TradingView Information: Integrating Market Sentiment Immediately Onto Your Charts

TradingView Information: Integrating Market Sentiment Immediately Onto Your Charts

Associated Articles: TradingView Information: Integrating Market Sentiment Immediately Onto Your Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to TradingView Information: Integrating Market Sentiment Immediately Onto Your Charts. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

TradingView Information: Integrating Market Sentiment Immediately Onto Your Charts

TradingView has quickly grow to be a go-to platform for thousands and thousands of merchants and traders worldwide, because of its highly effective charting instruments, strong social options, and ever-expanding suite of analytical assets. One more and more essential function is the combination of stories instantly onto charts, basically altering how customers devour and react to market-moving data. This text delves into the importance of TradingView’s information integration, exploring its performance, advantages, and implications for buying and selling methods.

The Energy of Contextualized Info:

Historically, merchants relied on separate information sources, usually scrambling to attach headlines with worth motion. This fragmented method led to delays in reacting to essential data and a scarcity of contextual understanding. TradingView’s information integration addresses this by seamlessly embedding related information articles and headlines instantly onto the chart itself. This contextualization is essential; seeing a information article about an organization’s earnings report instantly alongside the value chart of its inventory supplies a right away and intuitive hyperlink between trigger and impact. The person can immediately grasp the potential influence of the information on the asset’s worth, facilitating sooner and extra knowledgeable decision-making.

Performance and Options:

TradingView’s information integration boasts a variety of functionalities designed to boost the person expertise and supply complete market protection:

-

Actual-time Information Feed: A repeatedly up to date feed shows breaking information related to the chosen asset or market. This streamlines the news-gathering course of, eliminating the necessity to always test a number of sources. The feed is customizable, permitting customers to filter by information supply, key phrase, or relevance.

-

Information Alerts: Customers can set personalized alerts for particular key phrases, symbols, or information sources. This proactive method ensures that merchants are notified immediately when essential information breaks, minimizing the chance of lacking market-moving occasions. These alerts could be delivered on to the platform or through e-mail, guaranteeing well timed entry no matter whether or not the person is actively monitoring the charts.

-

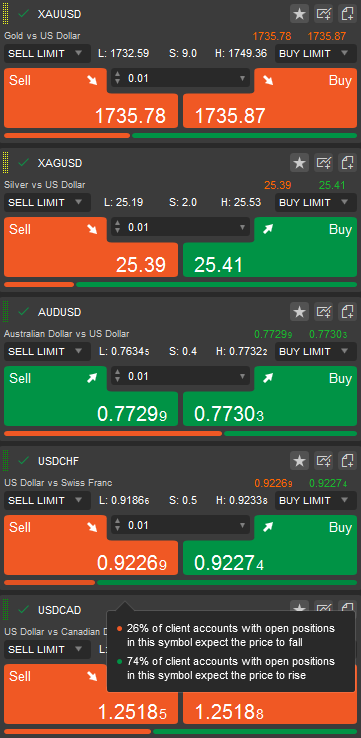

Sentiment Evaluation: Whereas not explicitly acknowledged as a function throughout all information sources, the combination usually incorporates sentiment evaluation, subtly highlighting the general tone of the information article (optimistic, detrimental, or impartial). This supplies a fast evaluation of the potential market influence, saving useful time in deciphering the nuanced language of monetary reporting. That is significantly useful when coping with advanced or ambiguous information.

-

Supply Diversification: TradingView sources information from a wide range of respected monetary information shops, guaranteeing a various and balanced perspective. This prevents reliance on a single supply and reduces the chance of biased data influencing buying and selling selections. The variety of sources additionally permits merchants to check and distinction totally different views on the identical occasion.

-

Integration with Charting Instruments: Probably the most highly effective facet is the seamless integration with the platform’s complete charting instruments. Customers can instantly hyperlink information occasions to particular worth actions, analyzing the correlation between information and worth motion. This enables for the event of extra subtle buying and selling methods based mostly on news-driven worth reactions. As an illustration, a dealer can simply determine the exact second a information occasion triggered a worth spike or dip, informing future buying and selling selections.

Advantages for Totally different Dealer Profiles:

The advantages of TradingView’s information integration prolong throughout numerous buying and selling types and expertise ranges:

-

Newbie Merchants: The contextualized nature of the information feed considerably simplifies the method of understanding market dynamics. New merchants can readily join information occasions to cost actions, fostering a deeper understanding of market forces.

-

Intermediate Merchants: The information alerts and customizable filters permit for extra environment friendly market monitoring. Merchants can deal with particular sectors or belongings, guaranteeing they obtain well timed notifications about occasions related to their buying and selling methods.

-

Superior Merchants: The mixing with charting instruments allows the event of subtle buying and selling methods based mostly on information sentiment and worth motion evaluation. Superior merchants can leverage this data to refine their threat administration and enhance their general buying and selling efficiency.

-

Swing Merchants: Swing merchants profit from the power to determine potential entry and exit factors based mostly on news-driven worth actions. The information feed may help determine potential catalysts for important worth swings.

-

Day Merchants: Day merchants can use real-time information updates to react shortly to market-moving occasions, capitalizing on short-term worth fluctuations. The pace and accuracy of the information supply are essential for this buying and selling model.

Implications for Buying and selling Methods:

The provision of built-in information basically impacts buying and selling technique growth. Merchants can now:

-

Develop Information-Primarily based Buying and selling Methods: This entails figuring out particular information occasions that persistently set off predictable worth actions. By analyzing historic information and correlating information occasions with worth motion, merchants can develop methods that exploit these patterns.

-

Improve Threat Administration: Understanding the potential influence of stories occasions permits for more practical threat administration. Merchants can alter their positions or implement stop-losses based mostly on the potential volatility triggered by particular information.

-

Enhance Order Timing: The well timed supply of stories alerts permits merchants to execute orders at optimum moments, maximizing income and minimizing losses. That is significantly vital in fast-moving markets.

-

Refine Market Evaluation: Integrating information into the evaluation course of supplies a extra holistic view of market dynamics. Merchants can mix elementary and technical evaluation to make extra knowledgeable buying and selling selections.

Limitations and Issues:

Whereas TradingView’s information integration affords important benefits, it is essential to acknowledge limitations:

-

Info Overload: The fixed stream of stories can result in data overload, probably hindering efficient decision-making. Cautious filtering and prioritization are important.

-

Bias and Accuracy: Whereas TradingView sources information from respected shops, it is important to critically consider the knowledge acquired. Information could be biased or inaccurate, and merchants ought to at all times cross-reference data from a number of sources.

-

False Alerts: Not all information occasions set off important worth actions. Merchants should study to differentiate between market-moving information and noise.

-

Dependence on Expertise: Relying solely on automated information alerts can result in missed alternatives if the system malfunctions or experiences delays.

Conclusion:

TradingView’s integration of stories instantly onto charts represents a major development in buying and selling know-how. By contextualizing data and offering real-time updates, it empowers merchants of all ranges to make extra knowledgeable selections. Whereas limitations exist, the advantages of enhanced market consciousness, improved threat administration, and the potential for growing subtle news-based buying and selling methods considerably outweigh the drawbacks. Because the platform continues to evolve, its information integration will possible grow to be much more subtle and integral to the buying and selling expertise, additional blurring the traces between information consumption and lively market participation. The way forward for buying and selling is more and more data-driven, and TradingView’s information integration is a key part of this evolution.

Closure

Thus, we hope this text has supplied useful insights into TradingView Information: Integrating Market Sentiment Immediately Onto Your Charts. We thanks for taking the time to learn this text. See you in our subsequent article!