Development Line Chart Sample PDF: A Complete Information

Development Line Chart Sample PDF: A Complete Information

Associated Articles: Development Line Chart Sample PDF: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Development Line Chart Sample PDF: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Development Line Chart Sample PDF: A Complete Information

![How To Draw Trend Lines Perfectly Every Time [2022 Update]](https://dailypriceaction.com/wp-content/uploads/2014/09/how-to-use-trend-lines.png)

Development traces are elementary instruments in technical evaluation, offering visible representations of worth path and momentum. Understanding the way to establish, interpret, and make the most of development line chart patterns is essential for profitable buying and selling. This complete information delves into the intricacies of development line patterns, providing an in depth rationalization appropriate for each novice and skilled merchants. Whereas a PDF would usually accompany this data, this textual content serves in its place, offering the core content material you’d discover in such a doc.

I. Defining Development Traces:

Development traces are traces drawn on a worth chart connecting a sequence of upper lows (uptrend) or decrease highs (downtrend). They signify the general path of the value motion. A well-defined development line ought to ideally join a minimum of two vital swing factors. These swing factors are identifiable worth extremes marking a brief reversal in worth motion earlier than the development resumes. The extra contact factors a development line has, the stronger it’s thought-about.

A. Uptrend Traces:

An uptrend line connects a sequence of upper lows. Every subsequent low ought to be greater than the earlier one, indicating bullish momentum. A break above the uptrend line usually alerts a continuation of the uptrend, whereas a break beneath can point out a possible development reversal or a minimum of a brief pullback.

