Yen Vs Usd Historic Chart

yen vs usd historic chart

Associated Articles: yen vs usd historic chart

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to yen vs usd historic chart. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

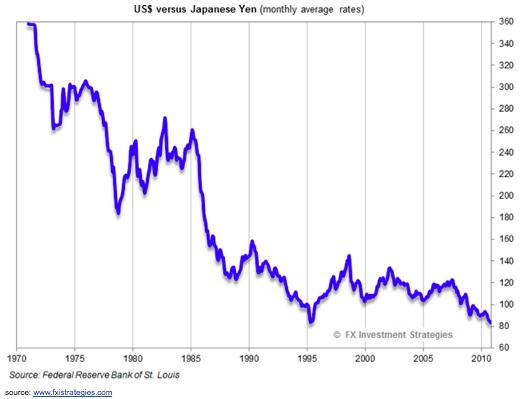

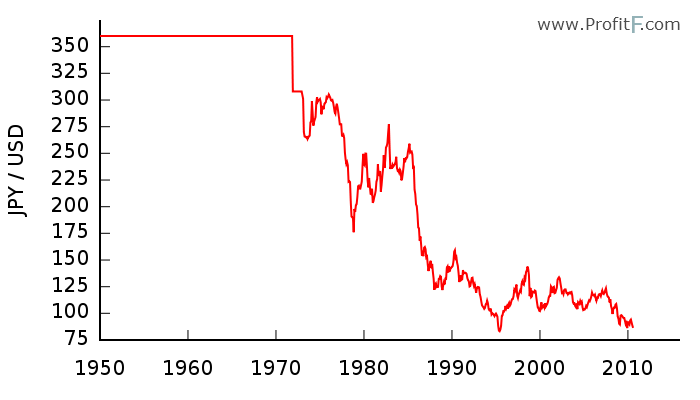

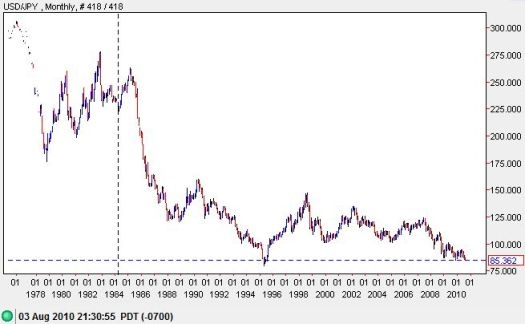

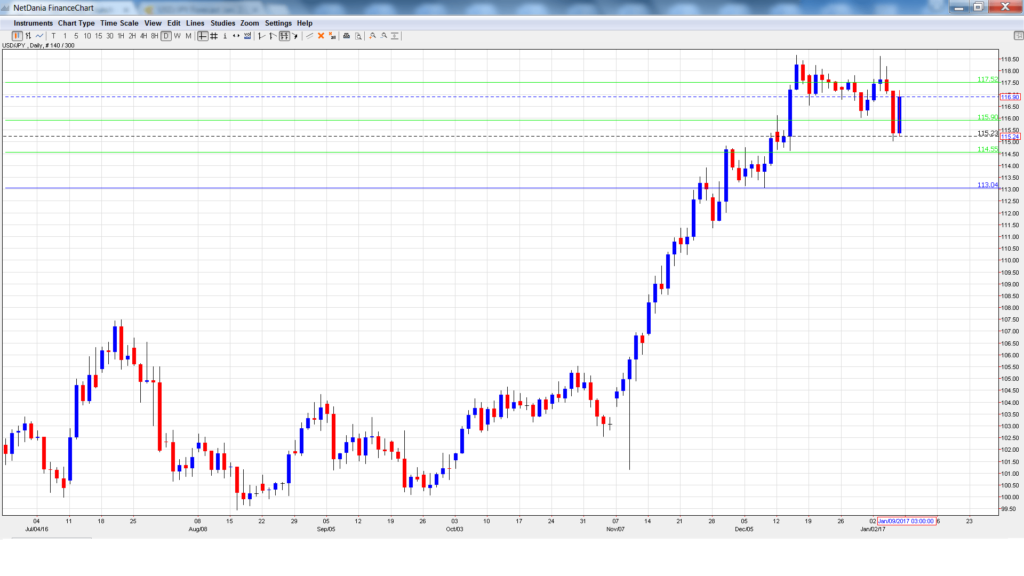

The Yen vs. USD: A Historic Chart and Narrative of Two Economies

The connection between the Japanese yen (JPY) and america greenback (USD) is a posh tapestry woven from financial insurance policies, international occasions, and market sentiment. Analyzing the historic chart of USD/JPY reveals not solely fluctuations in alternate charges but in addition a broader story of the interaction between two of the world’s most influential economies. This text will delve into the historic trajectory of the USD/JPY alternate fee, highlighting key durations of volatility and stability, and exploring the underlying financial components which have formed this dynamic relationship.

Early 2000s: A Interval of Relative Stability and Gradual Appreciation of the Yen

The early 2000s witnessed a interval of relative stability within the USD/JPY alternate fee, usually hovering inside a variety of 105-130 JPY per USD. This era adopted the Asian Monetary Disaster of 1997-98, which had considerably impacted the Japanese financial system. Japan’s financial system, characterised by deflation and gradual progress, noticed the Financial institution of Japan (BOJ) keep a comparatively free financial coverage, holding rates of interest low. Nevertheless, the US financial system skilled a interval of reasonable progress, resulting in comparatively increased rates of interest within the US in comparison with Japan. This rate of interest differential, although not dramatic, contributed to a gradual appreciation of the yen towards the greenback. The occasions of September eleventh, 2001, brought about a short spike within the yen’s worth as traders sought safe-haven belongings. Nevertheless, the general pattern remained considered one of gradual appreciation, reflecting the relative financial efficiency of the 2 international locations.

Mid-2000s: The Rise of World Imbalances and Yen Weak point

