Us Vs China Gdp Chart

us vs china gdp chart

Associated Articles: us vs china gdp chart

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to us vs china gdp chart. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

The US vs. China GDP Race: A Charting of Financial Titans

The worldwide financial panorama is dominated by two behemoths: the US and China. Their financial trajectories, intertwined but distinct, have formed the twenty first century and can proceed to outline the a long time to come back. Understanding the relative progress and measurement of their Gross Home Merchandise (GDPs) is essential to comprehending the shifting world energy dynamics and the implications for worldwide commerce, geopolitical stability, and world finance. This text delves into the historic relationship between US and Chinese language GDP, analyzing key developments depicted in comparative charts and exploring the underlying components driving their respective progress patterns.

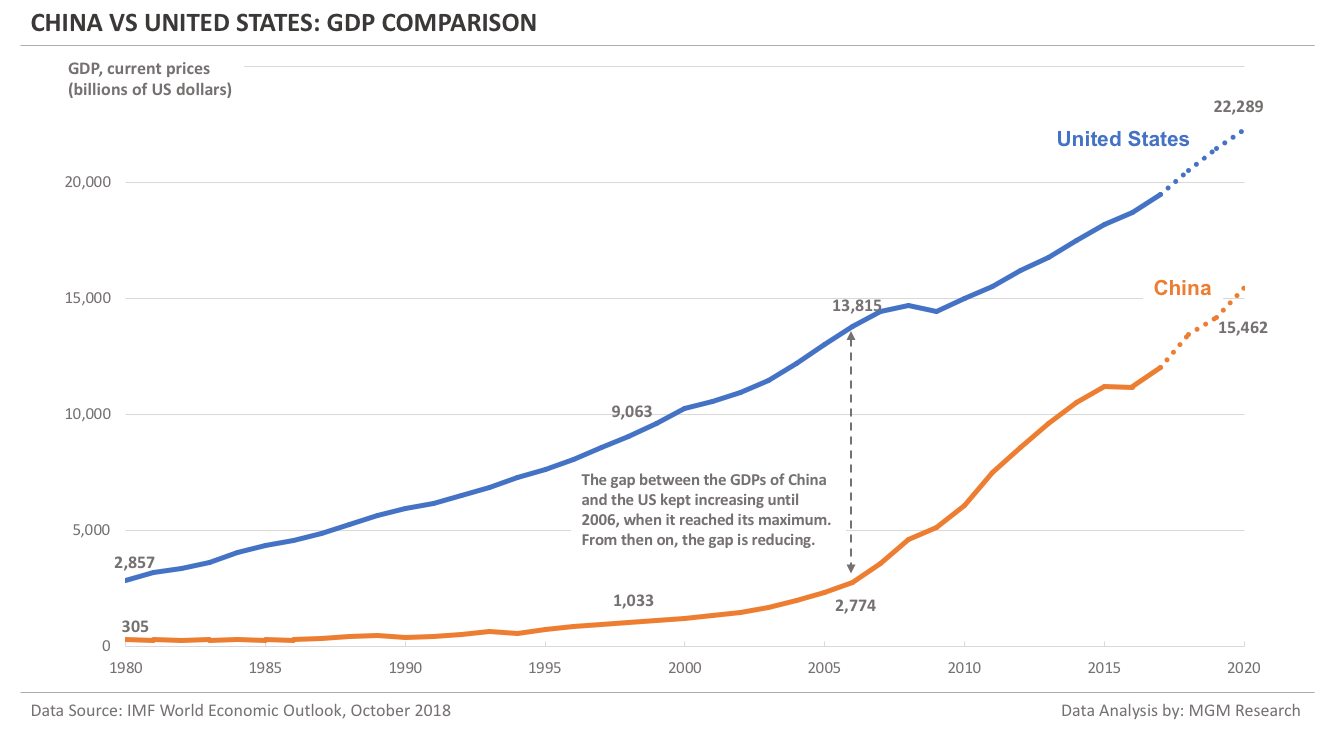

A Visible Narrative: The GDP Chart

Whereas a easy chart can’t seize the total complexity of those two economies, a visible illustration of their GDPs over time provides a robust start line. (Insert a chart right here displaying the nominal GDP of the US and China from 2000 to the current, ideally with knowledge from a good supply just like the World Financial institution or IMF. The chart needs to be clearly labeled and straightforward to grasp. Contemplate together with a second chart displaying GDP per capita for a extra nuanced comparability.)

