Thirty Years Of Silver: A Worth Chart Retrospective And Market Evaluation (1993-2023)

Thirty Years of Silver: A Worth Chart Retrospective and Market Evaluation (1993-2023)

Associated Articles: Thirty Years of Silver: A Worth Chart Retrospective and Market Evaluation (1993-2023)

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Thirty Years of Silver: A Worth Chart Retrospective and Market Evaluation (1993-2023). Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Thirty Years of Silver: A Worth Chart Retrospective and Market Evaluation (1993-2023)

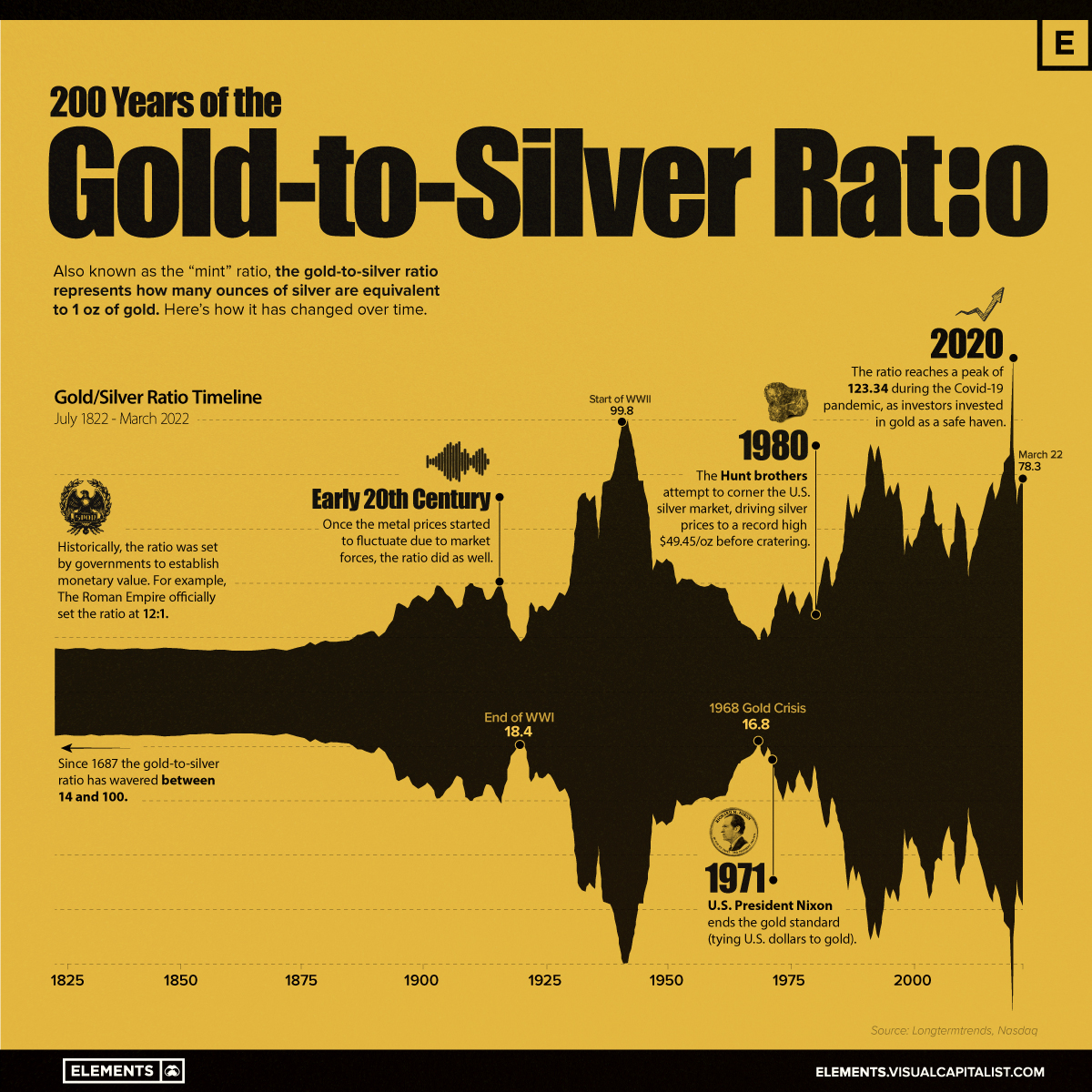

The silver market, a captivating mix of business demand and funding sentiment, has seen dramatic swings over the previous three many years. Analyzing a 30-year silver worth chart (1993-2023) reveals a posh interaction of financial forces, geopolitical occasions, and investor psychology which have formed its trajectory. This text will delve into the important thing intervals, drivers, and potential future implications, providing a complete overview of this valuable steel’s efficiency.