The mid-2000s noticed a shift within the USD/JPY dynamics. The US financial system, fueled by a housing increase and straightforward credit score, skilled a interval of sturdy progress, whereas Japan continued to grapple with deflation. This divergence in financial efficiency, coupled with the rising US present account deficit, led to a big weakening of the yen. The US greenback’s power was additionally buoyed by its position as a worldwide reserve forex and the rising demand for dollar-denominated belongings. The USD/JPY alternate fee climbed steadily, surpassing 120 after which 130 JPY per USD by the mid-2000s. This era highlights the impression of world imbalances and the position of reserve forex standing in influencing alternate charges.

The 2008 Monetary Disaster and its Aftermath: Protected-Haven Yen

The 2008 international monetary disaster dramatically altered the panorama of the USD/JPY alternate fee. Because the disaster unfolded, the yen skilled a pointy appreciation as traders flocked to its perceived safe-haven standing. The disaster uncovered vulnerabilities within the international monetary system, resulting in a flight to security and a surge in demand for the Japanese yen, a forex traditionally considered as a secure haven throughout occasions of uncertainty. The USD/JPY fee plummeted to beneath 80 JPY per USD, reflecting the numerous danger aversion within the international markets.

The post-crisis interval noticed a posh interaction of things influencing the USD/JPY fee. Quantitative easing (QE) insurance policies applied by each the BOJ and the Federal Reserve (Fed) performed an important position. Whereas initially the yen strengthened as a consequence of safe-haven demand, the BOJ’s subsequent aggressive QE program aimed toward stimulating the Japanese financial system led to a gradual weakening of the yen. The Fed’s QE packages, whereas aimed toward boosting the US financial system, additionally contributed to a weakening of the greenback, thus impacting the USD/JPY fee.

2012-2016: Abenomics and Yen Volatility

The interval from 2012 to 2016 witnessed the implementation of Abenomics, Prime Minister Shinzo Abe’s financial coverage aimed toward revitalizing the Japanese financial system. Abenomics concerned aggressive financial easing by the BOJ, aiming to fight deflation and stimulate progress. This coverage led to a big weakening of the yen, with the USD/JPY fee reaching ranges above 120 and even approaching 125 JPY per USD. The coverage’s success in stimulating inflation and progress was debated, however its impression on the alternate fee was simple. This era showcases the numerous affect of home financial insurance policies on alternate fee dynamics.