The chart instantly reveals a number of key takeaways:

-

US Dominance (Traditionally): For many years, the US held an simple lead by way of GDP. The sheer measurement of its economic system, pushed by a mature industrial base, sturdy service sector, and revolutionary technological prowess, remained unmatched.

-

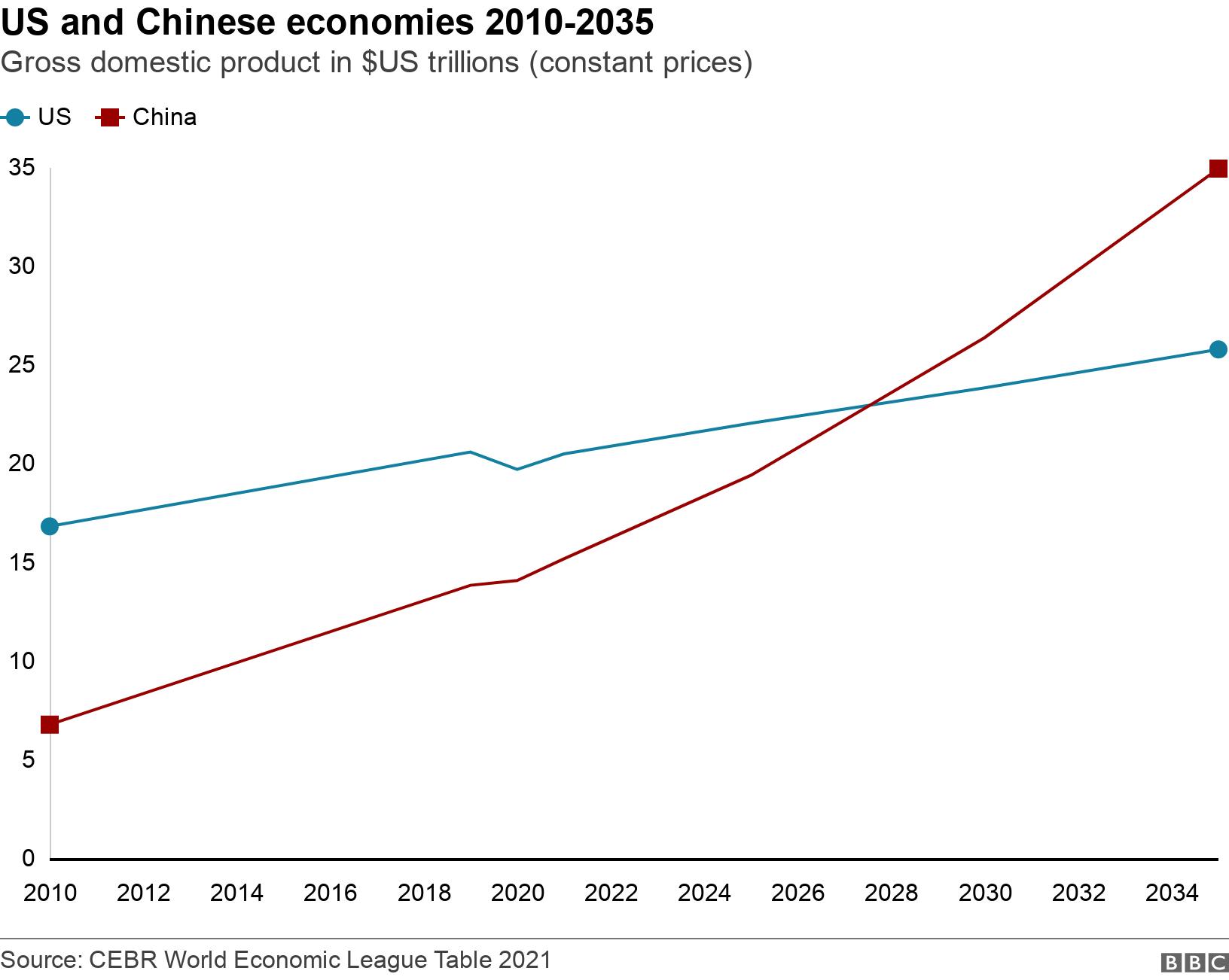

China’s Ascent: Probably the most hanging characteristic of the chart is the dramatic rise of China’s GDP. Ranging from a comparatively low base within the yr 2000, China’s economic system has skilled unprecedented progress, fueled by export-oriented manufacturing, large infrastructure investments, and a quickly increasing home market.

-

The Closing Hole: Whereas the US nonetheless maintains a bigger GDP, the hole between the 2 economies has considerably narrowed over the previous 20 years. The speed of China’s GDP progress, though slowing lately, has been significantly quicker than that of the US, elevating the query of when, or if, China may surpass the US by way of nominal GDP.

Elements Driving US GDP Progress:

The US economic system’s power has traditionally stemmed from a number of key components:

-

Innovation and Expertise: The US has constantly been a pacesetter in technological innovation, fostering a vibrant entrepreneurial ecosystem and driving productiveness progress throughout varied sectors. This has resulted within the growth of worldwide dominant firms in know-how, prescription drugs, and different high-value industries.

-

Client Spending: Strong shopper spending constitutes a good portion of US GDP. A comparatively massive center class, entry to credit score, and a tradition of consumption have fueled financial progress.

-

Service Sector Dominance: The US service sector, encompassing finance, healthcare, schooling, and know-how providers, has performed an important position in driving financial progress and employment.

-

International Affect: The US greenback’s standing because the world’s reserve forex, coupled with its vital navy and political affect, has supplied the US economic system with sure benefits in worldwide commerce and finance.

