The Technical Evaluation Chart Patterns Cheat Sheet: A Complete Information

The Technical Evaluation Chart Patterns Cheat Sheet: A Complete Information

Associated Articles: The Technical Evaluation Chart Patterns Cheat Sheet: A Complete Information

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to The Technical Evaluation Chart Patterns Cheat Sheet: A Complete Information. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

The Technical Evaluation Chart Patterns Cheat Sheet: A Complete Information

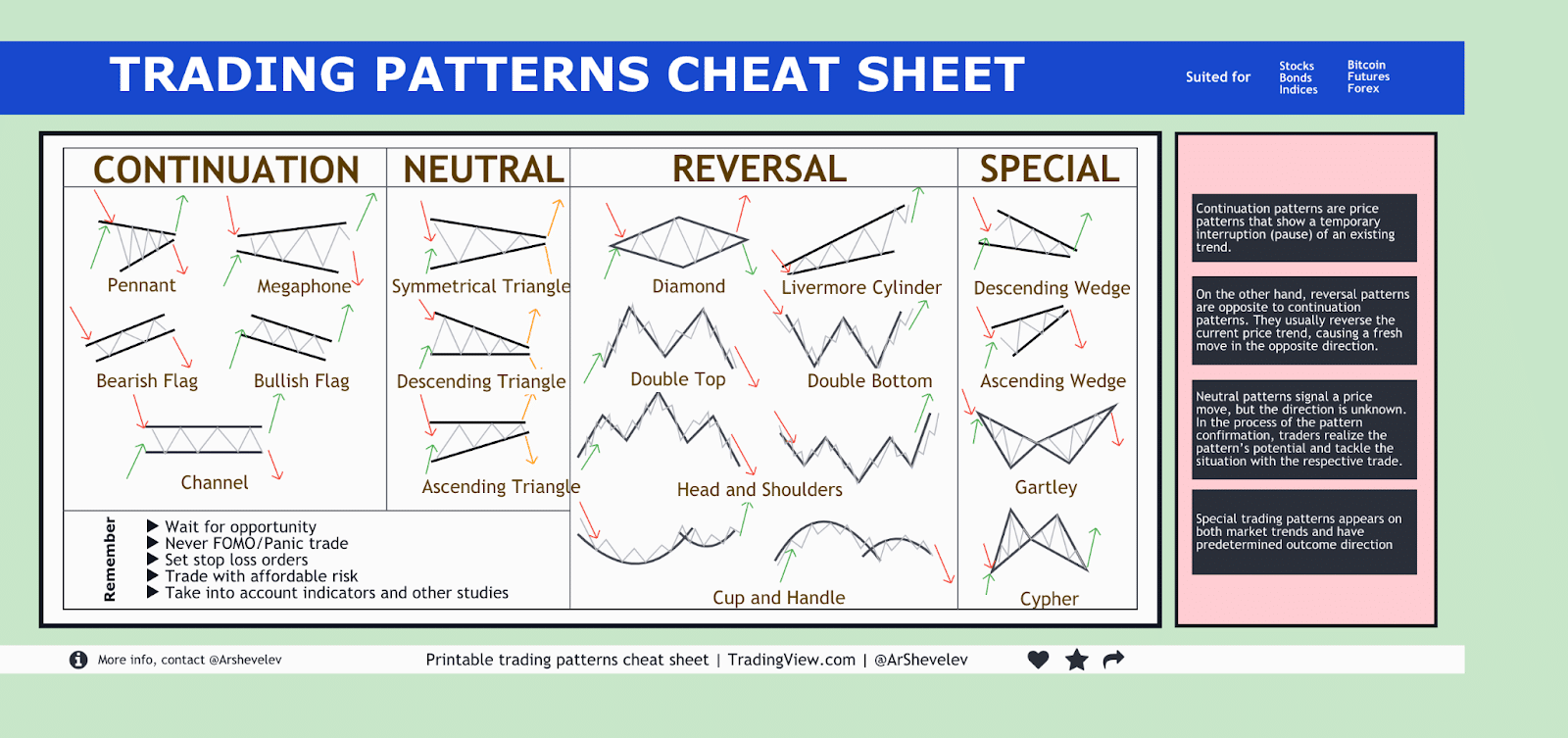

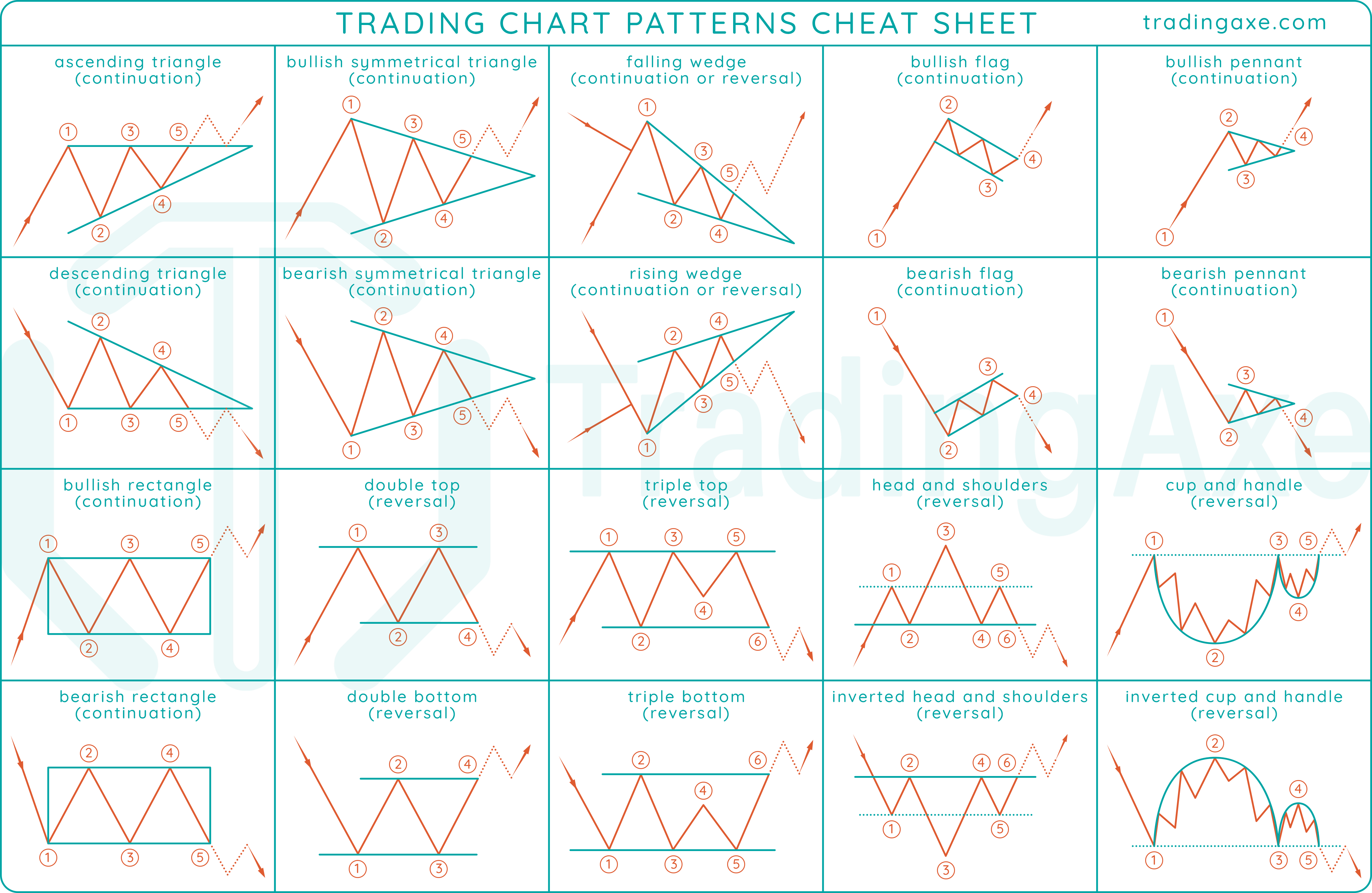

Technical evaluation is the artwork and science of forecasting future worth actions by learning previous market information, primarily via the usage of charts. Whereas basic evaluation focuses on an organization’s intrinsic worth, technical evaluation analyzes worth motion, quantity, and different market indicators to determine potential buying and selling alternatives. An important element of technical evaluation is recognizing and decoding chart patterns, which characterize recurring formations that always predict future worth actions. This cheat sheet offers a complete overview of frequent chart patterns, categorized for readability and supplemented with illustrative examples.