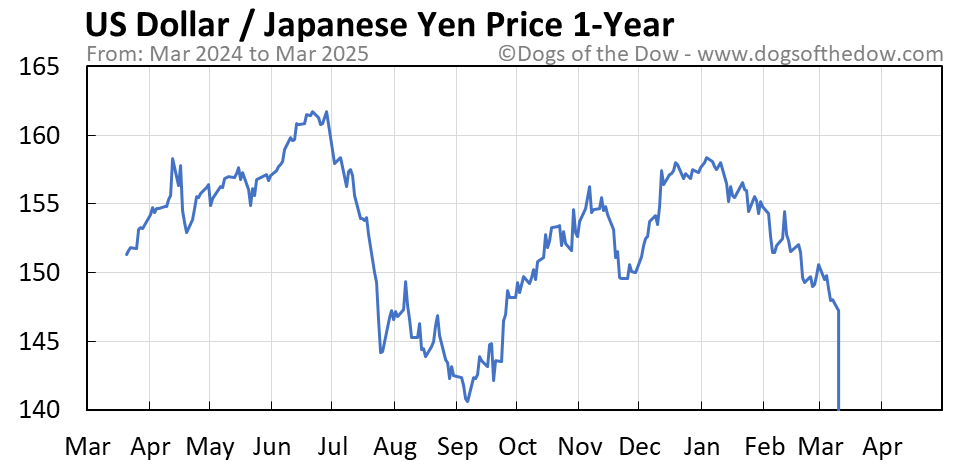

2017-Current: Commerce Wars, Pandemic, and Geopolitical Uncertainty

The interval from 2017 onwards has been characterised by elevated geopolitical uncertainty and volatility. The commerce struggle between the US and China, coupled with the COVID-19 pandemic, created important fluctuations within the USD/JPY alternate fee. The pandemic initially led to a safe-haven rally for the yen, however subsequent financial restoration and financial coverage responses from central banks led to a extra advanced image. Geopolitical tensions, such because the struggle in Ukraine, have additionally contributed to yen volatility. The USD/JPY fee has fluctuated considerably throughout this era, reflecting the advanced interaction of world financial and political occasions. The BOJ’s continued dedication to its ultra-loose financial coverage has additionally performed a big position in shaping the yen’s trajectory.

Elements Influencing the USD/JPY Change Charge:

A number of key components affect the USD/JPY alternate fee:

-

Curiosity Charge Differentials: The distinction in rates of interest between the US and Japan is a big driver of the alternate fee. Larger US rates of interest have a tendency to draw overseas funding, rising demand for the greenback and weakening the yen.

-

Financial Development: Relative financial progress between the US and Japan influences the alternate fee. Stronger US progress tends to strengthen the greenback, whereas stronger Japanese progress can strengthen the yen.

-

Threat Urge for food: World danger urge for food considerably impacts the yen’s worth. In periods of world uncertainty, traders typically search safe-haven belongings, resulting in a strengthening of the yen.

-

Financial Coverage: The financial insurance policies of the Fed and the BOJ play an important position in figuring out the USD/JPY alternate fee. Quantitative easing insurance policies, for instance, can weaken the respective forex.

-

Authorities Intervention: Each the US and Japanese governments can intervene within the overseas alternate market to affect the alternate fee, although such interventions are rare.

-

Geopolitical Occasions: World political occasions and geopolitical dangers can considerably impression the USD/JPY alternate fee, notably affecting investor sentiment and danger urge for food.

Conclusion:

The historic chart of USD/JPY reveals a dynamic and sophisticated relationship between the US and Japanese economies. The alternate fee has been influenced by a large number of things, together with rate of interest differentials, financial progress, danger urge for food, financial coverage, authorities intervention, and geopolitical occasions. Understanding these components is essential for anybody in search of to navigate the complexities of the overseas alternate market and make knowledgeable funding selections. The longer term trajectory of the USD/JPY alternate fee will doubtless proceed to be formed by these components, together with rising international financial and political developments. Continued monitoring of financial indicators, financial coverage selections, and geopolitical occasions is crucial for predicting future actions within the USD/JPY alternate fee. The connection between the yen and the greenback stays a compelling examine in worldwide finance, providing priceless insights into the intricate workings of world economies.

Closure

Thus, we hope this text has supplied priceless insights into yen vs usd historic chart. We hope you discover this text informative and useful. See you in our subsequent article!