Nevertheless, the US economic system faces challenges:

-

Revenue Inequality: Rising earnings inequality poses a threat to sustained shopper spending and general financial stability.

-

Ageing Inhabitants: An ageing inhabitants and declining delivery charges might pressure social safety and healthcare methods, impacting future financial progress.

-

Infrastructure Deficiencies: The US infrastructure lags behind many developed nations, hindering productiveness and financial competitiveness.

-

Political Polarization: Political gridlock and partisan divisions can hamper efficient policymaking and financial progress.

Elements Driving China’s GDP Progress:

China’s outstanding financial progress has been pushed by a confluence of things:

-

Export-Oriented Manufacturing: China’s integration into the worldwide economic system, initially as a "manufacturing unit of the world," allowed it to leverage its low labor prices and ample manufacturing capability to gasoline export-led progress.

-

Infrastructure Improvement: Large investments in infrastructure, together with roads, railways, ports, and power grids, have facilitated financial exercise and related totally different areas of the nation.

-

Home Consumption Progress: Whereas export-led progress was initially dominant, China has more and more targeted on boosting home consumption to drive financial enlargement.

-

Overseas Direct Funding (FDI): Attracting vital FDI has supplied capital, know-how, and experience to assist financial growth.

Nevertheless, China’s progress trajectory faces headwinds:

-

Demographic Shifts: China’s quickly ageing inhabitants and declining delivery charge pose challenges to its future workforce and financial progress.

-

Debt Ranges: Excessive ranges of company and authorities debt increase considerations about monetary stability.

-

Technological Dependence: Whereas China has made strides in technological innovation, it stays reliant on international know-how in sure key areas.

