The Chart Of Accounts Guide: Your Enterprise’s Monetary Roadmap

The Chart of Accounts Guide: Your Enterprise’s Monetary Roadmap

Associated Articles: The Chart of Accounts Guide: Your Enterprise’s Monetary Roadmap

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to The Chart of Accounts Guide: Your Enterprise’s Monetary Roadmap. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

The Chart of Accounts Guide: Your Enterprise’s Monetary Roadmap

:max_bytes(150000):strip_icc()/chart-accounts-4117638b1b6246d7847ca4f2030d4ee8.jpg)

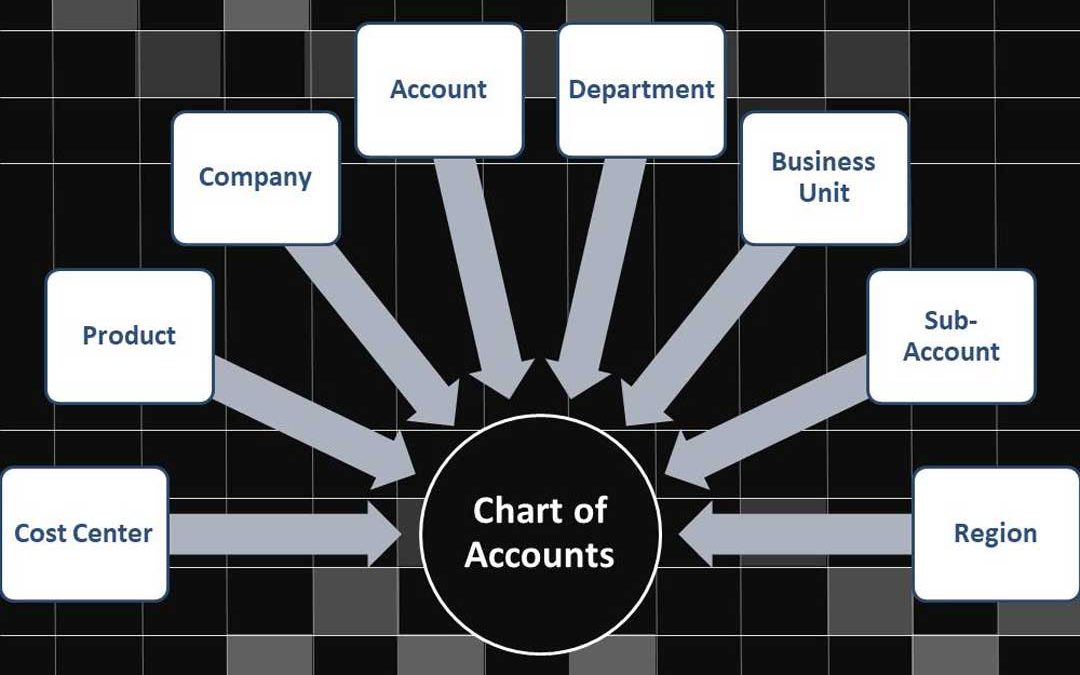

The chart of accounts (COA) is the spine of any sound monetary system. It is greater than only a listing of accounts; it is a meticulously organized framework that dictates how a enterprise data, classifies, and summarizes its monetary transactions. Consider it because the blueprint to your firm’s monetary reporting – an in depth roadmap guiding you thru the complexities of economic accounting. This complete information delves into the intricacies of the chart of accounts e-book, exploring its construction, elements, design concerns, and its essential function in enterprise success.

Understanding the Basis: What’s a Chart of Accounts?

A chart of accounts is a structured listing of all of the accounts utilized by a enterprise to report its monetary transactions. Every account represents a selected component of the enterprise’s monetary exercise, comparable to belongings, liabilities, fairness, revenues, and bills. These accounts are organized hierarchically, usually utilizing a numbering system to make sure consistency and facilitate straightforward retrieval of knowledge. The chart of accounts serves as a central repository for all monetary information, permitting for correct monetary reporting and evaluation.

The Construction of a Chart of Accounts:

The construction of a chart of accounts is often primarily based on the widely accepted accounting rules (GAAP) or Worldwide Monetary Reporting Requirements (IFRS), relying on the jurisdiction and the dimensions of the enterprise. A typical construction makes use of a hierarchical system, usually incorporating a numbering system to categorize accounts. This enables for detailed breakdowns and simpler monitoring of particular monetary actions. A typical construction would possibly embody:

-

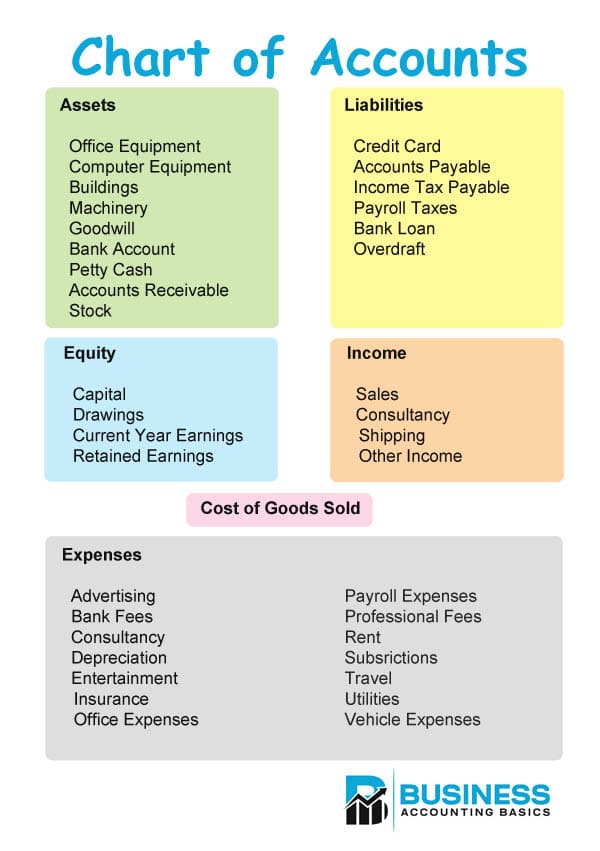

Property: These characterize what a enterprise owns. Examples embody money, accounts receivable, stock, property, plant, and gear (PP&E), and investments. These are sometimes additional categorized into present belongings (simply transformed to money inside a 12 months) and non-current belongings (long-term belongings).

-

Liabilities: These characterize what a enterprise owes to others. Examples embody accounts payable, salaries payable, loans payable, and deferred income. Like belongings, these are categorized into present liabilities (due inside a 12 months) and non-current liabilities (long-term obligations).

-

Fairness: This represents the proprietor’s stake within the enterprise. For sole proprietorships and partnerships, that is usually the proprietor’s capital account. For firms, it consists of retained earnings and contributed capital.

-

Revenues: These characterize the revenue generated from the enterprise’s operations. Examples embody gross sales income, service income, curiosity income, and rental revenue.

-

Bills: These characterize the prices incurred in producing income. Examples embody price of products offered (COGS), salaries expense, lease expense, utilities expense, and advertising expense.

Designing Your Chart of Accounts: Key Concerns:

Making a well-structured chart of accounts is essential for environment friendly monetary administration. A number of elements must be thought-about through the design course of:

-

Trade-Particular Wants: The chart of accounts ought to mirror the particular necessities of your business. A producing firm may have totally different account wants than a service-based enterprise. As an example, a producing firm will want accounts for uncooked supplies, work-in-progress, and completed items, whereas a service firm would possibly concentrate on accounts associated to labor prices and repair contracts.

-

Enterprise Dimension and Complexity: A small enterprise might require a less complicated chart of accounts than a big company with various operations. A bigger firm might need extra detailed sub-accounts inside every main class to trace particular tasks, departments, or product strains.

-

Future Progress: The chart of accounts must be designed to accommodate future development and growth. It is important to anticipate potential adjustments within the enterprise’s operations and incorporate flexibility into the construction. This avoids the necessity for vital restructuring afterward.

-

Accounting Software program Compatibility: The chart of accounts must be suitable along with your chosen accounting software program. Most accounting software program packages permit for personalization, however understanding the software program’s limitations and capabilities is essential for environment friendly integration.

-

Consistency and Standardization: Sustaining consistency and standardization throughout all monetary data is important for correct monetary reporting. A well-defined chart of accounts ensures that everybody within the group makes use of the identical account names and codes, minimizing errors and bettering information integrity.

The Chart of Accounts Guide: Past the Digital World

Whereas most fashionable companies make the most of accounting software program to handle their chart of accounts, sustaining a bodily or digital "chart of accounts e-book" stays worthwhile. This e-book serves as a complete reference doc, offering a transparent overview of your entire accounting construction. It ought to embody:

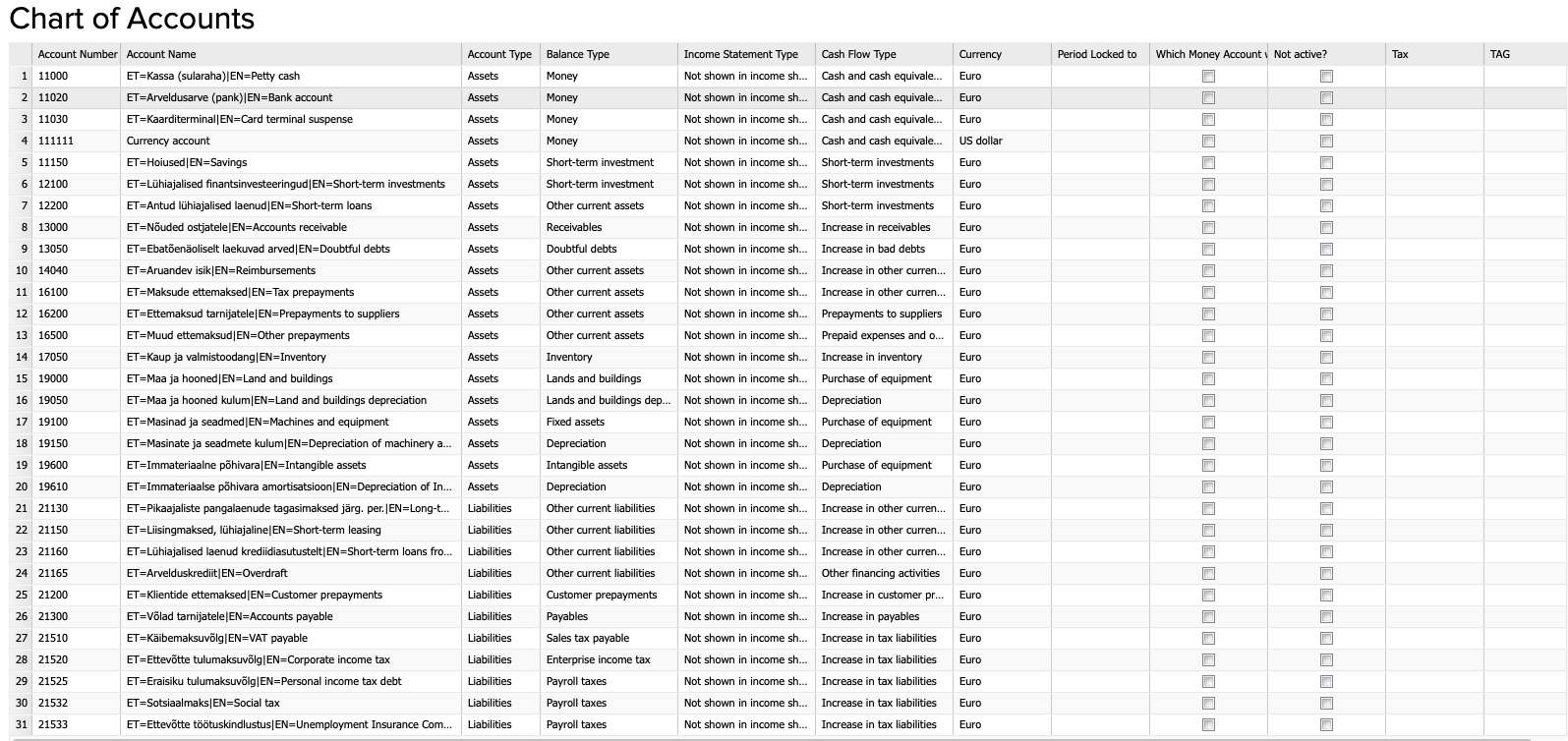

- Account Quantity: A novel numerical identifier for every account.

- Account Identify: A transparent and concise description of the account’s goal.

- Account Kind: Specifies whether or not the account is an asset, legal responsibility, fairness, income, or expense.

- Sub-accounts (if relevant): Particulars any sub-accounts inside a foremost account class.

- Account Steadiness: This part can be utilized to manually monitor account balances, although that is usually dealt with routinely by accounting software program.

Sustaining and Updating the Chart of Accounts:

The chart of accounts is not a static doc; it requires common assessment and updates to mirror adjustments within the enterprise’s operations. Because the enterprise grows and evolves, new accounts could also be wanted, and present accounts might have to be modified or eradicated. Common assessment ensures the chart of accounts stays related and precisely displays the corporate’s monetary actions. This course of ought to contain collaboration between accounting employees and administration to make sure accuracy and alignment with enterprise goals.

The Significance of a Properly-Outlined Chart of Accounts:

A well-designed and maintained chart of accounts provides quite a few advantages:

-

Correct Monetary Reporting: It supplies a stable basis for correct and dependable monetary statements, permitting for knowledgeable decision-making.

-

Improved Monetary Evaluation: The detailed categorization of accounts facilitates in-depth monetary evaluation, figuring out tendencies, areas of energy and weak spot, and potential dangers.

-

Enhanced Inner Management: A well-structured chart of accounts improves inner management by offering a transparent framework for recording and monitoring transactions, lowering the chance of errors and fraud.

-

Streamlined Auditing: A well-organized chart of accounts simplifies the audit course of, making it simpler for auditors to confirm the accuracy and completeness of economic data.

-

Facilitated Budgeting and Forecasting: The chart of accounts supplies a framework for growing budgets and monetary forecasts, permitting for higher planning and useful resource allocation.

Conclusion:

The chart of accounts e-book is an indispensable instrument for any enterprise, no matter measurement or business. It is the cornerstone of a sturdy monetary system, offering a structured framework for recording, classifying, and summarizing monetary transactions. By fastidiously designing, implementing, and sustaining a well-defined chart of accounts, companies can guarantee correct monetary reporting, enhance decision-making, and improve total monetary administration. Investing the effort and time to create a complete and well-organized chart of accounts is an important step in the direction of reaching long-term monetary success. It isn’t merely a e-book; it is the roadmap to your monetary future.

![Ecommerce Accounting & Bookkeeping Guide To Best Practices [2024]](https://www.ecommerceceo.com/wp-content/uploads/2020/12/image-1024x598.png)

Closure

Thus, we hope this text has supplied worthwhile insights into The Chart of Accounts Guide: Your Enterprise’s Monetary Roadmap. We thanks for taking the time to learn this text. See you in our subsequent article!