The QQQ Chart: A Deep Dive Into The Invesco QQQ Belief And Its Historic Efficiency

The QQQ Chart: A Deep Dive into the Invesco QQQ Belief and its Historic Efficiency

Associated Articles: The QQQ Chart: A Deep Dive into the Invesco QQQ Belief and its Historic Efficiency

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to The QQQ Chart: A Deep Dive into the Invesco QQQ Belief and its Historic Efficiency. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

The QQQ Chart: A Deep Dive into the Invesco QQQ Belief and its Historic Efficiency

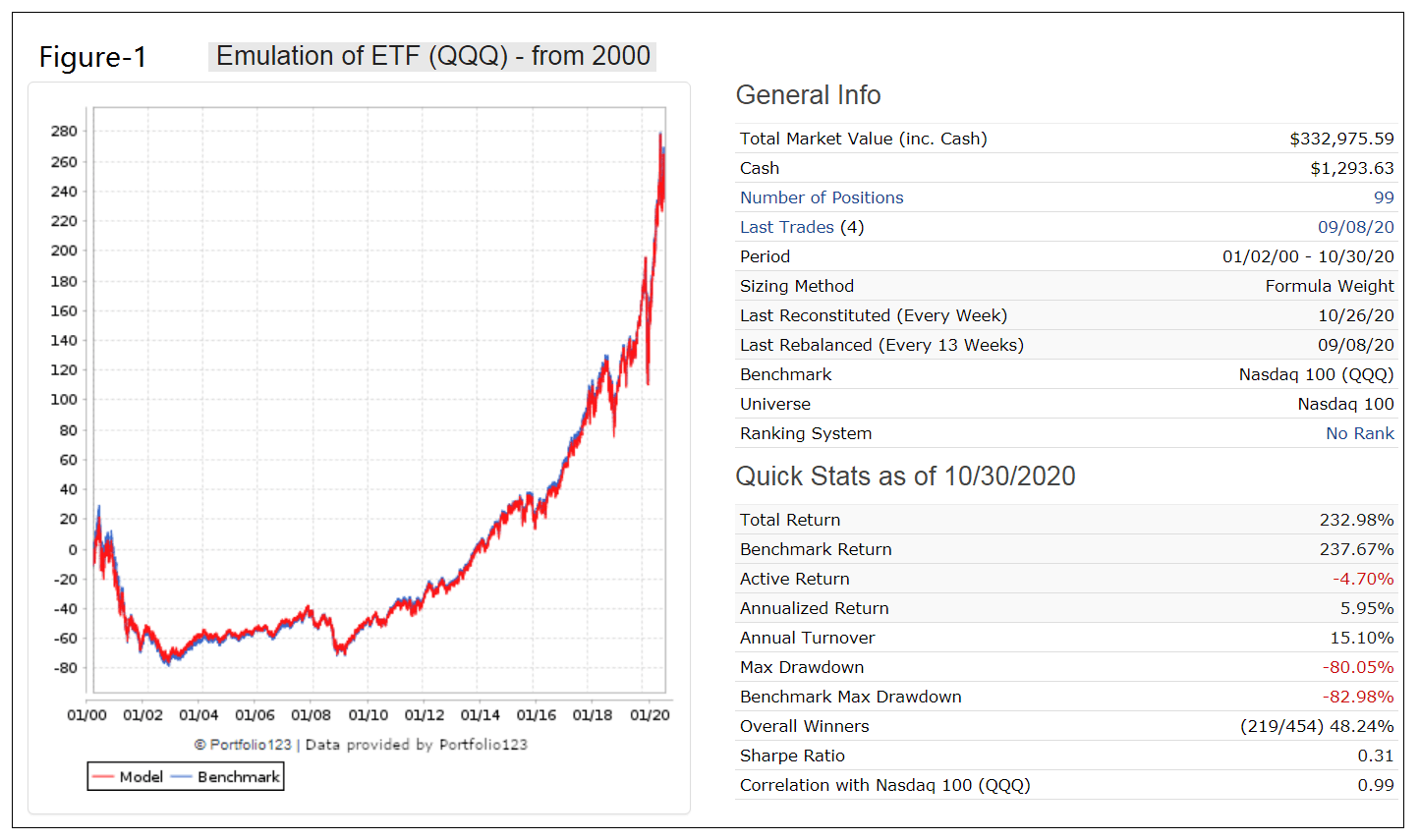

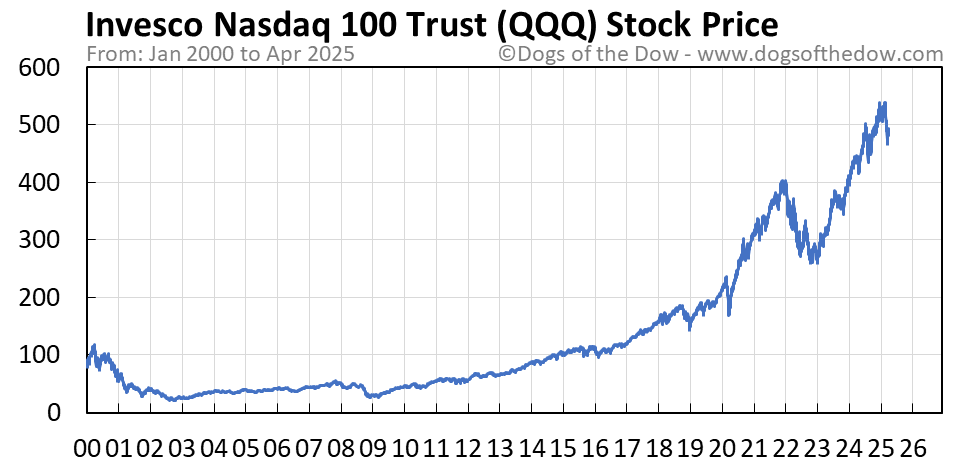

The Invesco QQQ Belief (QQQ) is likely one of the hottest and extensively traded exchange-traded funds (ETFs) on the planet, monitoring the Nasdaq-100 Index. This index contains 100 of the biggest non-financial corporations listed on the Nasdaq Inventory Market, representing a big slice of the expertise sector and broader US development financial system. Understanding the QQQ chart, its historic efficiency, and its implications for traders requires a complete evaluation extending past easy worth actions. This text will delve into the intricacies of the QQQ, inspecting its historic efficiency in numerous market situations, evaluating it to related benchmarks, and exploring its suitability for various funding methods.

Understanding the QQQ’s Composition and Methodology:

The QQQ’s success stems from its easy methodology: mirroring the Nasdaq-100. This index is market-capitalization-weighted, that means bigger corporations have a better affect on the general index worth. This focus in large-cap tech giants like Apple, Microsoft, Amazon, and Google (Alphabet) inherently introduces each vital upside potential and appreciable danger. Whereas this focus can result in distinctive returns throughout bull markets, it additionally exposes the QQQ to heightened volatility throughout downturns, as witnessed through the dot-com bubble burst and the COVID-19 pandemic sell-off.

The absence of economic corporations from the Nasdaq-100 is a key differentiator. This exclusion considerably impacts the QQQ’s correlation with broader market indices just like the S&P 500, which features a substantial monetary sector illustration. Understanding this distinction is essential for diversification methods. Whereas the QQQ can provide greater development potential, it won’t provide the identical stage of diversification and danger mitigation as a broader market index fund.

Historic Efficiency Evaluation: A Multi-faceted Perspective:

Analyzing the QQQ’s historic efficiency requires wanting past easy year-over-year returns. We have to take into account numerous market cycles, financial situations, and geopolitical occasions to realize a whole image.

