USDJPY: Navigating The Crosscurrents – A Technical Chart Evaluation

USDJPY: Navigating the Crosscurrents – A Technical Chart Evaluation

Associated Articles: USDJPY: Navigating the Crosscurrents – A Technical Chart Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to USDJPY: Navigating the Crosscurrents – A Technical Chart Evaluation. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

USDJPY: Navigating the Crosscurrents – A Technical Chart Evaluation

By [Your Name/CNBC Analyst Name]

The USDJPY pair, a bellwether for world threat sentiment and financial coverage divergence, continues to captivate merchants. Its current worth motion displays a fancy interaction of macroeconomic components, geopolitical uncertainties, and technical indicators, creating an interesting panorama for evaluation. This in-depth article will dissect the USDJPY technical chart, inspecting key help and resistance ranges, trendlines, oscillators, and candlestick patterns to offer a complete outlook on the pair’s potential trajectory.

Macroeconomic Backdrop:

Earlier than diving into the technical evaluation, it is essential to acknowledge the numerous macroeconomic forces shaping the USDJPY. The divergence between the Federal Reserve’s (Fed) financial coverage tightening and the Financial institution of Japan’s (BOJ) continued dedication to yield curve management (YCC) stays a major driver. The Fed’s aggressive fee hikes, geared toward combating inflation, strengthen the US greenback, whereas the BOJ’s ultra-loose financial coverage weakens the Japanese yen. Nonetheless, current whispers of potential shifts within the BOJ’s stance, significantly relating to the YCC, introduce important uncertainty and volatility into the equation. Additional complicating the image are world development considerations, vitality costs, and the continued warfare in Ukraine, all of which impression threat urge for food and consequently, the USDJPY.

Technical Chart Evaluation: A Multi-faceted Strategy

Analyzing the USDJPY requires a holistic method, integrating numerous technical instruments and indicators. We’ll study the every day, weekly, and month-to-month charts to determine prevailing traits and potential turning factors.