The Nineteen Nineties: A Interval of Consolidation and Uncertainty

The early Nineteen Nineties noticed silver costs languishing, reflecting a world financial local weather marked by recessionary pressures and technological developments that lowered the steel’s industrial significance in some sectors. The worth hovered across the $4-$6 per ounce vary for a lot of the last decade. This era was characterised by:

- Technological developments: The rise of fiber optics and different applied sciences lowered the demand for silver in electronics, a major marketplace for the steel.

- Weak financial progress: World financial stagnation dampened industrial manufacturing and funding demand for silver.

- Lack of great funding demand: Silver lacked the sturdy funding attraction it could later acquire, primarily as a result of dominance of gold within the valuable metals funding area.

The chart for this era would present a comparatively flat trajectory with minor fluctuations, reflecting the general lack of great worth drivers. The absence of main geopolitical occasions or financial shocks contributed to the subdued worth motion.

The 2000s: The Rise of Funding Demand and Industrial Development

The brand new millennium ushered in a interval of great progress for silver costs. This was pushed by a confluence of things:

- Elevated industrial demand: Rising economies, notably in Asia, fueled a surge in industrial manufacturing, boosting the demand for silver in electronics, photo voltaic panels, and different purposes.

- Rising funding curiosity: Considerations about inflation, forex debasement, and the general financial outlook led traders to hunt different belongings, together with silver. The rise of exchange-traded funds (ETFs) additional facilitated funding in silver.

- Geopolitical uncertainties: Occasions just like the Iraq Struggle and the 2008 monetary disaster heightened investor nervousness, pushing traders in the direction of safe-haven belongings like silver.