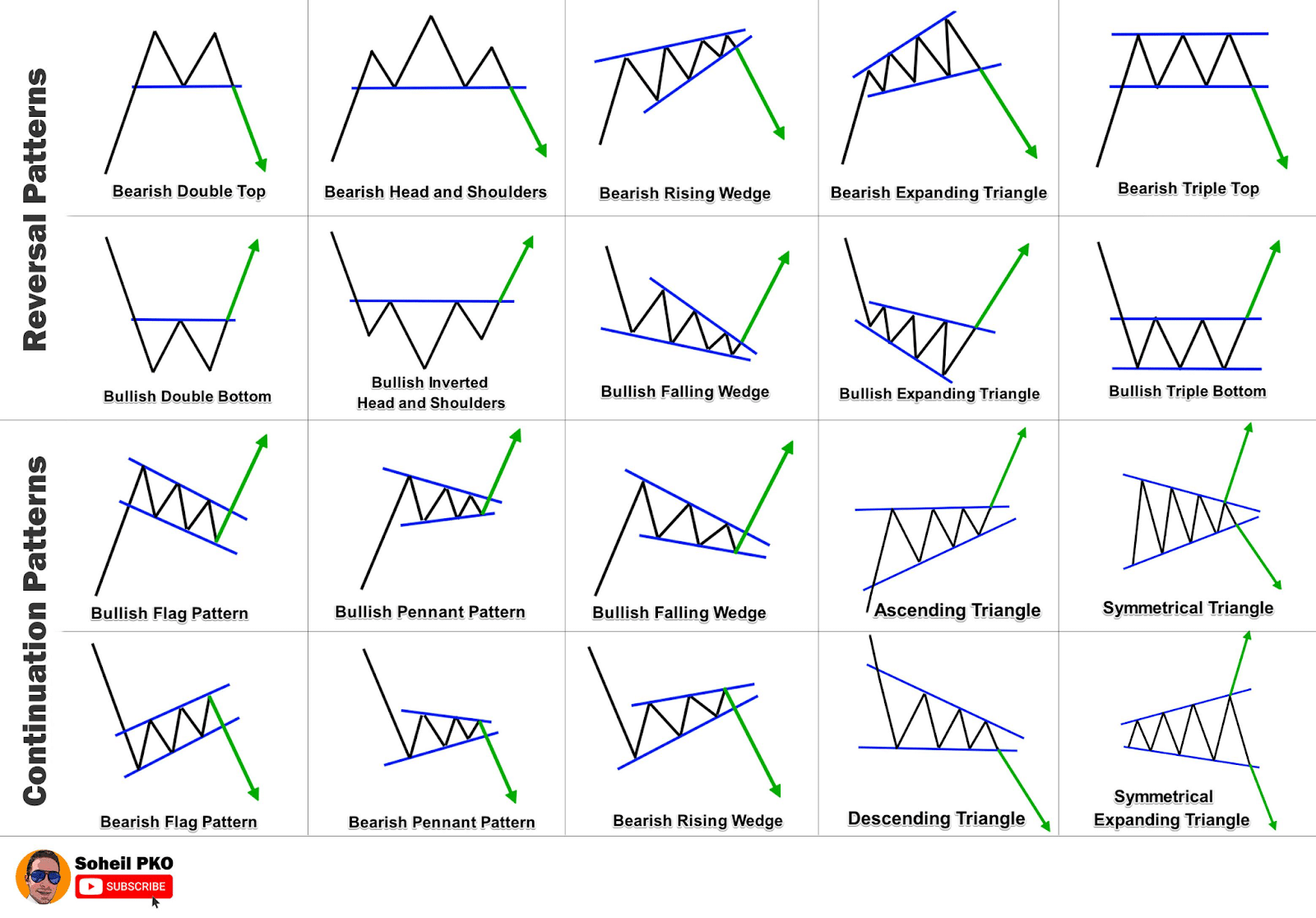

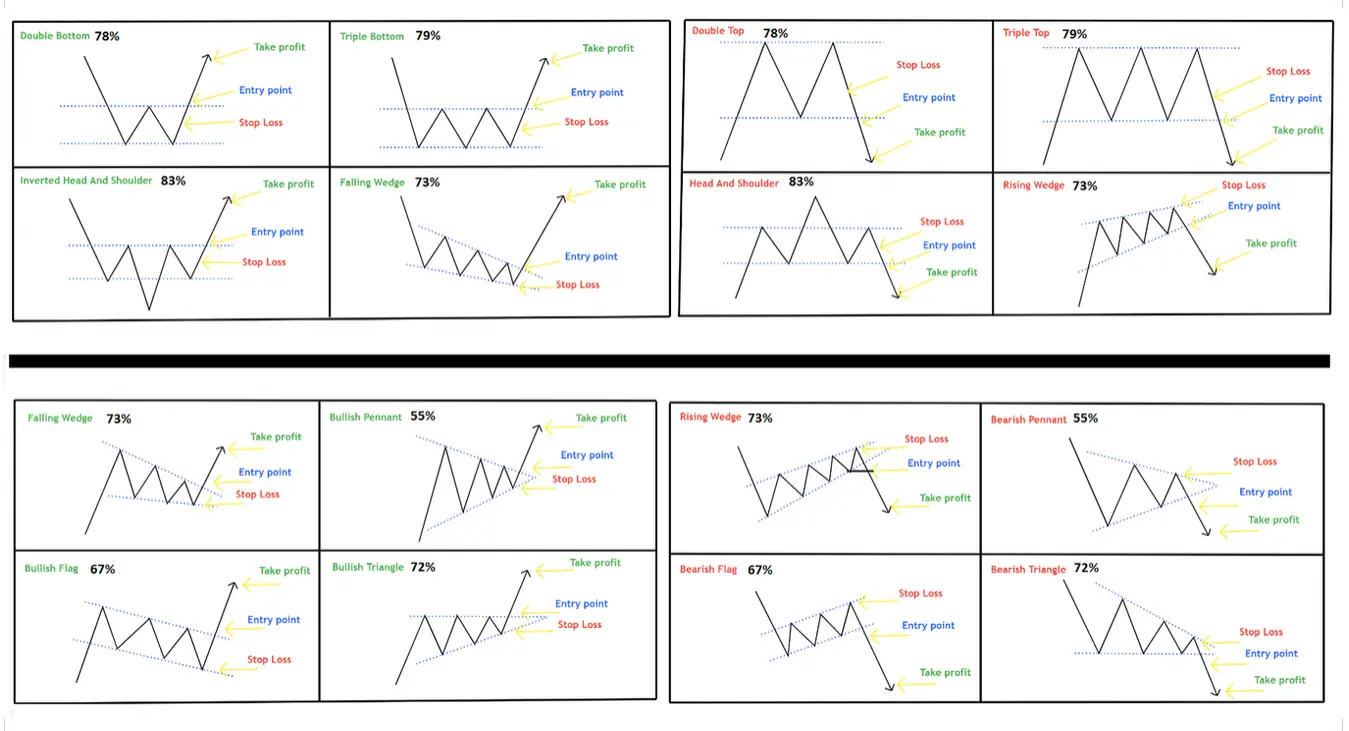

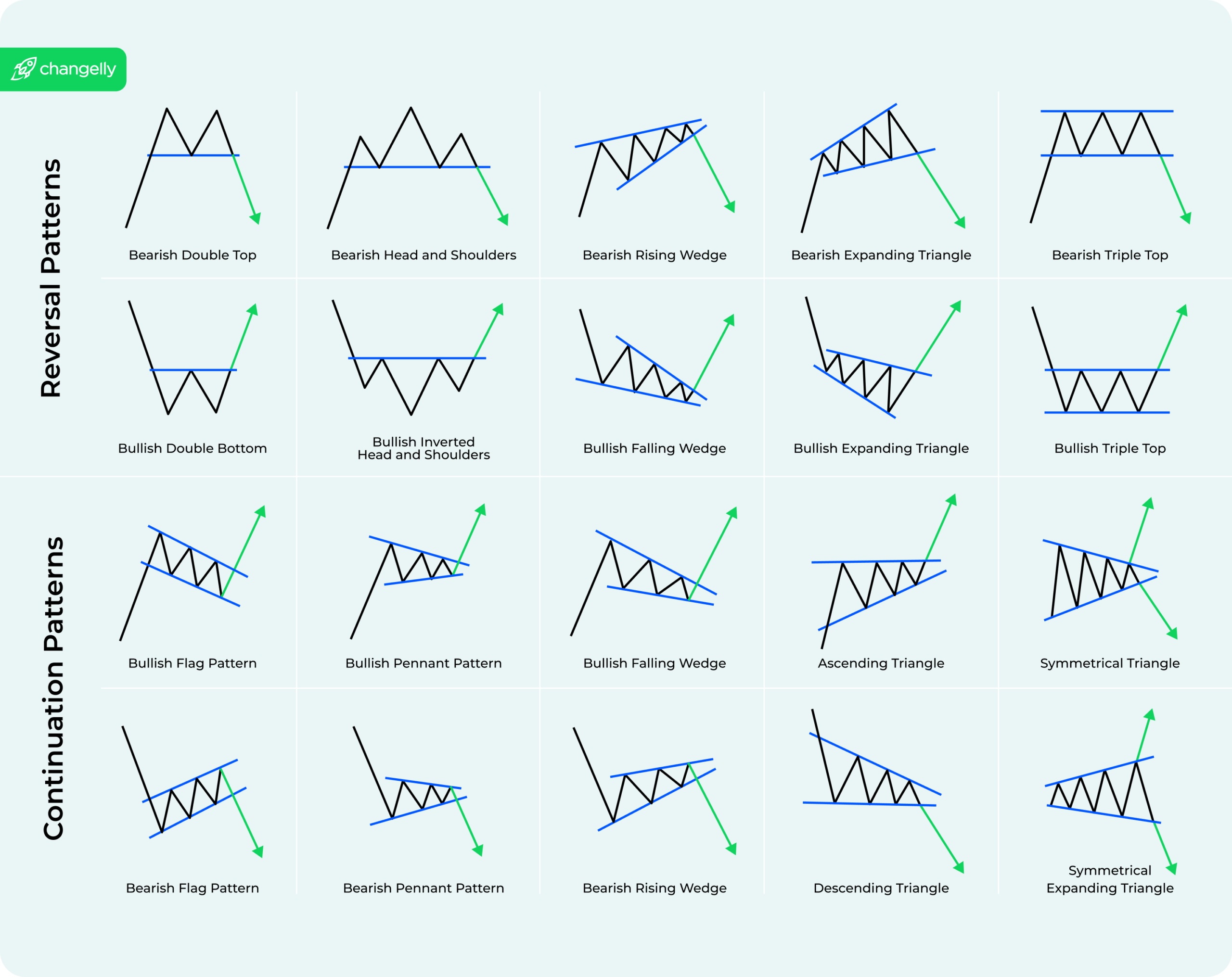

I. Reversal Patterns: These patterns sign a possible change within the prevailing development, from an uptrend to a downtrend (or vice versa).

A. Head and Shoulders (H&S):

- Description: A 3-peak formation resembling a head and two shoulders. The "head" is the best peak, flanked by two decrease "shoulders." A neckline connects the troughs between the peaks.

- Significance: A bearish reversal sample. A break beneath the neckline confirms the sample and suggests a possible downtrend.

- Goal Value: Neckline break minus the head-to-neckline distance.

- Picture: (Insert picture of a Head and Shoulders sample)

- Instance: A inventory in a robust uptrend varieties a head and shoulders sample. As soon as the worth breaks beneath the neckline, merchants anticipate a major worth drop, probably promoting their positions.

