant for funds made to non-residents, as per the provisions of the Double Taxation Avoidance Agreements (DTAAs) and the Revenue Tax Act.

Significance of PAN and TAN

The Everlasting Account Quantity (PAN) and Tax Deduction and Assortment Account Quantity (TAN) play a vital function in TDS compliance. The deductor is required to acquire the PAN of the deductee, and failure to take action may end up in larger TDS charges. The deductor additionally wants a TAN to deduct and deposit TDS.

Penalties of Non-Compliance

Non-compliance with TDS rules can result in penalties and curiosity costs. Each the deductor and the deductee can face authorized penalties if TDS just isn’t deducted or deposited appropriately. Due to this fact, correct TDS calculation and well timed deposit are essential for avoiding authorized problems.

Downloading the TDS Fee Chart for FY 21-22 PDF

Whereas a complete desk can’t be straight included inside this textual content format, you’ll be able to simply discover the official TDS fee chart for FY 21-22 by looking on-line utilizing key phrases like "TDS fee chart FY 21-22 PDF obtain Revenue Tax Division." The official web site of the Revenue Tax Division of India is probably the most dependable supply for this data. Make sure you obtain the PDF from a trusted supply to keep away from inaccuracies or deceptive data.

Disclaimer: This text gives normal details about TDS charges for FY 21-22. It’s not an alternative to skilled tax recommendation. The knowledge supplied right here is for academic functions solely and shouldn’t be thought of as authorized or monetary recommendation. It is essential to seek the advice of with a certified tax skilled or consult with the official Revenue Tax Division publications for correct and up to date data particular to your scenario. Tax legal guidelines are complicated and topic to alter, so staying knowledgeable is crucial for compliance. All the time seek the advice of the related sections of the Revenue Tax Act, 1961, and any relevant notifications for probably the most correct and up-to-date data. This data is meant to offer a normal understanding and shouldn’t be used for making tax choices with out skilled recommendation.

![[PDF] TDS Rate Chart FY 2023-24 PDF - Panot Book](https://panotbook.com/wp-content/uploads/2023/04/tds-rate-chart-fy-2023-24.webp)

Closure

Thus, we hope this text has supplied precious insights into TDS Fee Chart for FY 21-22: A Complete Information and Downloadable PDF. We thanks for taking the time to learn this text. See you in our subsequent article!