The Dot-Com Bubble (1995-2000): The QQQ, closely weighted in expertise shares, skilled a meteoric rise throughout this era, reflecting the exuberant optimism surrounding the web revolution. Nonetheless, the next burst resulted in a dramatic decline, highlighting the inherent danger related to concentrated sector publicity. This era serves as an important reminder of the cyclical nature of expertise investments and the significance of danger administration.

The 2008 Monetary Disaster: The QQQ, regardless of its exclusion of economic corporations, was considerably impacted by the 2008 disaster. The interconnectedness of the worldwide financial system meant that even non-financial corporations felt the ripple results of the monetary meltdown. The disaster underscored the significance of contemplating systemic danger, even when investing in seemingly insulated sectors.

The Submit-2008 Restoration and the Rise of the Tech Giants: The interval following the 2008 disaster witnessed a outstanding restoration, notably for the expertise sector. The QQQ considerably outperformed the broader market, pushed by the distinctive development of corporations like Apple, Microsoft, and Google. This era highlights the long-term development potential of expertise, but in addition emphasizes the significance of figuring out and investing in corporations with sustainable aggressive benefits.

The COVID-19 Pandemic and Subsequent Restoration: The preliminary phases of the COVID-19 pandemic noticed a pointy decline within the QQQ, reflecting broader market uncertainty. Nonetheless, the next restoration was much more dramatic, pushed by the elevated reliance on expertise throughout lockdowns and the acceleration of digital transformation. This era showcases the QQQ’s sensitivity to macroeconomic occasions and its capability for fast restoration.

Evaluating QQQ to Benchmarks:

Evaluating the QQQ’s efficiency to different benchmarks, such because the S&P 500 and the Nasdaq Composite, supplies helpful insights. Whereas the QQQ typically outperforms the S&P 500 throughout bull markets, it could possibly additionally underperform during times of broader market uncertainty or when different sectors outperform expertise. In comparison with the Nasdaq Composite, the QQQ gives a extra concentrated publicity to the biggest corporations, resulting in probably greater returns but in addition greater volatility.

Threat and Volatility:

The QQQ’s inherent focus in large-cap expertise shares makes it a comparatively risky funding. Whereas this volatility can result in vital returns during times of robust development, it additionally exposes traders to substantial losses throughout market downturns. Understanding and managing this danger is essential for any investor contemplating investing within the QQQ. Diversification inside a broader portfolio is crucial to mitigate this danger.

Suitability for Completely different Funding Methods:

The QQQ’s suitability will depend on an investor’s danger tolerance, funding horizon, and total funding targets. It is ideally suited to traders with the next danger tolerance and a long-term funding horizon who’re comfy with the potential for vital worth swings. For traders looking for decrease volatility, a extra diversified portfolio together with different asset lessons and market indices could be extra applicable.

Technical Evaluation of the QQQ Chart:

Analyzing the QQQ chart utilizing technical indicators like shifting averages, relative power index (RSI), and MACD can present helpful insights into potential buying and selling alternatives. Nonetheless, it is essential to keep in mind that technical evaluation just isn’t a foolproof technique and must be used together with basic evaluation and a radical understanding of the underlying market situations.

Conclusion:

The QQQ chart displays the efficiency of a strong section of the US financial system, providing vital development potential but in addition substantial danger. Its historic efficiency demonstrates each its capability for distinctive returns and its vulnerability throughout market downturns. Buyers contemplating investing within the QQQ should rigorously consider their danger tolerance, funding horizon, and total funding technique. Understanding the QQQ’s composition, historic efficiency, and its correlation with different market indices is paramount for making knowledgeable funding selections. A diversified portfolio, mixed with a long-term perspective and a sound understanding of market dynamics, is essential for efficiently navigating the complexities of investing within the QQQ. Do not forget that previous efficiency just isn’t indicative of future outcomes, and thorough due diligence is at all times needed earlier than making any funding selections.

Closure

Thus, we hope this text has offered helpful insights into The QQQ Chart: A Deep Dive into the Invesco QQQ Belief and its Historic Efficiency. We thanks for taking the time to learn this text. See you in our subsequent article!