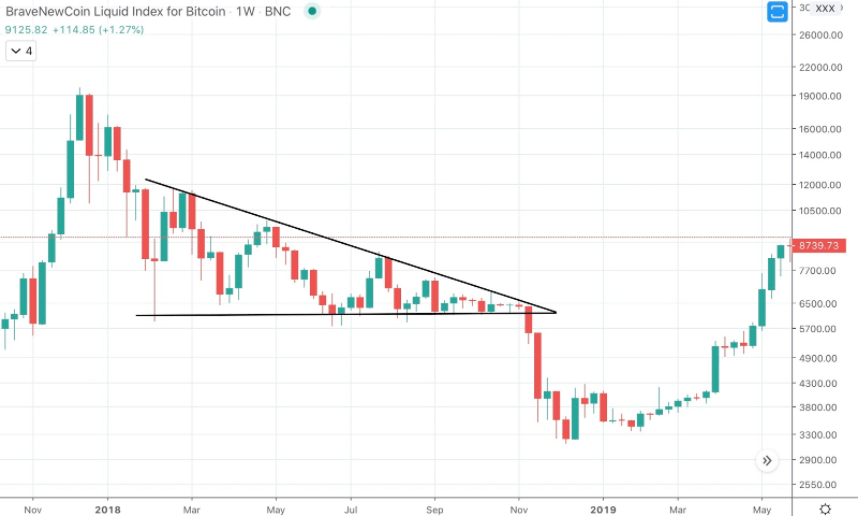

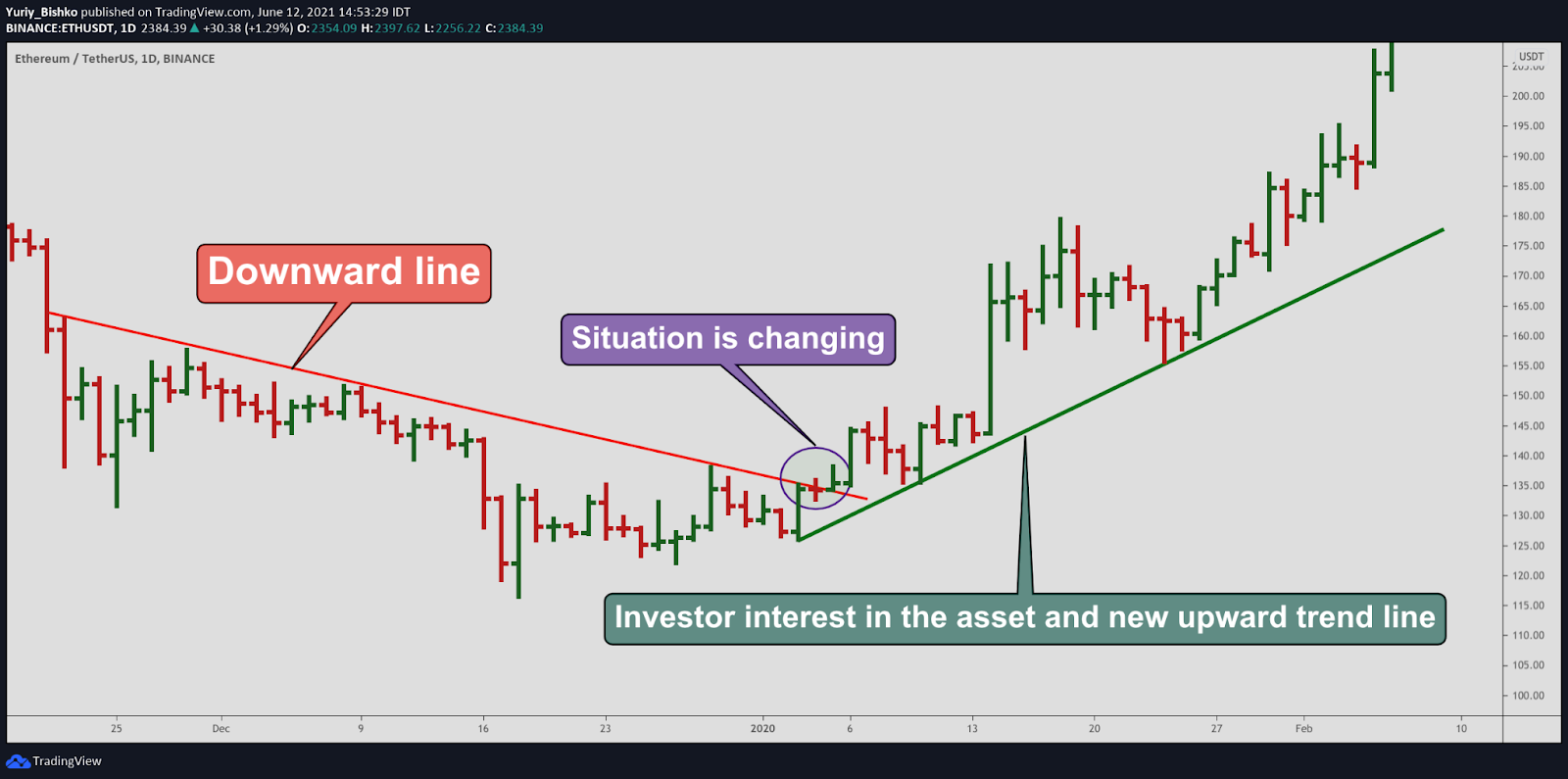

B. Downtrend Traces:

A downtrend line connects a sequence of decrease highs. Every subsequent excessive ought to be decrease than the earlier one, indicating bearish momentum. A break above the downtrend line usually alerts a possible development reversal or a major upward correction, whereas a break beneath can point out a continuation of the downtrend.

II. Drawing Development Traces:

Drawing correct development traces is paramount. Whereas subjective to a level, a number of pointers improve accuracy:

- Swing Factors: Deal with figuring out clear swing highs and lows. Keep away from utilizing minor fluctuations in worth to attract the road.

- Visible Attraction: The road ought to visually signify the general development. It should not be overly jagged or pressured to suit each minor worth motion.

- Software program Help: Buying and selling platforms usually present instruments for mechanically drawing development traces, which might assist in objectivity.

- A number of Timeframes: Analyzing development traces throughout a number of timeframes (e.g., every day, weekly, month-to-month) supplies a extra complete perspective. A robust development on a better timeframe often helps developments on decrease timeframes.

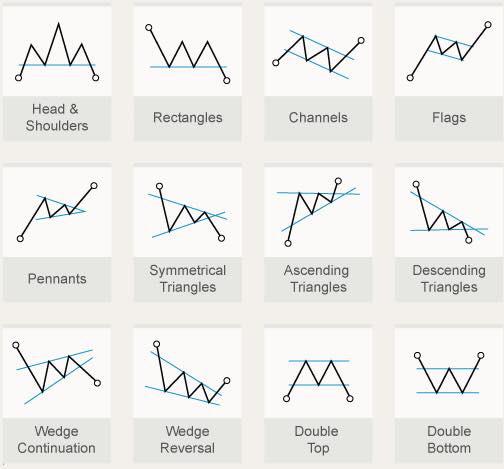

III. Sorts of Development Line Chart Patterns:

Past easy uptrend and downtrend traces, a number of vital patterns emerge from their interplay and breaks:

A. Help and Resistance: Development traces act as dynamic assist and resistance ranges. Help ranges are areas the place shopping for stress is anticipated to beat promoting stress, stopping additional worth declines. Resistance ranges are areas the place promoting stress is anticipated to beat shopping for stress, stopping additional worth will increase. Breaks above resistance or beneath assist usually sign vital worth actions.