B. Inverse Head and Shoulders (IH&S):

- Description: The mirror picture of the H&S sample. It options three troughs, with the central trough being the bottom. A neckline connects the peaks between the troughs.

- Significance: A bullish reversal sample. A break above the neckline confirms the sample and suggests a possible uptrend.

- Goal Value: Neckline break plus the head-to-neckline distance.

- Picture: (Insert picture of an Inverse Head and Shoulders sample)

- Instance: A inventory in a downtrend varieties an inverse head and shoulders sample. A breakout above the neckline can sign a major worth enhance, attracting patrons.

C. Double Prime:

- Description: Two consecutive peaks at roughly the identical worth degree, adopted by a decrease trough.

- Significance: A bearish reversal sample. A break beneath the trough confirms the sample.

- Goal Value: Trough break minus the space between the height and the trough.

- Picture: (Insert picture of a Double Prime sample)

- Instance: A inventory reaches a peak, retraces barely, after which reaches the same peak earlier than declining considerably.

D. Double Backside:

- Description: Two consecutive troughs at roughly the identical worth degree, adopted by the next peak.

- Significance: A bullish reversal sample. A break above the height confirms the sample.

- Goal Value: Peak break plus the space between the height and the trough.

- Picture: (Insert picture of a Double Backside sample)

- Instance: A inventory experiences a major drop, recovers barely, after which drops to the same low earlier than rebounding strongly.

E. Triple Prime/Backside:

- Description: Much like double tops/bottoms, however with three peaks/troughs at roughly the identical worth degree.