-

Geopolitical Dangers: Rising geopolitical tensions with the US and different international locations pose dangers to China’s financial progress and world commerce relationships.

Past Nominal GDP: A Broader Perspective

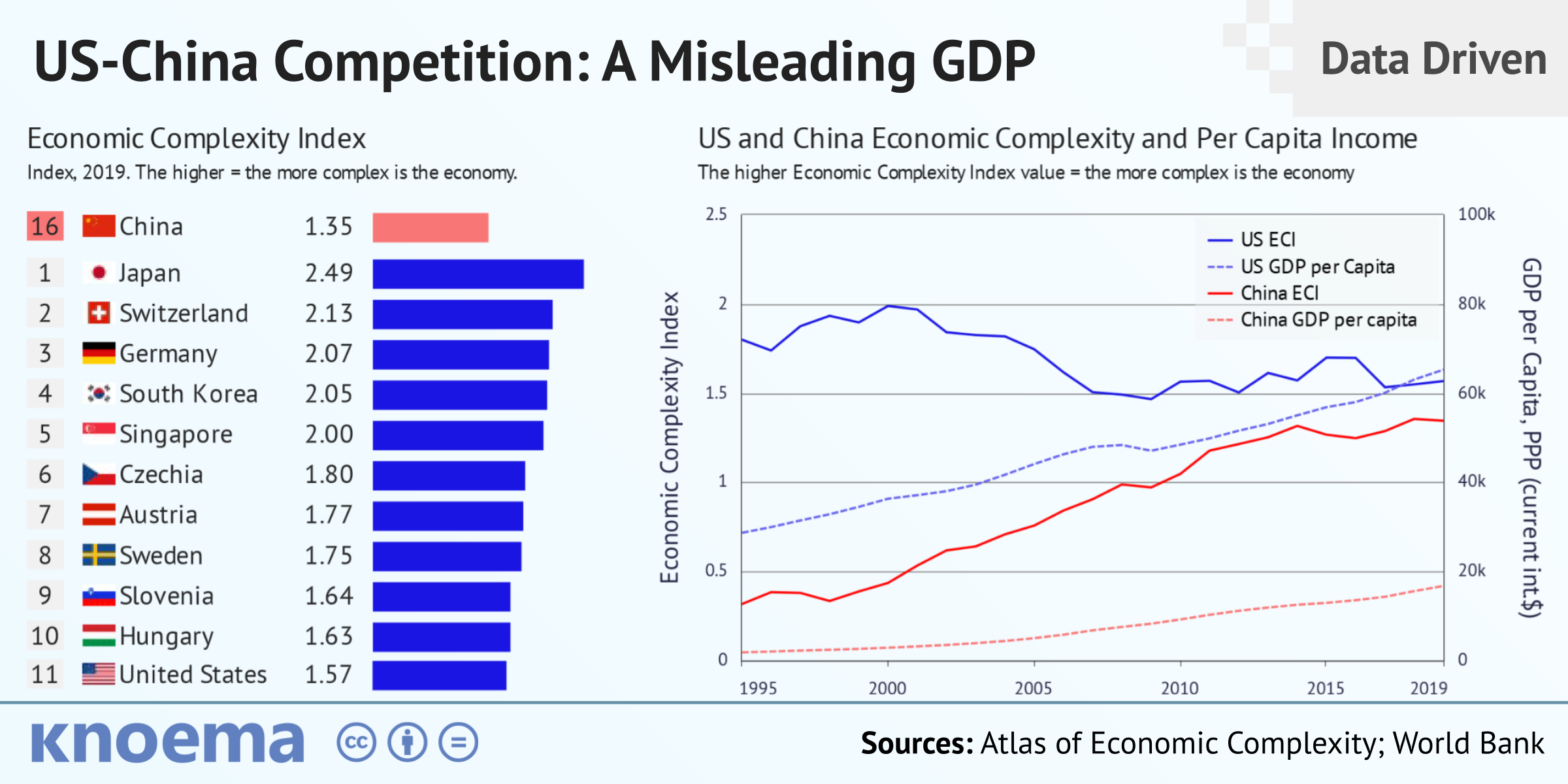

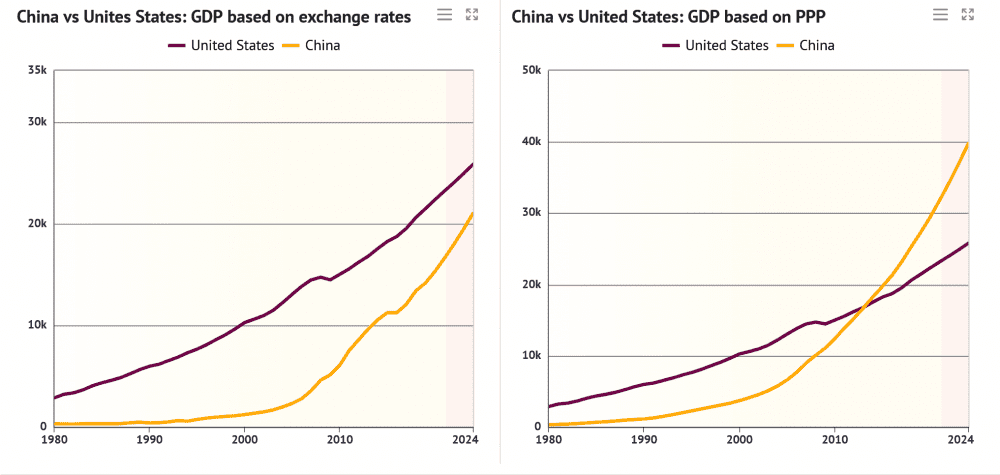

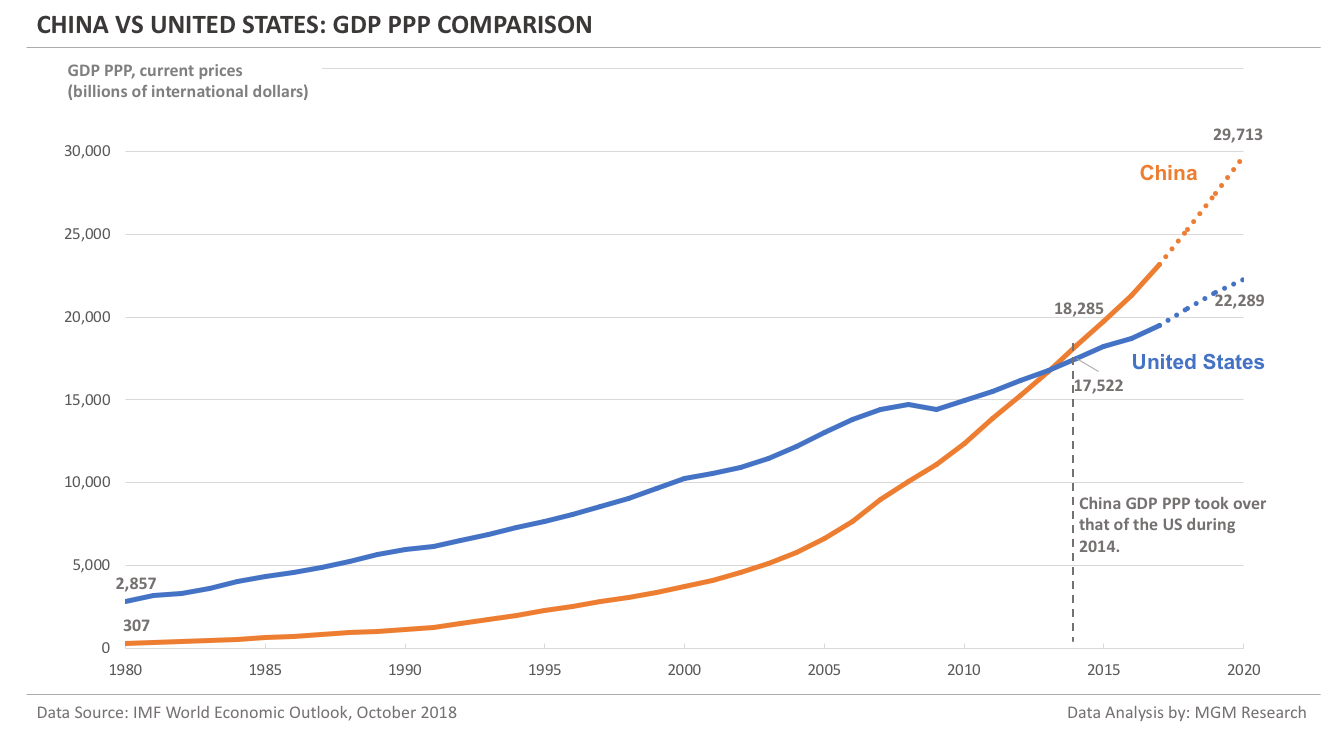

Whereas nominal GDP gives a helpful benchmark for evaluating the dimensions of economies, it would not inform the entire story. Evaluating GDP per capita provides a extra nuanced understanding of dwelling requirements and financial well-being. (Refer again to the GDP per capita chart.) This reveals that regardless of China’s spectacular GDP progress, the US nonetheless enjoys a considerably