The Chart Of Accounts: A Complete Information With Steadiness Listings

The Chart of Accounts: A Complete Information with Steadiness Listings

Associated Articles: The Chart of Accounts: A Complete Information with Steadiness Listings

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to The Chart of Accounts: A Complete Information with Steadiness Listings. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

The Chart of Accounts: A Complete Information with Steadiness Listings

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

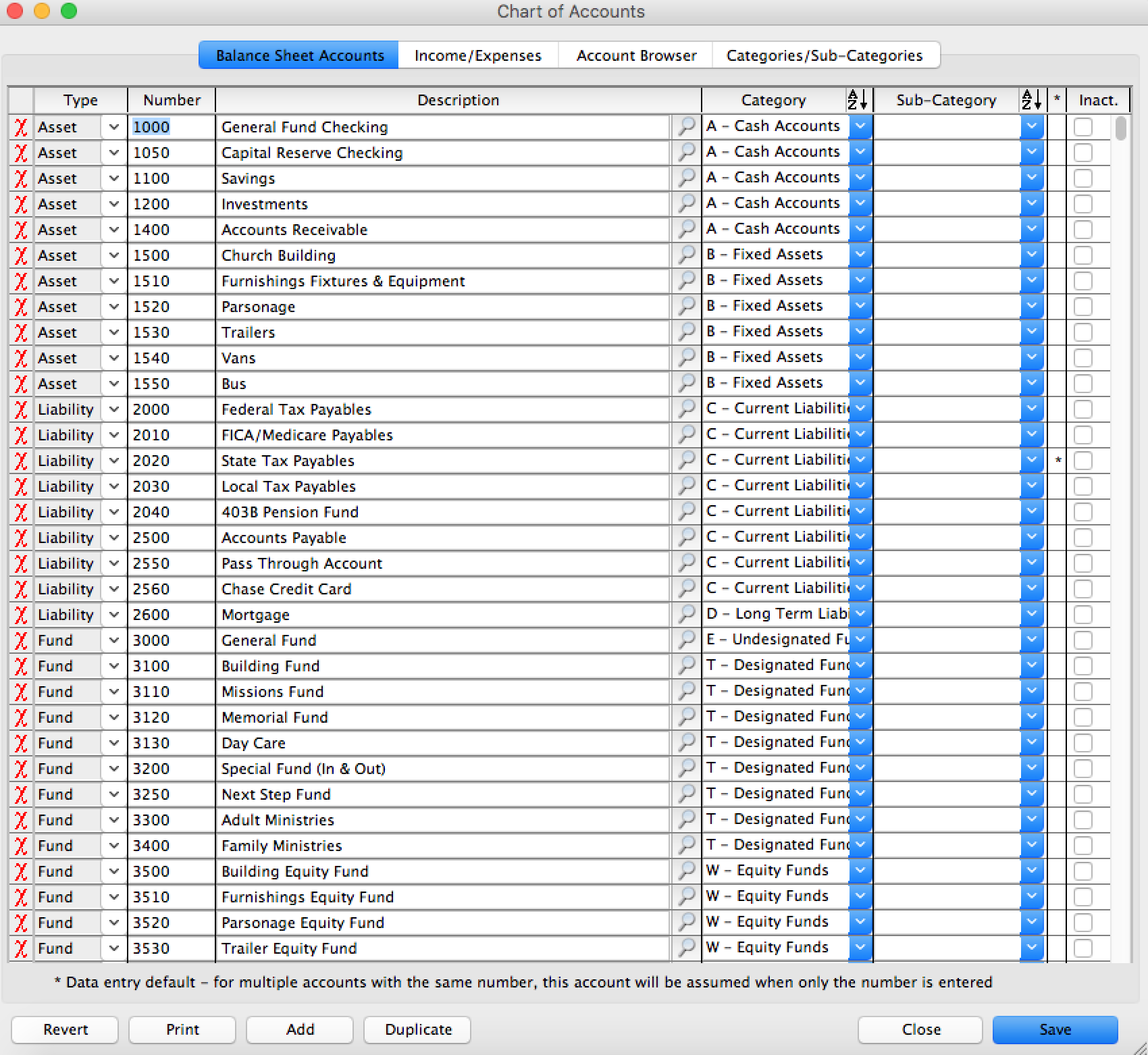

The chart of accounts (COA) is the spine of any efficient accounting system. It is a structured checklist of all of the accounts a enterprise makes use of to document its monetary transactions. This complete information will delve into the intricacies of a chart of accounts, explaining its construction, the kinds of accounts it consists of, how balances are listed, and its essential position in monetary reporting and decision-making. We will even discover greatest practices for creating and sustaining a strong and adaptable COA.

Understanding the Construction of a Chart of Accounts:

A well-designed chart of accounts follows a hierarchical construction, usually utilizing a numbering system to categorize accounts and facilitate simple identification. This construction permits for detailed monitoring of monetary exercise and simplifies the method of producing monetary statements. Generally used constructions embrace:

-

Numerical System: That is probably the most prevalent technique, utilizing a collection of numbers to categorize accounts. For instance, asset accounts would possibly begin with "1", liabilities with "2", and fairness with "3". Sub-accounts are then added, making a extra granular breakdown. As an illustration, 1100 would possibly characterize Money, 1200 Accounts Receivable, and so forth.

