The Energy Of Compounding: Visualizing Dividend Reinvestment With Charts

The Energy of Compounding: Visualizing Dividend Reinvestment with Charts

Associated Articles: The Energy of Compounding: Visualizing Dividend Reinvestment with Charts

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to The Energy of Compounding: Visualizing Dividend Reinvestment with Charts. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

The Energy of Compounding: Visualizing Dividend Reinvestment with Charts

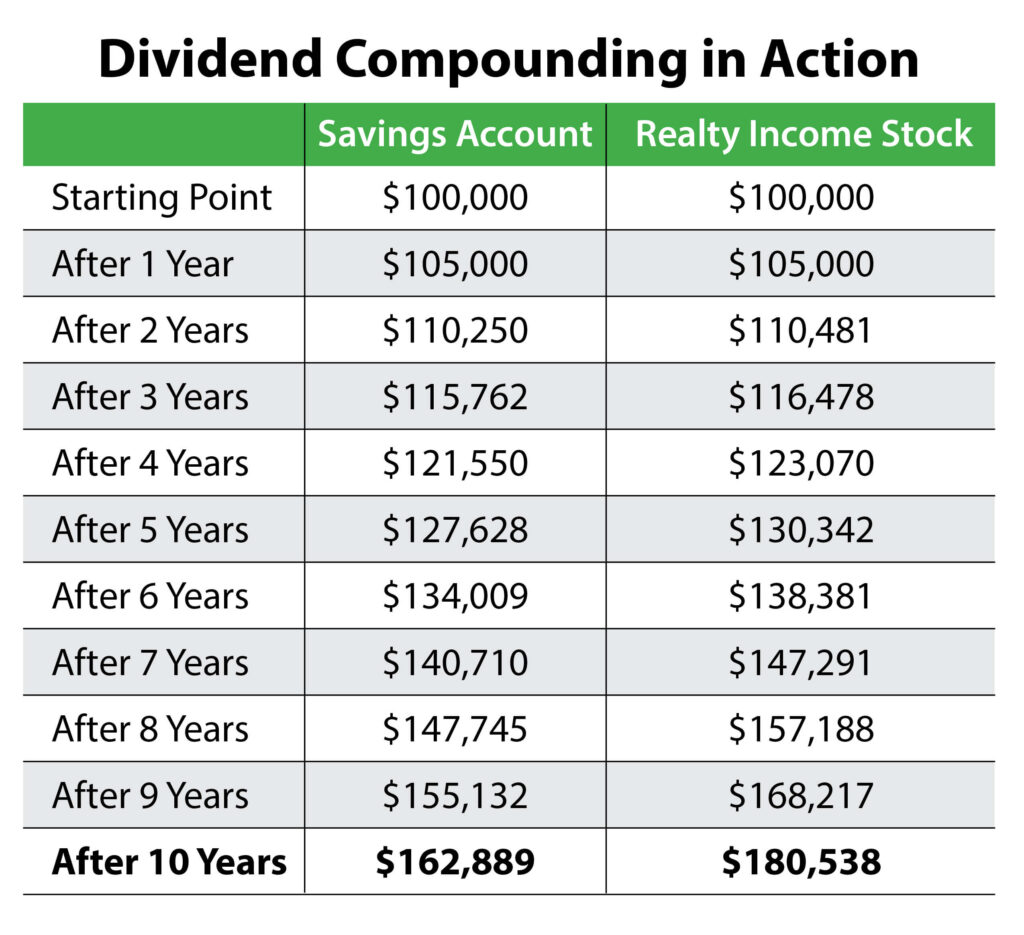

Dividend reinvestment plans (DRIPs) are a strong device for long-term buyers looking for to maximise returns. By routinely reinvesting dividends again into the identical inventory or fund, buyers harness the magic of compounding, accelerating wealth accumulation over time. Understanding the impression of DRIPs requires a visible illustration, and charts are the perfect medium to showcase the potential for development. This text explores the varied kinds of charts used to visualise dividend reinvestment, their strengths and weaknesses, and how one can interpret the info they current to make knowledgeable funding selections.

Why Charts are Important for Understanding DRIPs:

Whereas numerical information can illustrate the expansion of a DRIP funding, charts present a extra intuitive and readily digestible illustration. They remodel complicated monetary info into simply comprehensible visible patterns, highlighting key developments and illustrating the impression of compounding over time. A well-constructed chart can immediately talk the long-term advantages of dividend reinvestment, showcasing the facility of constant, small investments rising exponentially over time.