B. Parallel Channels: These patterns kind when two parallel development traces enclose worth actions inside a channel. The higher development line represents resistance, and the decrease development line represents assist. Breakouts from these channels may be sturdy indicators of future worth path.

C. Triangles: Triangles are consolidation patterns shaped by converging development traces. There are three important varieties:

- Symmetrical Triangles: Each the higher and decrease development traces converge, making a symmetrical form. Breakouts from symmetrical triangles can happen in both path, making them much less dependable than different patterns.

- Ascending Triangles: The higher development line is horizontal, representing resistance, whereas the decrease development line slopes upward, representing growing assist. Breakouts from ascending triangles are often bullish.

- Descending Triangles: The decrease development line is horizontal, representing assist, whereas the higher development line slopes downward, representing lowering resistance. Breakouts from descending triangles are often bearish.

D. Flags and Pennants: These are short-term continuation patterns that seem inside established developments.

- Flags: These patterns resemble an oblong or barely tilted field inside a development. They usually point out a brief pause earlier than the development resumes in its authentic path.

- Pennants: These patterns resemble a triangle inside a development. Just like flags, they sign a brief pause earlier than the development resumes.

E. Development Line Breakouts:

Breakouts from development traces are vital occasions. A breakout above an uptrend line confirms the continuation of the uptrend, whereas a breakout beneath a downtrend line confirms the continuation of the downtrend. Nevertheless, false breakouts can happen, the place the value briefly breaks the development line however then reverses. Due to this fact, affirmation by way of different technical indicators is commonly essential to keep away from false alerts.

IV. Affirmation and Danger Administration:

Whereas development traces are helpful instruments, they shouldn’t be utilized in isolation. Affirmation from different technical indicators, equivalent to quantity, shifting averages, or oscillators, enhances the reliability of development line alerts. Danger administration is essential. Cease-loss orders ought to be positioned to restrict potential losses, and place sizing ought to be acceptable to the danger tolerance.

V. Sensible Software and Examples:

Let’s think about a hypothetical instance: Think about an uptrend in a inventory’s worth. We are able to draw an uptrend line connecting a sequence of upper lows. If the value breaks beneath this uptrend line, it alerts a possible weakening of the uptrend. Nevertheless, we’d like affirmation from different indicators, equivalent to lowering quantity or a bearish divergence between worth and an oscillator. If confirmed, this may very well be a sign to scale back or exit the lengthy place. Conversely, a break above a resistance stage (maybe a earlier excessive or a horizontal resistance line) may present a powerful purchase sign, particularly if accompanied by growing quantity and bullish momentum indicators.

VI. Limitations of Development Traces:

Development traces are subjective and susceptible to interpretation. Completely different merchants could draw development traces barely in a different way, resulting in various interpretations. Moreover, development traces will not be at all times dependable, notably in uneven or sideways markets. False breakouts can happen, resulting in incorrect buying and selling alerts. Due to this fact, development traces ought to be used along side different technical evaluation instruments for a extra complete and correct evaluation of market developments.

VII. Conclusion:

Development line chart patterns are highly effective instruments for figuring out and capitalizing on market developments. By understanding the way to establish, interpret, and make the most of these patterns, merchants can enhance their buying and selling choices and doubtlessly improve their profitability. Nevertheless, it is essential to do not forget that development traces will not be foolproof, and affirmation from different indicators and diligent danger administration are important for profitable buying and selling. This information supplies a powerful basis for understanding and making use of development line evaluation in your buying and selling methods. Keep in mind to at all times apply on a demo account earlier than utilizing these methods with actual capital. Steady studying and adapting to market situations are key to mastering this vital facet of technical evaluation.

Closure

Thus, we hope this text has offered helpful insights into Development Line Chart Sample PDF: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!