-

Alphanumeric System: This method combines letters and numbers for categorization. It could supply better flexibility and readability, significantly in bigger organizations with complicated accounting wants. As an illustration, "A1000" would possibly characterize Money, "A2000" Accounts Receivable, and "B1000" would possibly characterize Price of Items Offered.

-

Descriptive System: This method makes use of descriptive account names as a substitute of numbers. Whereas simpler to know initially, it could possibly change into cumbersome to handle and search in bigger techniques.

Whatever the chosen construction, a well-designed COA ought to be:

- Complete: It ought to embrace all accounts essential to document all transactions.

- Constant: Account names and numbers ought to be persistently utilized.

- Organized: Accounts ought to be logically grouped for simple navigation and reporting.

- Versatile: It ought to be adaptable to accommodate future modifications within the enterprise.

Varieties of Accounts in a Chart of Accounts:

A typical chart of accounts consists of accounts from the next classes, reflecting the elemental accounting equation (Belongings = Liabilities + Fairness):

-

Belongings: These characterize what a enterprise owns. Examples embrace:

- Present Belongings: Money, Accounts Receivable, Stock, Pay as you go Bills (short-term belongings anticipated to be transformed to money inside a yr).

- Non-Present Belongings: Property, Plant, and Tools (PP&E), Lengthy-term Investments (belongings not anticipated to be transformed to money inside a yr).

-

Liabilities: These characterize what a enterprise owes to others. Examples embrace:

- Present Liabilities: Accounts Payable, Salaries Payable, Brief-term Loans (obligations due inside a yr).

- Non-Present Liabilities: Lengthy-term Loans, Bonds Payable (obligations due past a yr).

-

Fairness: This represents the homeowners’ stake within the enterprise. For sole proprietorships and partnerships, that is typically merely "Proprietor’s Fairness." For companies, it consists of:

- Widespread Inventory: Represents the possession shares issued to traders.

- Retained Earnings: Amassed earnings that haven’t been distributed as dividends.

-

Income: These accounts document revenue generated from the enterprise’s operations. Examples embrace:

- Gross sales Income

- Service Income

- Curiosity Income

-

Bills: These accounts document the prices incurred in producing income. Examples embrace:

- Price of Items Offered (COGS)

- Salaries Expense

- Hire Expense

- Utilities Expense

- Advertising and marketing Expense

Itemizing Balances in a Chart of Accounts:

The chart of accounts itself will not be usually offered with balances. The COA supplies the framework for recording transactions. Balances are derived from the final ledger, which is a group of all particular person accounts and their transactions. Nonetheless, a report combining the COA with balances is extraordinarily helpful. This report could be formatted as a desk, displaying:

| Account Quantity | Account Title | Debit Steadiness | Credit score Steadiness |

|---|---|---|---|

| 1100 | Money | $10,000 | |

| 1200 | Accounts Receivable | $5,000 | |

| 1300 | Stock | $20,000 | |

| 2100 | Accounts Payable | $3,000 | |

| 2200 | Salaries Payable | $1,000 | |

| 3100 | Proprietor’s Fairness | $25,000 | |

| 4000 | Gross sales Income | $40,000 | |

| 5000 | Price of Items Offered | $15,000 | |

| 5100 | Salaries Expense | $8,000 |

This desk exhibits the steadiness of every account at a particular cut-off date. Observe that asset, expense, and dividend accounts usually have debit balances, whereas legal responsibility, fairness, and income accounts usually have credit score balances. The double-entry bookkeeping system ensures that the full debits all the time equal the full credit.

Utilizing the Chart of Accounts with Accounting Software program:

Trendy accounting software program automates a lot of the method of managing a chart of accounts and monitoring balances. These techniques typically present instruments for:

- Creating and customizing a COA: Customers can simply add, modify, or delete accounts.

- Automating transaction posting: Transactions are mechanically posted to the suitable accounts.

- Producing monetary studies: Software program generates steadiness sheets, revenue statements, and different studies immediately from the COA and normal ledger.

- Reconciliation: Software program aids in reconciling financial institution statements and different accounts.

Finest Practices for Managing a Chart of Accounts:

- Common Evaluate and Updates: The COA ought to be reviewed and up to date periodically to make sure it stays related and correct. Enterprise progress and modifications in accounting requirements might necessitate changes.

- Constant Utility: All personnel concerned in recording transactions ought to persistently apply the COA.

- Clear and Concise Account Names: Account names ought to be clear and unambiguous to keep away from confusion.

- Use of a Chart of Accounts Guide: A guide outlining the aim and utilization of every account will be invaluable for coaching and reference.

- Segmentation for Massive Companies: Massive organizations might profit from segmenting their COA by division, product line, or geographic location for extra detailed evaluation.

Conclusion:

The chart of accounts is a elementary element of any profitable accounting system. A well-designed and maintained COA supplies a transparent, organized construction for recording monetary transactions, facilitating correct monetary reporting, and supporting knowledgeable enterprise decision-making. By understanding the construction, kinds of accounts, and greatest practices for managing a COA, companies can considerably enhance their monetary administration capabilities. The flexibility to generate a report displaying the COA with balances supplies a strong snapshot of the monetary well being of the group at any given time, permitting for proactive monetary planning and management.

Closure

Thus, we hope this text has supplied helpful insights into The Chart of Accounts: A Complete Information with Steadiness Listings. We recognize your consideration to our article. See you in our subsequent article!