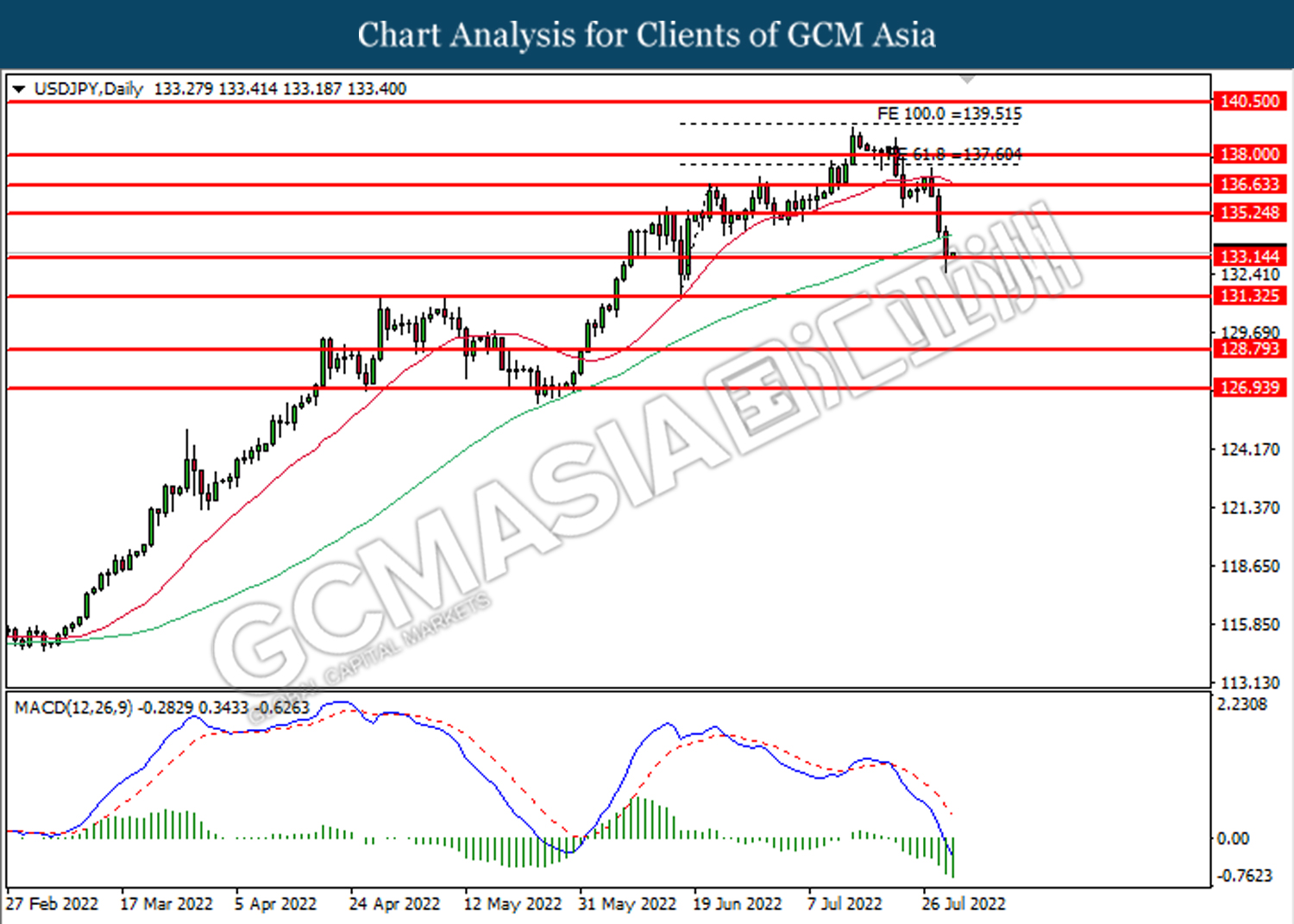

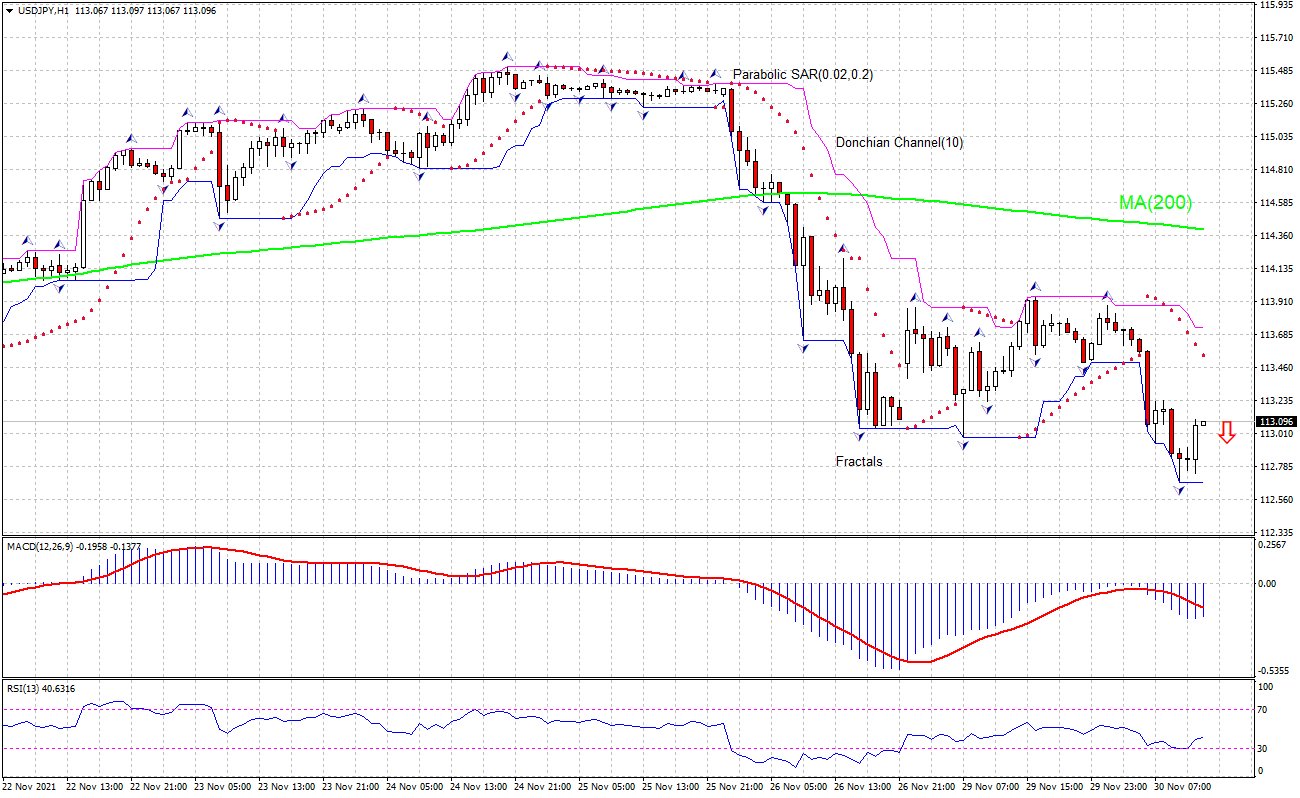

1. Day by day Chart Evaluation:

The every day chart (insert picture of every day USDJPY chart right here) at the moment reveals [describe the current trend – e.g., a short-term uptrend, downtrend, or consolidation]. Key help ranges to observe are [list and explain the significance of key support levels, e.g., previous lows, trendline support, Fibonacci retracement levels]. Conversely, resistance ranges lie at [list and explain the significance of key resistance levels, e.g., previous highs, trendline resistance, psychological levels like 150.00].

Candlestick Patterns: Observe the current candlestick formations. The presence of [mention specific candlestick patterns observed, e.g., bullish engulfing patterns, bearish hammers, doji stars] may supply clues about potential shifts in momentum. As an example, a bullish engulfing sample close to a key help stage would possibly sign a possible bounce, whereas a bearish hammer close to a resistance stage may point out a reversal.

Shifting Averages: The [mention specific moving averages used, e.g., 20-day, 50-day, 200-day moving averages] present insights into the short-term and long-term traits. A bullish crossover (e.g., the 20-day MA crossing above the 50-day MA) would possibly counsel a strengthening uptrend, whereas a bearish crossover may point out a weakening development. The 200-day MA usually acts as a big long-term help or resistance stage.

Relative Energy Index (RSI): The RSI (insert picture exhibiting RSI indicator on the every day chart) is at the moment at [mention the RSI value]. A studying above 70 usually suggests the market is overbought, indicating potential for a correction, whereas a studying under 30 suggests oversold situations, doubtlessly indicating a bounce. Nonetheless, it is essential to contemplate the RSI together with different indicators, as it may possibly stay in overbought or oversold territory for prolonged durations.

2. Weekly Chart Evaluation:

The weekly chart (insert picture of weekly USDJPY chart right here) provides a broader perspective on the development. This timeframe helps determine longer-term help and resistance ranges, which are sometimes extra important than these noticed on the every day chart. [Describe the prevailing trend on the weekly chart, highlighting key support and resistance levels. Mention any significant trendlines, Fibonacci retracements, or other technical patterns visible on the weekly timeframe.]