increased GDP per capita, reflecting variations in productiveness, earnings distribution, and general dwelling requirements.

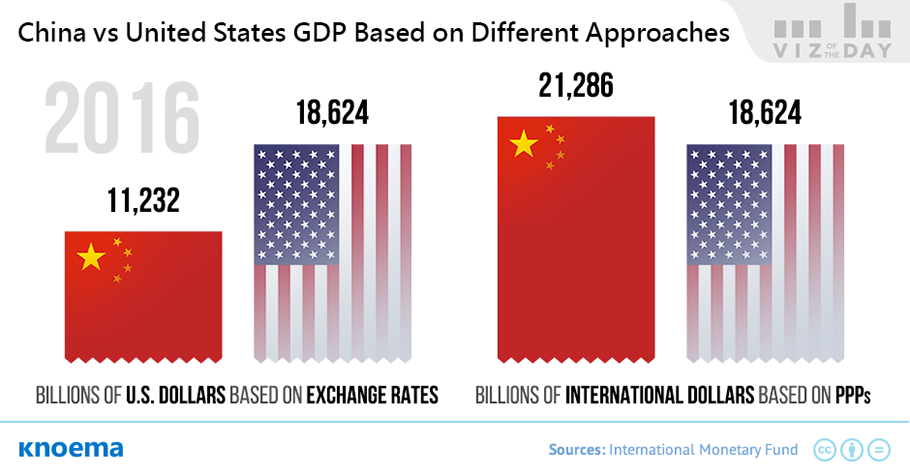

Moreover, different metrics like buying energy parity (PPP) GDP, which adjusts for variations in the price of items and providers throughout international locations, can present a unique perspective on the relative financial power of the US and China.

Conclusion: A Persevering with Race with Unclear Outcomes

The race between the US and China’s GDP is much from over. Whereas the US at the moment maintains a bigger GDP, China’s continued financial progress, albeit at a slower tempo than in earlier a long time, presents a major problem to US financial dominance. The long run trajectory of each economies will rely on a fancy interaction of things, together with technological innovation, demographic shifts, geopolitical developments, and home coverage decisions. Understanding these dynamics is essential for companies, policymakers, and people navigating the more and more interconnected world economic system. The charts introduced right here provide a snapshot in time, however ongoing monitoring and evaluation are important to completely grasp the evolving financial relationship between these two world powerhouses.

Closure

Thus, we hope this text has supplied beneficial insights into us vs china gdp chart. We respect your consideration to our article. See you in our subsequent article!