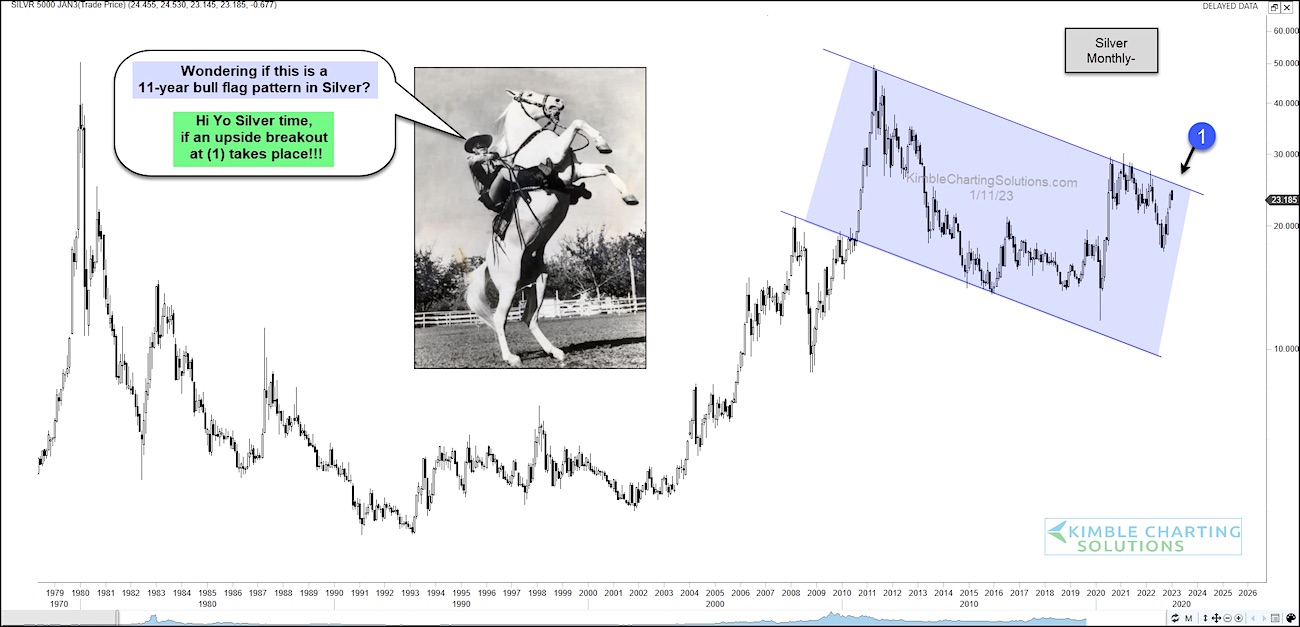

The silver worth chart for the 2000s would depict a major upward pattern, punctuated by occasional corrections. The worth reached a excessive of over $50 per ounce in 2011, reflecting the sturdy funding and industrial demand. This era highlights the interaction between industrial and funding components in driving silver costs.

The 2010s: Volatility and Consolidation

The 2010s witnessed a extra unstable interval for silver. The worth skilled sharp swings, influenced by:

- The 2011 peak and subsequent decline: The surge in worth in 2011 was adopted by a major correction, pushed by profit-taking and considerations concerning the sustainability of the investment-driven rally.

- Fluctuating industrial demand: The worldwide financial restoration was uneven, impacting the demand for silver throughout varied industrial sectors.

- US financial coverage: The Federal Reserve’s financial coverage, notably its quantitative easing applications, had a major affect on the worth of silver and different valuable metals.

The chart for this decade would showcase intervals of sharp will increase and reduces, reflecting the heightened volatility. The worth consolidated across the $15-$20 per ounce vary for a lot of the last decade, with occasional spikes and dips. This era underscores the affect of macroeconomic components and investor sentiment on silver worth actions.

The 2020s: Pandemic, Inflation, and Geopolitical Tensions

The 2020s have introduced a novel set of challenges and alternatives for the silver market. The COVID-19 pandemic, coupled with inflationary pressures and geopolitical tensions, have considerably impacted the worth:

- Pandemic-induced demand: The pandemic initially led to a decline in industrial demand, however this was partially offset by elevated funding demand as traders sought safe-haven belongings.

- Inflationary pressures: Rising inflation globally has boosted the attraction of silver as an inflation hedge, driving up costs.

- Geopolitical dangers: The continuing struggle in Ukraine, tensions with China, and different geopolitical occasions have additional contributed to the uncertainty available in the market, pushing traders in the direction of silver.

The silver worth chart for this decade exhibits a interval of elevated volatility, with costs reaching highs not seen since 2011. The interaction between pandemic-related uncertainty, inflation, and geopolitical dangers has created a posh surroundings for silver, making it a dynamic and doubtlessly profitable funding.

Elements Influencing Future Silver Costs

Predicting future silver costs stays difficult, however a number of components are prone to play a vital position:

- Industrial demand: The continued progress of renewable power applied sciences, electronics, and different sectors reliant on silver will considerably affect future demand.

- Funding demand: Investor sentiment, inflation expectations, and the general financial outlook will proceed to drive funding flows into silver.

- Provide dynamics: Mining manufacturing, recycling charges, and geopolitical components affecting silver provide will affect worth ranges.

- Authorities insurance policies: Financial insurance policies, laws, and commerce insurance policies can considerably affect the silver market.

Conclusion:

A 30-year assessment of the silver worth chart reveals a captivating journey marked by intervals of stability, progress, and volatility. The interaction between industrial demand, funding sentiment, and macroeconomic components has formed the steel’s worth trajectory. Whereas predicting future costs stays speculative, understanding the historic tendencies and key drivers is essential for traders and market contributors. The way forward for silver seems promising, notably given its position in essential rising applied sciences and its potential as an inflation hedge in an more and more unsure international panorama. Nevertheless, warning is warranted, because the market stays inclined to vital worth swings pushed by varied financial and geopolitical forces. Steady monitoring of those components is important for navigating the complexities of the silver market and making knowledgeable funding selections. Additional analysis into particular geopolitical occasions, technological developments and macroeconomic knowledge factors throughout the 30-year interval will present a extra granular and insightful evaluation of silver worth actions.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has offered useful insights into Thirty Years of Silver: A Worth Chart Retrospective and Market Evaluation (1993-2023). We respect your consideration to our article. See you in our subsequent article!