Sorts of Charts Used to Visualize Dividend Reinvestment:

A number of chart varieties successfully visualize dividend reinvestment information. The commonest embrace:

-

Line Charts: Line charts are wonderful for displaying the expansion of an funding over time. The x-axis represents time (years, months, and even days), whereas the y-axis represents the entire funding worth, together with reinvested dividends. A line chart clearly exhibits the upward trajectory of the funding, illustrating the cumulative impact of compounding. It is notably helpful for evaluating the expansion of a DRIP towards different funding methods or market benchmarks.

-

Bar Charts: Bar charts are efficient for evaluating the efficiency of various DRIPs or funding methods over a selected interval. Every bar represents the entire funding worth at a specific time limit, permitting for simple visible comparability. Whereas much less efficient at exhibiting the continual development over time in comparison with line charts, bar charts excel at highlighting variations in efficiency at particular intervals.

-

Space Charts: Space charts mix the options of line charts and bar charts. They present the expansion over time like a line chart, however the space below the road is crammed, offering a visible illustration of the cumulative funding worth. This may be notably helpful for highlighting the contribution of reinvested dividends to the general development.

-

Pie Charts: Pie charts are helpful for exhibiting the proportion of the entire funding worth attributed to preliminary funding versus reinvested dividends at a selected time limit. This clearly illustrates the compounding impact, demonstrating how reinvested dividends contribute considerably to the general development over time. Nevertheless, pie charts are much less efficient at displaying development over time.

-

Mixture Charts: Combining completely different chart varieties, akin to a line chart exhibiting the entire funding worth alongside a bar chart exhibiting annual dividends, can present a complete overview of the funding’s efficiency. This enables buyers to see each the general development and the contribution of dividends to that development.

Decoding Charts of Dividend Reinvested Portfolios:

When deciphering charts depicting DRIP efficiency, a number of key points want consideration:

-

Time Horizon: The longer the time horizon depicted on the chart, the extra pronounced the impact of compounding can be. Brief-term fluctuations could obscure the long-term upward development.

-

Dividend Yield: The dividend yield of the underlying asset considerably impacts the expansion trajectory. Greater-yielding shares or funds will typically present steeper development curves on the chart.

-

Market Volatility: Market fluctuations will have an effect on the expansion curve. Durations of market downturn will end in non permanent dips within the chart, however the long-term upward development ought to persist if the underlying asset is essentially sound.

-

Reinvested Dividend Frequency: The frequency of dividend reinvestment (month-to-month, quarterly, yearly) can affect the smoothness of the expansion curve. Extra frequent reinvestments will typically result in a smoother, extra constant upward development.

-

Comparability Benchmarks: Evaluating the DRIP efficiency to related benchmarks, akin to a broad market index (e.g., S&P 500), offers context and helps assess the effectiveness of the DRIP technique.

Limitations of Charts:

Whereas charts are highly effective instruments, they’ve limitations:

-

Oversimplification: Charts can typically oversimplify complicated monetary realities. They do not seize all of the nuances of funding efficiency, akin to transaction prices or tax implications.

-

Deceptive Scales: Manipulating the scales of a chart can distort the notion of development or efficiency. All the time fastidiously study the axes to keep away from misinterpretations.

-

Lack of Context: Charts alone do not present ample context. They need to at all times be accompanied by related information and explanations.

Constructing Your Personal Charts:

A number of instruments can be utilized to create charts visualizing dividend reinvestment:

-

Spreadsheet Software program (Excel, Google Sheets): These packages provide built-in charting capabilities, permitting customers to simply create numerous chart varieties from their funding information.

-

Monetary Software program: Many monetary software program packages embrace charting instruments particularly designed for funding evaluation.

-

On-line Charting Instruments: Quite a few on-line instruments enable customers to create and customise charts, typically with interactive options.

Conclusion:

Charts are indispensable instruments for understanding and visualizing the facility of dividend reinvestment. Through the use of acceptable chart varieties and punctiliously deciphering the info introduced, buyers can achieve a clearer understanding of the long-term development potential of their DRIP investments. Whereas charts provide a strong visible illustration, it is essential to do not forget that they need to be used along with different analytical instruments and an intensive understanding of the underlying investments to make knowledgeable and accountable funding selections. Bear in mind to at all times take into account your danger tolerance, funding objectives, and diversify your portfolio appropriately. The charts are a information, not a assure of future returns.

Closure

Thus, we hope this text has supplied helpful insights into The Energy of Compounding: Visualizing Dividend Reinvestment with Charts. We respect your consideration to our article. See you in our subsequent article!