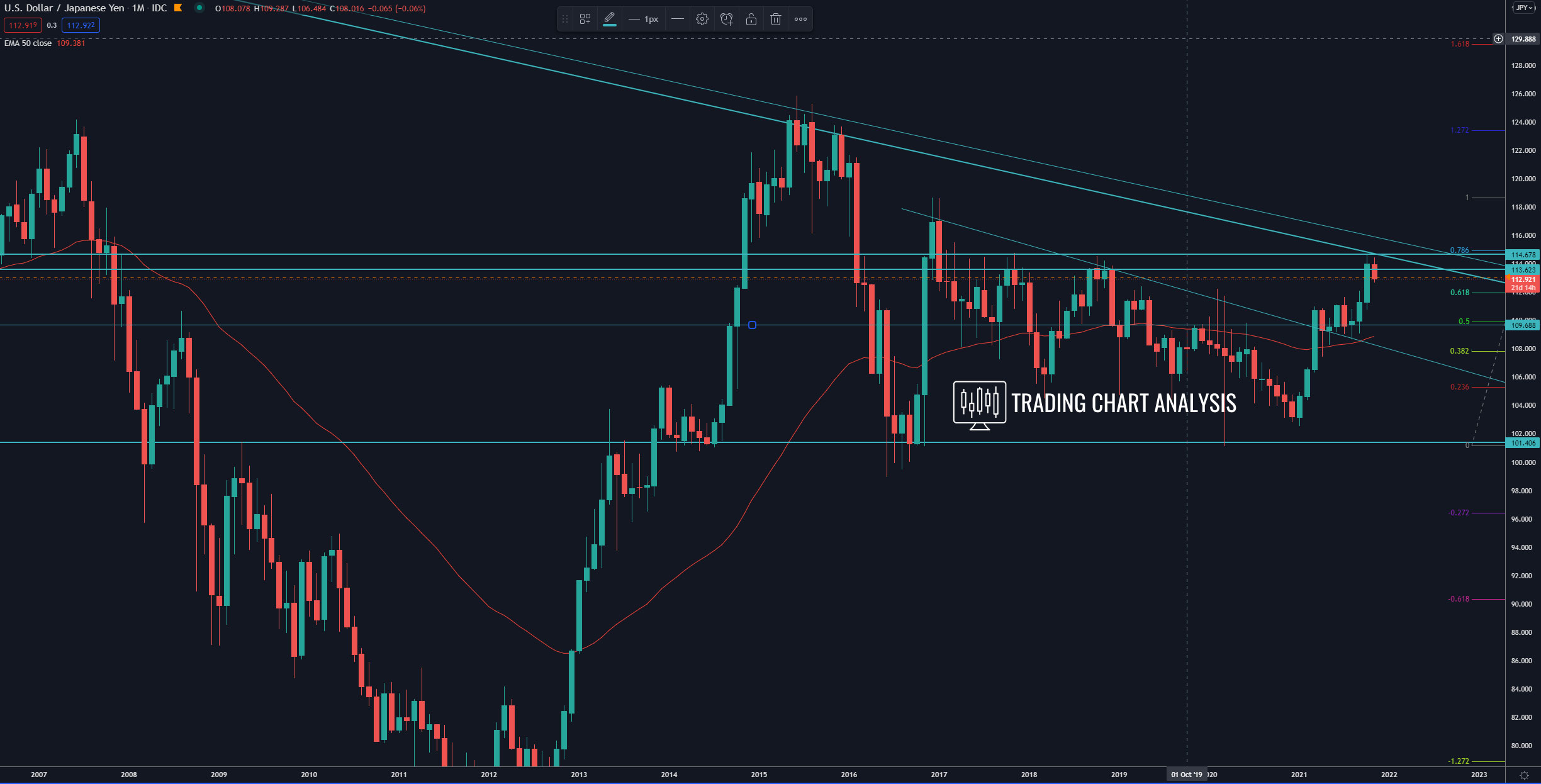

3. Month-to-month Chart Evaluation:

The month-to-month chart (insert picture of month-to-month USDJPY chart right here) offers the longest-term perspective. This timeframe is right for figuring out main development adjustments and long-term help and resistance ranges. [Describe the long-term trend on the monthly chart and its implications for the pair’s future direction. Discuss any significant historical price levels or patterns that may be relevant.]

Combining Indicators for a Complete Outlook:

Analyzing the USDJPY solely based mostly on one indicator is inadequate. A sturdy evaluation necessitates integrating a number of indicators to verify potential buying and selling alerts. For instance, a bullish crossover of shifting averages coupled with a bullish candlestick sample and an RSI studying close to oversold territory may present a powerful affirmation of a possible upward transfer. Conversely, a bearish crossover, bearish candlestick patterns, and an RSI studying close to overbought territory may counsel a possible downward transfer.

Threat Administration and Buying and selling Methods:

Buying and selling the USDJPY entails important threat on account of its volatility. Implementing sturdy threat administration methods is paramount. This contains utilizing stop-loss orders to restrict potential losses and taking income at predetermined ranges. Completely different buying and selling methods could be employed relying on one’s threat tolerance and market outlook. Scalpers would possibly concentrate on short-term trades, benefiting from small worth fluctuations, whereas swing merchants would possibly maintain positions for longer durations, aiming to capitalize on bigger worth actions. Lengthy-term buyers would possibly concentrate on the overarching development, adjusting their positions accordingly.

Geopolitical and Surprising Occasions:

It is essential to acknowledge that sudden geopolitical occasions or sudden shifts in financial coverage can considerably impression the USDJPY. These occasions can rapidly invalidate technical evaluation, highlighting the significance of staying knowledgeable about world developments and adapting buying and selling methods accordingly.

Conclusion:

The USDJPY pair stays a dynamic and complicated market, influenced by a mess of things. By combining thorough technical chart evaluation with an understanding of the macroeconomic backdrop and geopolitical panorama, merchants can develop knowledgeable buying and selling methods. Nonetheless, it is crucial to keep in mind that no technical evaluation can assure income, and threat administration stays essential in navigating the volatility of this main forex pair. Steady monitoring of the market and adaptation to altering situations are important for fulfillment in buying and selling the USDJPY. This evaluation offers a snapshot of the present market situations, however merchants ought to conduct their very own thorough analysis and take into account searching for skilled monetary recommendation earlier than making any funding choices.

Closure

Thus, we hope this text has offered priceless insights into USDJPY: Navigating the Crosscurrents – A Technical Chart Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!