- Significance: Reinforces the power of the double high/backside sign. A break beneath/above the related degree confirms the sample.

- Goal Value: Related calculation as double tops/bottoms.

- Picture: (Insert picture of a Triple Prime/Backside sample)

- Instance: A inventory reveals three makes an attempt to interrupt via a resistance degree (Triple Prime) earlier than lastly breaking down.

II. Continuation Patterns: These patterns recommend that the prevailing development will proceed in its present path.

A. Triangles: Triangles are characterised by converging trendlines.

- Symmetrical Triangle: Equal upward and downward slopes. The breakout could be both bullish or bearish.

- Ascending Triangle: Horizontal resistance line and an upward-sloping help line. Often bullish.

- Descending Triangle: Horizontal help line and a downward-sloping resistance line. Often bearish.

- Significance: Continuation patterns; breakouts typically sign a continuation of the development.

- Goal Value: The scale of the triangle projected from the breakout level.

- Picture: (Insert photographs of Symmetrical, Ascending, and Descending Triangles)

- Instance: A inventory in an uptrend varieties an ascending triangle, consolidating beneficial properties earlier than breaking out to larger highs.

B. Flags and Pennants: These patterns characterize non permanent pauses in a robust development.

- Flag: An oblong or parallelogram-shaped sample.

- Pennant: A triangular sample.

- Significance: Continuation patterns; breakouts typically sign a continuation of the prevailing development.

- Goal Value: The peak of the flagpole (the previous development) projected from the breakout level.

- Picture: (Insert photographs of Flag and Pennant patterns)

- Instance: A inventory experiences a pointy upward transfer, adopted by a short consolidation in a flag sample earlier than resuming its upward development.

C. Rectangles: These patterns characterize a interval of consolidation inside a variety.

- Description: A worth vary bounded by horizontal resistance and help ranges.

- Significance: A continuation sample; breakouts above resistance recommend a continuation of the uptrend, whereas breakouts beneath help recommend a continuation of the downtrend.

- Goal Value: The peak of the rectangle projected from the breakout level.

- Picture: (Insert picture of a Rectangle sample)

- Instance: A inventory trades inside an outlined vary for a number of weeks earlier than breaking out to the upside.

III. Different Essential Chart Patterns:

A. Gaps: These are intervals the place there isn’t any buying and selling exercise between consecutive worth bars.

- Breakaway Gaps: Gaps that happen originally of a robust development.

- Runaway Gaps (Exhaustion Gaps): Gaps that happen close to the top of a development.

- Widespread Gaps: Gaps which are crammed later within the worth motion.

- Significance: Gaps can sign important shifts in market sentiment.

- Picture: (Insert picture illustrating several types of gaps)

- Instance: A inventory worth jumps considerably in a single day, making a breakaway hole, indicating a robust bullish sentiment.

B. Rounding Tops and Bottoms: These patterns are characterised by a gradual curve resembling a bowl (backside) or an inverted bowl (high).

- Significance: Reversal patterns; rounding bottoms typically precede a bullish development, whereas rounding tops typically precede a bearish development.

- Goal Value: The gap from the highest/backside of the curve to the neckline (within the case of bottoms, the neckline is the resistance line that varieties the bottom of the curve).

- Picture: (Insert photographs of Rounding Prime and Backside patterns)

- Instance: A inventory steadily varieties a rounding backside sample, suggesting the top of a downtrend and the start of a possible uptrend.

IV. Essential Issues:

- Affirmation: Chart patterns ought to be confirmed by different technical indicators (e.g., quantity, transferring averages, RSI) for higher accuracy.

- Context: Take into account the broader market atmosphere and the particular traits of the asset being analyzed.

- Threat Administration: At all times use applicable threat administration strategies, similar to stop-loss orders, to guard your capital.

- Apply: Mastering chart sample recognition requires follow and expertise. Begin by analyzing historic charts and steadily develop your expertise.

This cheat sheet offers a foundational understanding of frequent chart patterns. Do not forget that technical evaluation will not be a precise science, and no sample ensures future worth actions. Combining chart sample recognition with different types of technical evaluation and threat administration methods can considerably enhance your buying and selling selections. Steady studying and refinement of your analytical expertise are important for fulfillment within the dynamic world of economic markets. At all times seek the advice of with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied beneficial insights into The Technical Evaluation Chart Patterns Cheat Sheet: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!